- United States

- /

- Banks

- /

- NasdaqGS:SYBT

Is Sector-Wide Credit Quality Anxiety Altering the Investment Case for Stock Yards Bancorp (SYBT)?

Reviewed by Sasha Jovanovic

- In recent days, investor sentiment toward regional banks shifted after disclosures from Zions Bancorp and Western Alliance Bancorp raised concerns about wider loan quality issues in the sector.

- This industry-wide anxiety has affected Stock Yards Bancorp's standing, as market participants react to heightened scrutiny of credit risk among regional lenders.

- We’ll explore how renewed focus on sector-wide credit quality concerns could impact Stock Yards Bancorp’s investment narrative going forward.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

What Is Stock Yards Bancorp's Investment Narrative?

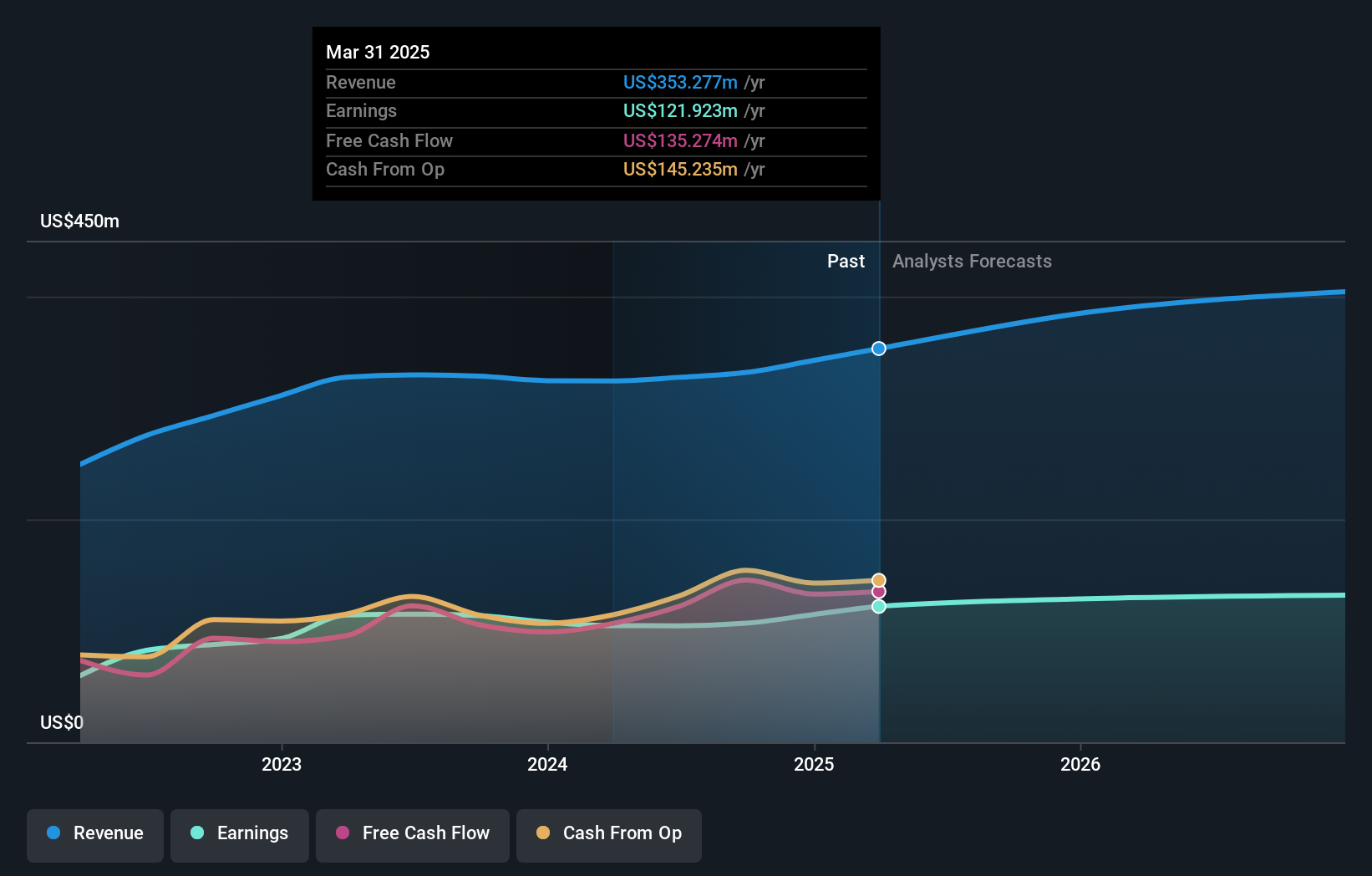

To believe in Stock Yards Bancorp today, you need confidence in the stability and resilience of regional banks, even as headlines call attention to wider credit concerns. The company’s solid earnings growth, disciplined cost control, and regular dividends have attracted value-focused shareholders in the past. However, the sector’s abrupt selloff, triggered by issues at Zions and Western Alliance, has suddenly made credit quality the focal point, forcing a re-evaluation of short-term catalysts and near-term risks. Previously, leadership changes, index inclusions, and robust buybacks were seen as primary drivers, but the narrative now hinges more on how well SYBT can assure the market of its asset quality and risk controls. Recent price moves show investors are sensitive, but the direct impact to SYBT isn't necessarily material unless further credit issues emerge within its own portfolio. The risk profile has shifted; monitoring loan performance is now critical alongside usual growth and shareholder return metrics. But not all risks stem from sector headlines, insider selling is another factor worth watching.

Despite retreating, Stock Yards Bancorp's shares might still be trading 32% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore 3 other fair value estimates on Stock Yards Bancorp - why the stock might be worth as much as 19% more than the current price!

Build Your Own Stock Yards Bancorp Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Stock Yards Bancorp research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Stock Yards Bancorp research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Stock Yards Bancorp's overall financial health at a glance.

Seeking Other Investments?

Our top stock finds are flying under the radar-for now. Get in early:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SYBT

Stock Yards Bancorp

Operates as a holding company for Stock Yards Bank & Trust Company that provides various financial services for individuals, corporations, and others in the United States.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives