- United States

- /

- Banks

- /

- NasdaqGS:SYBT

A Look at Stock Yards Bancorp’s (SYBT) Valuation Following Sector Credit Risk Concerns

Reviewed by Kshitija Bhandaru

Stock Yards Bancorp (SYBT) shares recently moved as investors reacted to industry-wide concerns after two regional banks disclosed large loan charge-offs and collateral problems. This has raised questions about credit risk across the sector.

See our latest analysis for Stock Yards Bancorp.

Shares of Stock Yards Bancorp have seen notable swings lately as sector-wide anxieties about loan quality grab headlines, with the stock closing at $66.47. While this year’s price return sits in negative territory, long-term shareholders have fared very well, enjoying a five-year total shareholder return of over 90%. These moves suggest momentum has cooled in response to new sector risks, but the company’s historical performance highlights resilience through broader cycles.

If you’re watching banks react to shifting credit trends, this could be a great time to branch out and discover fast growing stocks with high insider ownership

With shares still trading below analyst targets despite concerns, the question for investors now is whether Stock Yards Bancorp is undervalued amid sector worries or if the market is already factoring in future headwinds and growth.

Price-to-Earnings of 15.3x: Is it justified?

Stock Yards Bancorp trades at a price-to-earnings (P/E) ratio of 15.3x, putting it above the US Banks industry P/E average of 11.2x. With the last close price at $66.47, the market appears to be pricing the company at a premium relative to its sector peers.

The price-to-earnings ratio measures how much investors are willing to pay for each dollar of a company’s earnings. For banks like SYBT, this multiple signals market expectations around profitability and growth potential. A higher P/E often reflects confidence in continued earnings power or resilience through cycles, but can also point to overoptimism if future growth disappoints.

Stock Yards Bancorp's 15.3x P/E is substantially higher than the sector benchmark of 11.2x. This suggests that investors are valuing the company well above typical industry standards. Notably, the stock is also trading higher than its own estimated fair price-to-earnings ratio of 11.5x, further highlighting this premium and indicating that the market may eventually correct towards a lower level.

Explore the SWS fair ratio for Stock Yards Bancorp

Result: Price-to-Earnings of 15.3x (OVERVALUED)

However, risks remain if loan losses rise further or the industry faces additional shocks. These factors could pressure both valuations and long-term performance.

Find out about the key risks to this Stock Yards Bancorp narrative.

Another View: Our DCF Model Shows Undervalued Potential

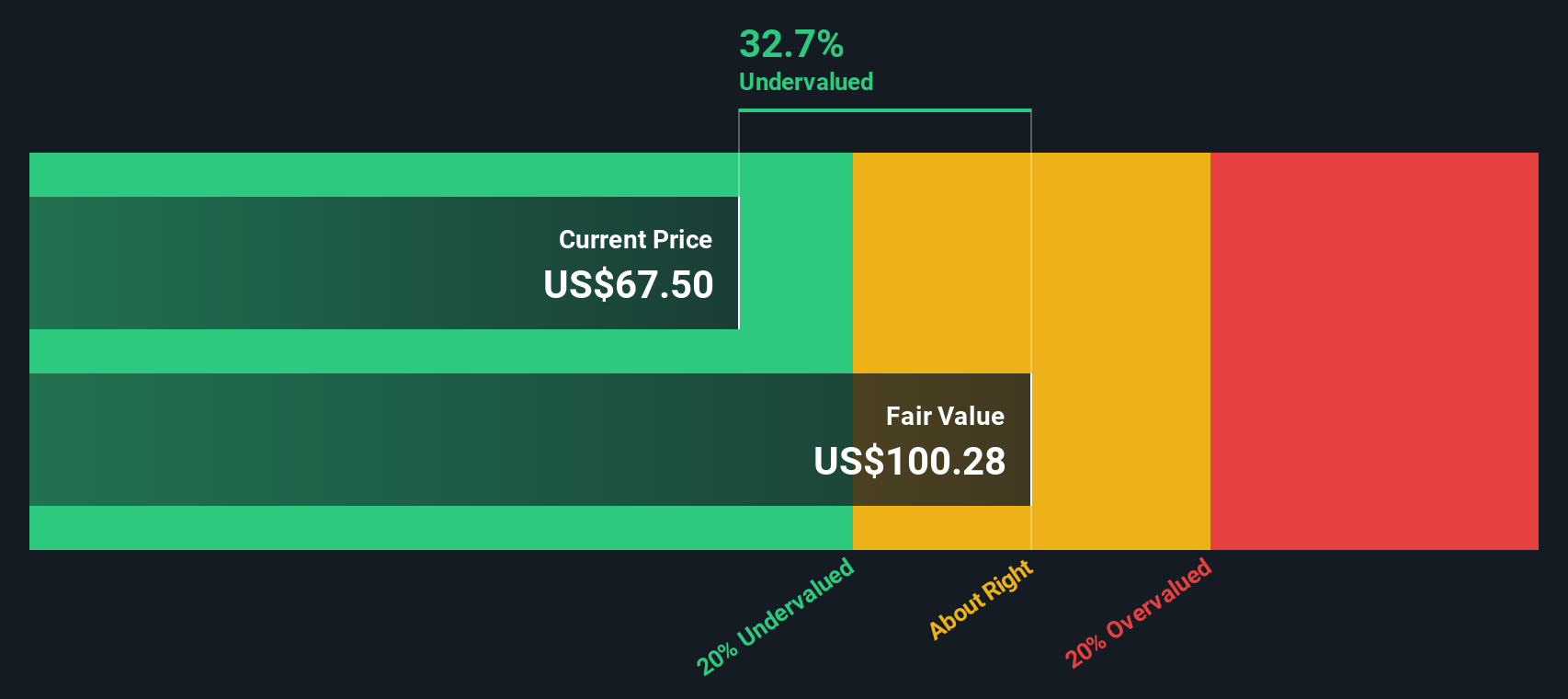

While the market is pricing Stock Yards Bancorp above peers on earnings, our SWS DCF model presents a different picture. The stock’s current price of $66.47 sits 33.7% below our estimated fair value of $100.28, suggesting considerable upside. Does this disconnect reflect overlooked value or hidden risks?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Stock Yards Bancorp for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Stock Yards Bancorp Narrative

If you'd rather draw your own conclusions or want to dig deeper into the numbers, you can shape a personalized view in just a few minutes using our tools. Do it your way with Do it your way.

A great starting point for your Stock Yards Bancorp research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Step ahead of the market and find stocks that fit your interests with our powerful screener tools. Your next opportunity could be just a click away, so don’t let it slip by.

- Accelerate your search for income by targeting strong yields with these 18 dividend stocks with yields > 3% offering 3% or better.

- Harness the AI revolution and tap into exponential growth by scanning these 24 AI penny stocks that are positioned to transform entire industries.

- Find undervalued companies that may be flying under Wall Street’s radar using these 878 undervalued stocks based on cash flows based on real cash flow metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SYBT

Stock Yards Bancorp

Operates as a holding company for Stock Yards Bank & Trust Company that provides various financial services for individuals, corporations, and others in the United States.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives