- United States

- /

- Banks

- /

- NasdaqGS:TBBK

Do Bancorp’s (TBBK) Buybacks and Expanded Block Partnership Signal a New Growth Phase?

Reviewed by Simply Wall St

- The Bancorp, Inc. recently reported its second-quarter and first-half 2025 results, highlighting year-over-year increases in both net income and earnings per share, and announced the completion of a significant share repurchase under its ongoing buyback program.

- In addition, the company revealed an expanded partnership with Block to provide new debit and prepaid card issuance services for Cash App customers, and outlined plans to repurchase up to US$500 million in shares over the next 18 months.

- We’ll examine how the expanded Block partnership and buyback plans may influence Bancorp’s growth-driven investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Bancorp Investment Narrative Recap

To be a shareholder in The Bancorp, Inc., you need to believe in the ongoing expansion of its fintech partnerships, particularly the growth potential from initiatives like the Block collaboration and payment card services. While the recent earnings and expanded Block partnership reinforce the company’s fintech-driven narrative and strengthen near-term catalysts, the risk remains concentrated in its dependency on major fintech clients, meaning any disruption in these relationships could materially affect results.

Among recent announcements, the substantial US$500 million share repurchase plan stands out. This buyback could support earnings per share growth in the short term, especially at a time when management is highlighting robust performance. However, the scale of buybacks also puts a spotlight on capital management amid possible economic or interest rate changes.

By contrast, one major factor investors should be aware of is the company’s concentrated exposure to a few large fintech partners, as a shift in these relationships could ...

Read the full narrative on Bancorp (it's free!)

Bancorp's narrative projects $497.5 million revenue and $337.0 million earnings by 2028. This requires a -0.1% yearly revenue decline and a $119.5 million earnings increase from $217.5 million current earnings.

Uncover how Bancorp's forecasts yield a $70.76 fair value, a 10% upside to its current price.

Exploring Other Perspectives

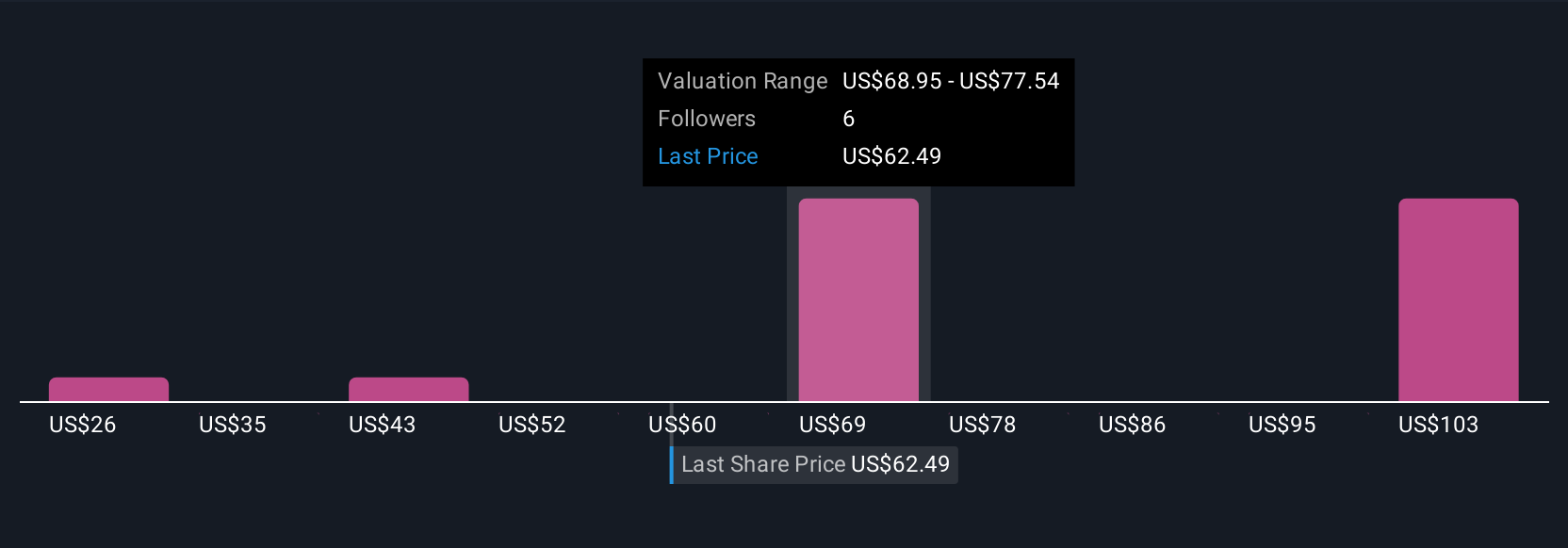

Simply Wall St Community members provided four fair value estimates for The Bancorp, Inc., ranging widely from US$26 to US$122.08 per share. This diversity of outlooks sits against the backdrop of ongoing fintech partnership expansion, signaling the importance of examining how such catalysts may or may not drive future performance.

Explore 4 other fair value estimates on Bancorp - why the stock might be worth as much as 91% more than the current price!

Build Your Own Bancorp Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bancorp research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Bancorp research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bancorp's overall financial health at a glance.

Looking For Alternative Opportunities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bancorp might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TBBK

Bancorp

Operates as the financial holding company for The Bancorp Bank, National Association that provides banking products and services in the United States.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives