- United States

- /

- Banks

- /

- NasdaqGS:TBBK

Bancorp (TBBK) Is Up 6.9% After Fed Rate Cut Hopes Lift Regional Bank Shares

Reviewed by Sasha Jovanovic

- In the past week, regional bank shares including The Bancorp moved higher after a cooler-than-expected inflation report raised expectations for possible Federal Reserve interest rate cuts. This shift in sentiment reflects growing confidence that lower funding costs and increased loan demand could benefit banks if rates are reduced.

- The likely impact of potential interest rate cuts on funding costs is a key factor to consider when assessing Bancorp's investment outlook.

- We’ll now explore how the prospect of lower interest rates could influence Bancorp’s narrative and future growth drivers.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Bancorp Investment Narrative Recap

To be a shareholder in The Bancorp, you have to believe in the bank’s ability to drive growth through its fintech partnerships and targeted fee income expansion, while managing potential margin compression and near-term profitability headwinds. The recent optimism from the softer inflation report and potential rate cuts may lessen funding cost pressure in the short term, but margin risk tied to lower interest rates remains a key factor for investors to watch. In the current environment, the main catalyst is still fintech-driven fee growth, but the risk of margin pressure has not disappeared.

A particularly relevant announcement is Bancorp’s increased share repurchase plan to a total of US$500 million through 2026. With the short-term benefit from positive rate sentiment, this buyback program could support earnings per share, though the ability to maintain capital deployment may hinge on how rates and margins evolve.

However, investors should not lose sight of the continued possibility that margin pressure could become more significant if rate cuts lead to…

Read the full narrative on Bancorp (it's free!)

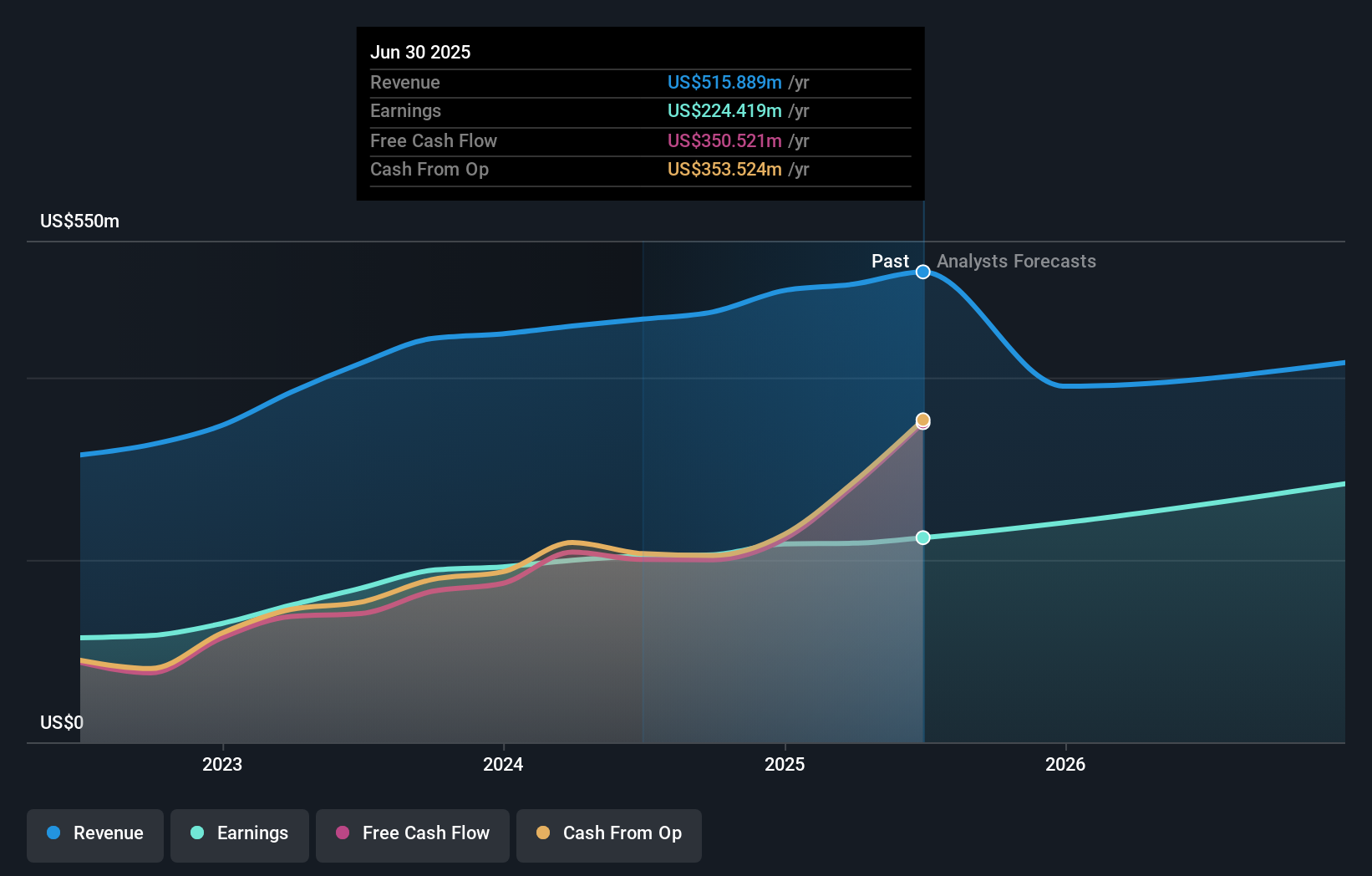

Bancorp's narrative projects $497.5 million revenue and $337.0 million earnings by 2028. This requires a 0.1% annual revenue decline and a $119.5 million earnings increase from $217.5 million today.

Uncover how Bancorp's forecasts yield a $70.76 fair value, a 10% downside to its current price.

Exploring Other Perspectives

Five members of the Simply Wall St Community estimate Bancorp's fair value between US$45.50 and US$95.30. While expectations for ongoing margin pressure persist, such variation reflects just how widely opinions about the company’s outlook can diverge and invites you to explore alternative viewpoints.

Explore 5 other fair value estimates on Bancorp - why the stock might be worth 42% less than the current price!

Build Your Own Bancorp Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bancorp research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Bancorp research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bancorp's overall financial health at a glance.

Contemplating Other Strategies?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bancorp might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TBBK

Bancorp

Operates as the financial holding company for The Bancorp Bank, National Association that provides banking products and services in the United States.

Excellent balance sheet with acceptable track record.

Market Insights

Community Narratives