- United States

- /

- Banks

- /

- NasdaqGS:PNFP

Pinnacle Financial Partners (PNFP): Evaluating Valuation After Recent Share Price Stumble

Reviewed by Kshitija Bhandaru

See our latest analysis for Pinnacle Financial Partners.

Zooming out, this latest 5% slide is only part of a broader pattern for Pinnacle Financial Partners. After a solid multi-year run, momentum has clearly faded in recent months, with a sharp 22% share price drop over the last quarter. While the one-year total shareholder return is down just 1%, the five-year total return of 148% shows the stock has rewarded long-term investors despite recent turbulence.

If you’re looking to spot what’s next or broaden your investing perspective, now is a smart time to discover fast growing stocks with high insider ownership

With performance wavering after strong gains, investors are left to wonder if the recent decline is a sign Pinnacle Financial Partners stock is undervalued, or if the market is already factoring in all future growth potential.

Most Popular Narrative: 18% Undervalued

The most widely followed narrative gives Pinnacle Financial Partners a fair value well above its last close, suggesting the market is not fully appreciating the company's outlook. With a robust premium set by analysts, investors are left asking what is driving this optimism and whether it can be sustained.

Migration-driven population and business growth in high-opportunity Sun Belt and Southeast markets continues to broaden Pinnacle's customer base, resulting in outsized loan and deposit growth even during challenging macro and rate cycles. This structurally supports double-digit revenue and net interest income growth.

Curious what financial engines and bold growth bets drive this projected value? The real story lies in ambitious assumptions about regional market dominance and future margins. Want a glimpse behind the curtain? Unlock the narrative and learn what numbers are fueling analyst expectations.

Result: Fair Value of $112.08 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, concentration in Southeastern markets and competition from fintechs could challenge Pinnacle’s growth if local economies weaken or if digital rivals capture market share.

Find out about the key risks to this Pinnacle Financial Partners narrative.

Another View: What Do Market Comparisons Say?

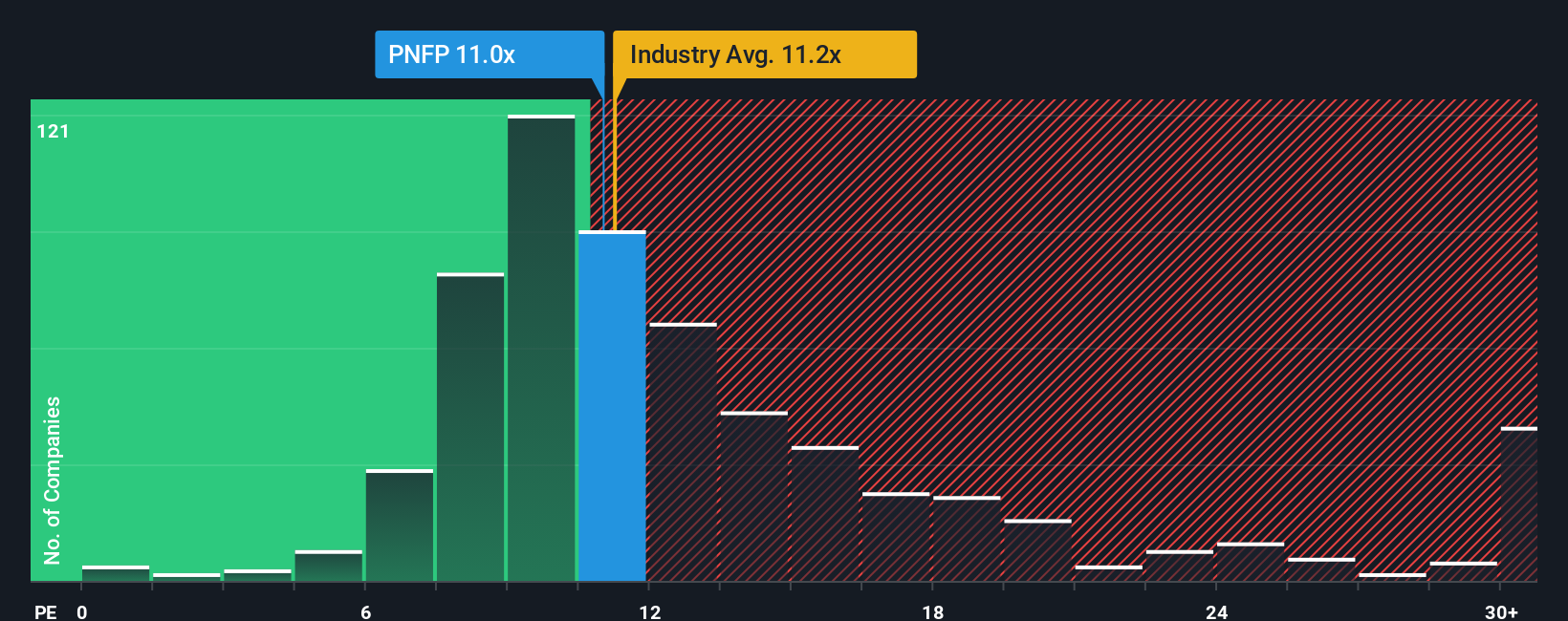

Looking at how Pinnacle Financial Partners stacks up against similar banks, its price-to-earnings ratio of 12.2x is near the industry average of 11.8x, making it look a bit pricey compared to other banks. However, it trades well below a fair ratio of 22.1x and better than the peer average of 13.9x. This raises a practical question: is the stock’s premium a warning sign, or could the market be slow to recognize its full potential?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Pinnacle Financial Partners Narrative

If you want a fresh perspective or trust your own instincts more, dive into the data and start building your own take in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Pinnacle Financial Partners.

Looking for More Investment Ideas?

Don't wait for the market to show you opportunities. Seize them for yourself. Some of the best trends are hiding in plain sight, ready for your attention.

- Unleash your portfolio's potential in artificial intelligence by tapping into these 25 AI penny stocks, making waves with automation and advanced data analytics in diverse industries.

- Seize the chance to earn steady income by checking out these 19 dividend stocks with yields > 3%, offering yields above 3% while balancing growth and stability.

- Make your next move with confidence and target value plays with these 898 undervalued stocks based on cash flows, revealing stocks that may be trading below their real worth based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PNFP

Pinnacle Financial Partners

Operates as the bank holding company for Pinnacle Bank that provides various banking products and services to individuals, businesses, and professional entities in the United States.

Very undervalued with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives