- United States

- /

- Banks

- /

- NasdaqGS:PROV

It Might Not Be A Great Idea To Buy Provident Financial Holdings, Inc. (NASDAQ:PROV) For Its Next Dividend

Provident Financial Holdings, Inc. (NASDAQ:PROV) is about to trade ex-dividend in the next three days. Typically, the ex-dividend date is one business day before the record date which is the date on which a company determines the shareholders eligible to receive a dividend. The ex-dividend date is important as the process of settlement involves two full business days. So if you miss that date, you would not show up on the company's books on the record date. Thus, you can purchase Provident Financial Holdings' shares before the 17th of May in order to receive the dividend, which the company will pay on the 8th of June.

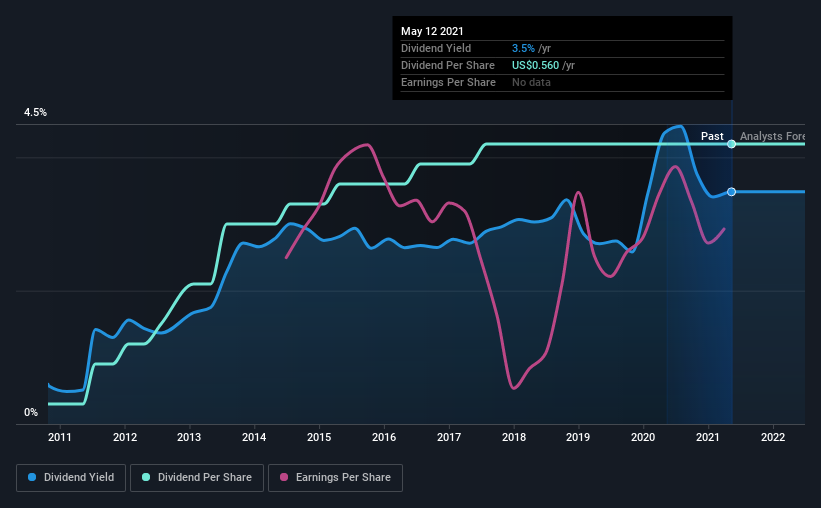

The company's upcoming dividend is US$0.14 a share, following on from the last 12 months, when the company distributed a total of US$0.56 per share to shareholders. Based on the last year's worth of payments, Provident Financial Holdings stock has a trailing yield of around 3.5% on the current share price of $16.08. We love seeing companies pay a dividend, but it's also important to be sure that laying the golden eggs isn't going to kill our golden goose! So we need to check whether the dividend payments are covered, and if earnings are growing.

See our latest analysis for Provident Financial Holdings

Dividends are usually paid out of company profits, so if a company pays out more than it earned then its dividend is usually at greater risk of being cut. Provident Financial Holdings is paying out an acceptable 72% of its profit, a common payout level among most companies.

Generally speaking, the lower a company's payout ratios, the more resilient its dividend usually is.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

When earnings decline, dividend companies become much harder to analyse and own safely. If earnings decline and the company is forced to cut its dividend, investors could watch the value of their investment go up in smoke. With that in mind, we're discomforted by Provident Financial Holdings's 6.5% per annum decline in earnings in the past five years. Ultimately, when earnings per share decline, the size of the pie from which dividends can be paid, shrinks.

The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. In the past 10 years, Provident Financial Holdings has increased its dividend at approximately 30% a year on average. Growing the dividend payout ratio while earnings are declining can deliver nice returns for a while, but it's always worth checking for when the company can't increase the payout ratio any more - because then the music stops.

To Sum It Up

Has Provident Financial Holdings got what it takes to maintain its dividend payments? We're not overly enthused to see Provident Financial Holdings's earnings in retreat at the same time as the company is paying out more than half of its earnings as dividends to shareholders. These characteristics don't generally lead to outstanding dividend performance, and investors may not be happy with the results of owning this stock for its dividend.

With that in mind though, if the poor dividend characteristics of Provident Financial Holdings don't faze you, it's worth being mindful of the risks involved with this business. For example - Provident Financial Holdings has 1 warning sign we think you should be aware of.

We wouldn't recommend just buying the first dividend stock you see, though. Here's a list of interesting dividend stocks with a greater than 2% yield and an upcoming dividend.

If you’re looking to trade Provident Financial Holdings, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:PROV

Provident Financial Holdings

Operates as the bank holding company for Provident Savings Bank, F.S.B.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives