- United States

- /

- Banks

- /

- NasdaqCM:PKBK

Parke Bancorp (PKBK) Earnings Growth Surges 42%, Challenging Cautious Investor Narratives

Reviewed by Simply Wall St

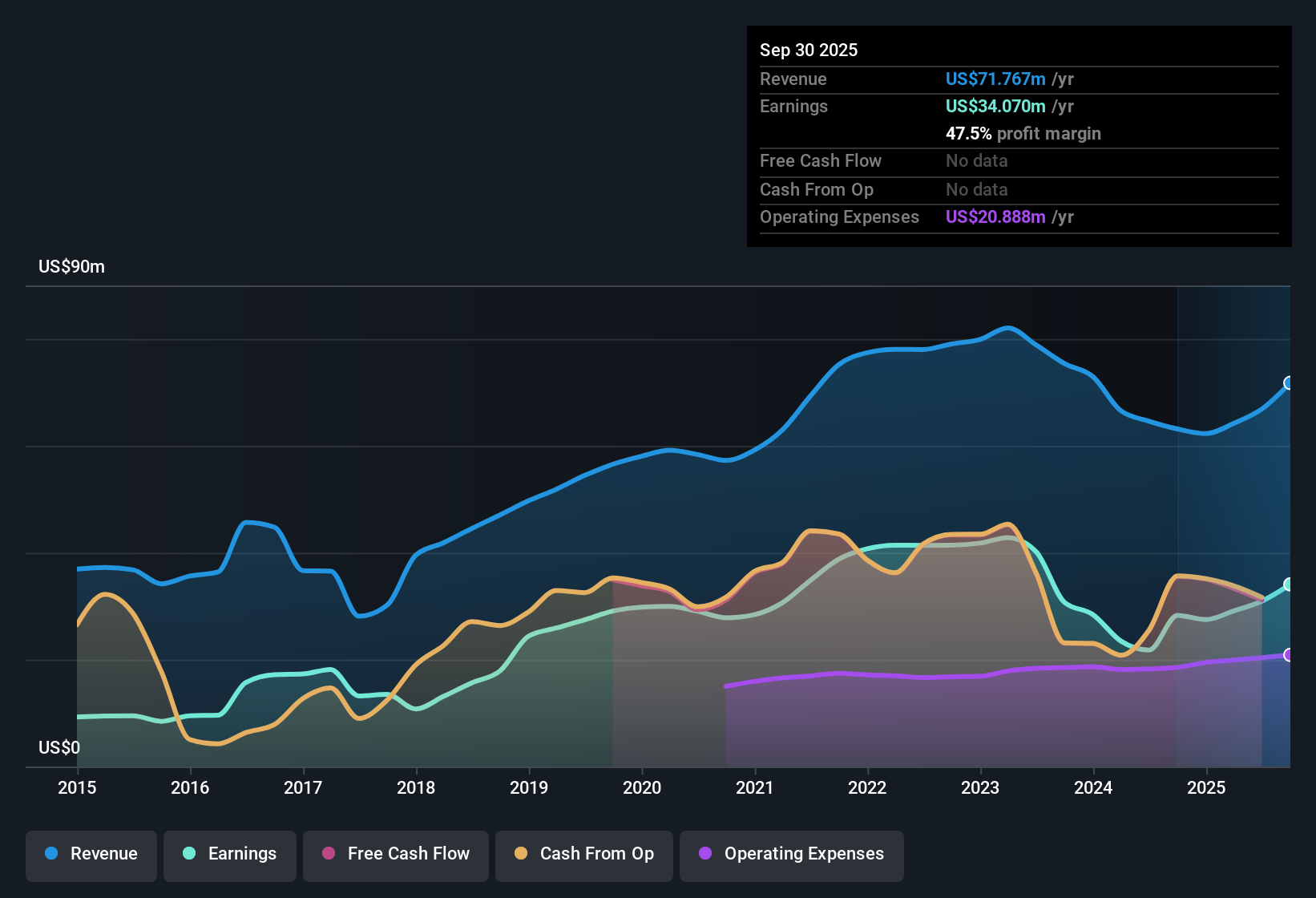

Parke Bancorp (PKBK) posted a 42.1% year-over-year surge in earnings, easily outpacing its five-year average annual decline of 4.9%. Net profit margins widened to 46.3% from last year’s 33.7%, highlighting better profitability, while the company now trades at an 8.3x Price-to-Earnings ratio, which is below both peers and the broader US banks industry. With improved profit growth, a higher margin, and valuation multiples below industry benchmarks, investors may see fresh reasons for optimism, though uncertainty around future growth remains a point of caution.

See our full analysis for Parke Bancorp.Next, we will see how these headline numbers measure up against the narratives followed by investors and analysts alike. Sometimes the market view aligns, and other times it gets challenged.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margins Widen to 46.3%

- Net profit margin rose to 46.3%, compared to 33.7% last year, marking a sizeable increase in profitability over the period.

- Recent financials highlight management's focus on operational efficiency. This supports the view that Parke Bancorp's conservative, steady approach is keeping expenses in check and allowing more of each dollar in revenue to reach the bottom line.

- Supporters point to the company’s higher margins as evidence of disciplined operations, which is particularly reassuring amid broader sector uncertainty.

- Attracting investors who value predictability and resilience, these margin trends help reinforce Parke Bancorp’s reputation as a stable income source, even if the pace of growth is not dramatic.

Growth Outpaces Five-Year Trend

- Annual earnings grew 42.1% year-over-year, whereas over the last five years, earnings had averaged a 4.9% annual decline. This signals a reversal in performance trend.

- It is noteworthy that, despite broader sector headwinds and the absence of clear growth catalysts, Parke Bancorp has delivered a sharp swing to growth after years of declines.

- This shift could catch the attention of investors previously adopting a “wait and see” stance, as recent results show more momentum than might be expected from the company’s long-term averages.

- However, prevailing opinion remains cautious, noting that a single strong year does not guarantee future growth, especially given ongoing macroeconomic pressures impacting regional banks.

Valuation Undercuts Peer Benchmarks

- With a Price-to-Earnings Ratio of 8.3x, Parke Bancorp trades at a substantial discount compared to its peer average of 14.6x and the US banking industry’s 11.3x.

- Market watchers note that while the stock appears attractively valued, the discount may partly reflect skepticism about the sustainability of the recent turnaround.

- The lower multiple could present a compelling entry for value-focused investors. At the same time, it signals that the market wants to see more consistent profit and revenue momentum before fully re-rating the stock.

- Despite the rebound, some remain on the sidelines, mindful of the risks tied to ongoing revenue and earnings growth uncertainty in this sector climate.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Parke Bancorp's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite the recent profit surge, Parke Bancorp’s uncertain growth outlook and history of earnings declines may concern investors seeking steadier expansion.

If consistent results are your priority, focus on stable growth stocks screener (2091 results) to see stocks delivering proven, stable growth whatever the economic climate brings.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:PKBK

Parke Bancorp

Operates as the bank holding company for Parke Bank that provides personal and business financial services to individuals and small to mid-sized businesses.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives