- United States

- /

- Banks

- /

- NasdaqGM:SMBC

Southern Missouri Bancorp (SMBC) Margin Growth Reinforces Bullish Narrative on Profit Quality and Value

Reviewed by Simply Wall St

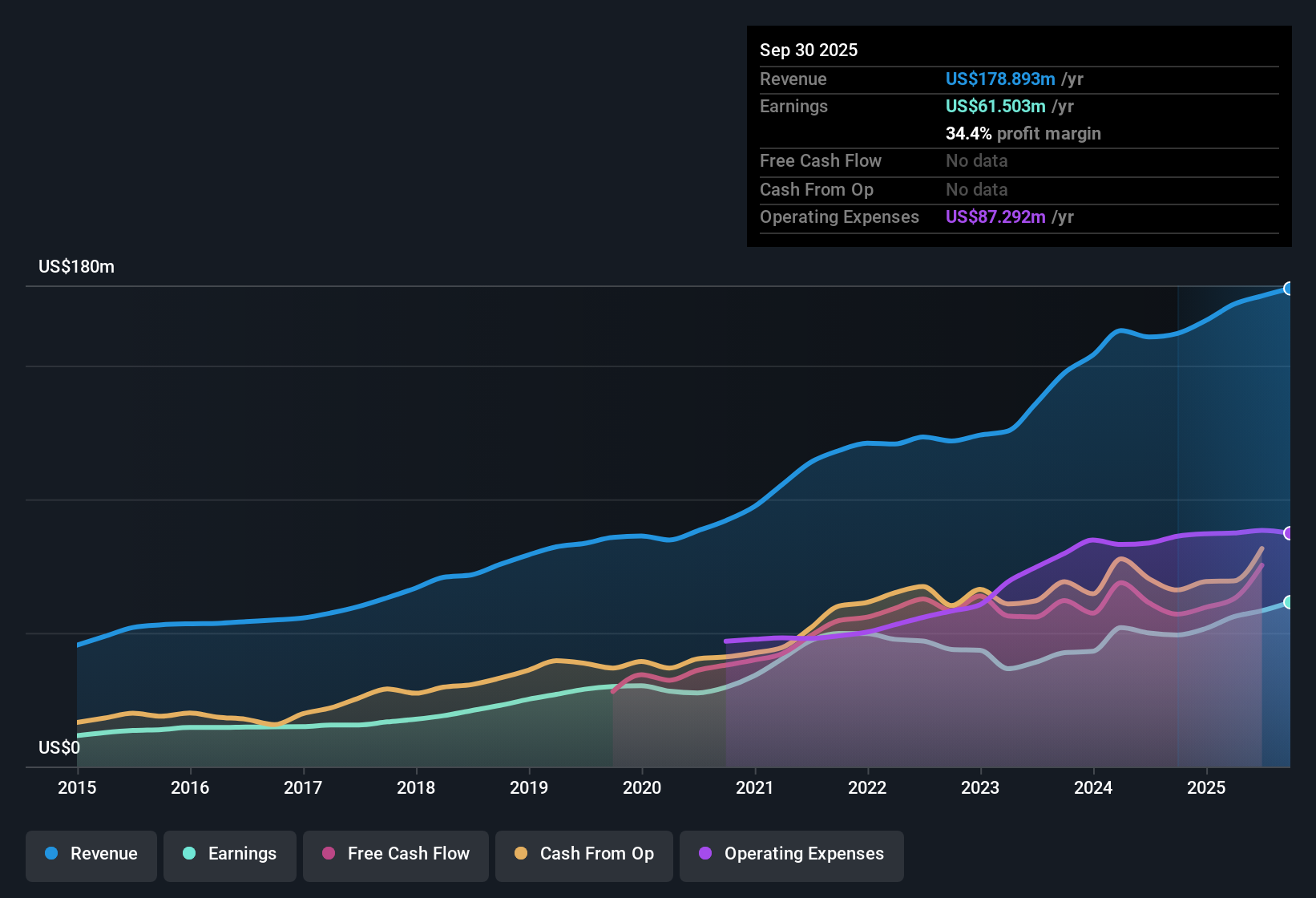

Southern Missouri Bancorp (SMBC) reported a net profit margin of 33.1%, a notable rise from last year's 31.1%. Annual EPS growth reached 16.8%, outpacing its 5-year average growth rate of 7% per year. Over the past five years, SMBC’s earnings have continued to climb at a compounded rate of 7% annually, while its Price-To-Earnings Ratio of 10.1x is lower than both the peer average of 17.2x and the US Banks industry average of 11.3x. With a share price of $52, SMBC currently trades below its estimated fair value of $107.08, positioning the stock as an intriguing prospect given its strong profitability and attractive valuation multiples.

See our full analysis for Southern Missouri Bancorp.The next step is to weigh these headline numbers against the most widely held narratives about SMBC. This helps identify where the data aligns with or challenges the prevailing story lines followed by the community and analysts alike.

See what the community is saying about Southern Missouri Bancorp

Margins Expand to 33.1% as Net Profitability Outpaces History

- SMBC’s net profit margin reached 33.1%, rising from last year’s 31.1% and surpassing its 5-year average profit pace of 7% annual earnings growth.

- Analysts' consensus view is that expanding profit margins now support the expectation for accelerated growth in coming years.

- Consensus notes that management’s focus on digital banking and core loan growth is credited for the margin gains, supporting anticipated margin expansion up to 36.8% by 2028.

- Analysts caution, however, that some of this progress depends on containing funding costs and maintaining credit quality, since areas such as agriculture could introduce pressure if sector risks materialize.

Consensus sees margins and core profits broadening, but investors are watching for signs of new provision risks or cost increases as the growth trajectory continues. 📊 Read the full Southern Missouri Bancorp Consensus Narrative.

Dividend Adds Appeal as Share Trades Below DCF Fair Value

- With its share price at $52.00, SMBC trades at a discount to both its DCF fair value of $107.08 and the peer average price-to-earnings ratio (10.1x versus peer average 17.2x).

- Analysts' consensus view notes that these valuation multiples reinforce the case for the stock’s potential, especially given the ongoing dividend stream.

- Consensus highlights the company’s attractive yield and solid dividend record, making the value discount stand out in a regional banking sector where reliable payers are scarce.

- The main debate centers on whether today’s price fully reflects forecasted earnings power or if further sector turbulence could close the value gap more gradually than anticipated.

Insider Selling Emerges, but Major Risks Appear Contained

- Recent filings indicate a minor risk from insider selling, though no significant risks were flagged in the reviewed statements.

- Analysts' consensus view states that, for now, operational and credit risks are well-managed, but single-category exposures such as agricultural loans remain under scrutiny.

- Consensus flags that agricultural loan quality and market volatility could affect asset quality if commodity prices remain low or collateral values decline further.

- Analysts see the company’s proactive reserving and federal support as capable of offsetting short-term spikes in delinquencies, keeping long-term risk contained.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Southern Missouri Bancorp on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on these figures? Put your perspective to work and shape your own narrative in just a few minutes by using Do it your way

A great starting point for your Southern Missouri Bancorp research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

While SMBC has delivered robust profit growth and attractive value, its exposure to agricultural loans and minor insider selling indicate ongoing risk to asset quality and future stability.

If you want to limit those vulnerabilities, check out solid balance sheet and fundamentals stocks screener (1984 results) to discover companies maintaining stronger balance sheets and more secure financial health in changing markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:SMBC

Southern Missouri Bancorp

Operates as the bank holding company for Southern Bank that provides banking and financial services to individuals and corporate customers in the United States.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives