- United States

- /

- Banks

- /

- NasdaqGS:ONB

Old National Bancorp (ONB): Evaluating Valuation as Shares Outpace Financial Sector in Recent Week

Reviewed by Simply Wall St

See our latest analysis for Old National Bancorp.

While Old National Bancorp’s share price has treaded water in recent months, it is worth noting the stock is still up a solid 37.2% on a total return basis over five years, even with a slight dip over the past year. That kind of long-term resilience suggests some investors see potential for renewed momentum if recent revenue and net income growth continue to impress.

If you are keeping an eye out for what is next in financials, this could be a smart time to broaden your perspective and discover fast growing stocks with high insider ownership

With shares still well below analyst price targets and strong fundamental growth on display, the key question now is whether Old National Bancorp remains an overlooked value or if the market has already priced in future gains.

Most Popular Narrative: 22.5% Undervalued

Compared to the last close price of $19.96, the narrative’s estimated fair value of $25.75 presents a notable gap. This valuation rests on several forward-looking assumptions that form a bold case for Old National Bancorp’s upside.

Strategic investment in digital banking infrastructure, highlighted by recent technology hires and ongoing upgrades, is enabling ONB to scale services efficiently, enhance client experience, and capitalize on the sector-wide shift toward digital and data-driven banking. This should drive greater noninterest income, improve net margins, and increase client retention over time.

What exactly fuels such a premium over the current share price? The narrative hinges on a mix of digital strategy and operational trends, all pointing toward ambitious margin expansion and future profitability. Curious what numbers back such confidence? There are striking projections behind this view of Old National Bancorp’s fair value. These details could reshape your expectations.

Result: Fair Value of $25.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing weakness in loan growth and continued pressure from commercial real estate exposure could quickly challenge the positive outlook for Old National Bancorp.

Find out about the key risks to this Old National Bancorp narrative.

Another View: What Do Earnings Ratios Say?

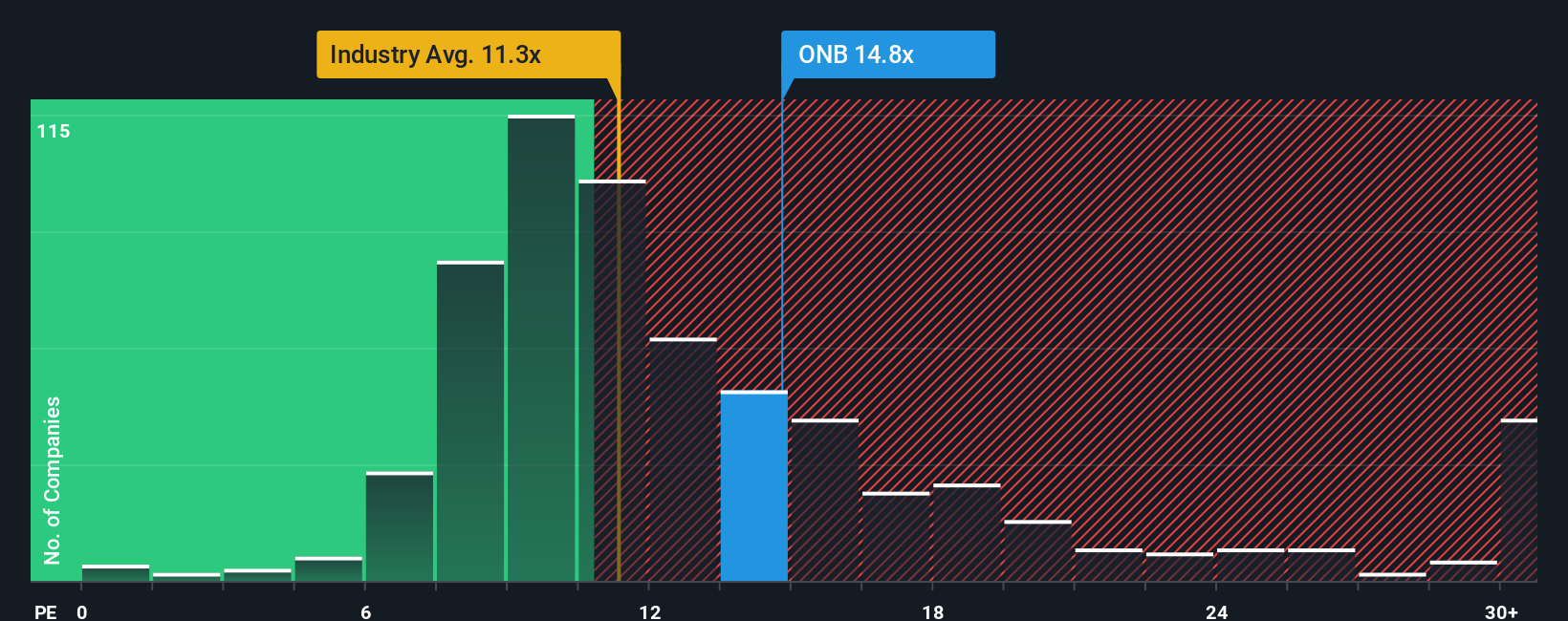

Looking at the company’s price-to-earnings ratio, Old National Bancorp trades at 13.2x, which is higher than both the peer average of 11.5x and the US Banks industry at 10.9x. Even compared to its own fair ratio of 16.7x, there is still a margin. Does this premium signal investor optimism, or could it point to heightened risk if expectations are missed?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Old National Bancorp Narrative

If you see things differently or want to test your own convictions, you can dive into the numbers and build a fresh viewpoint in just a few minutes. Do it your way

A great starting point for your Old National Bancorp research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Stay ahead of the market by checking out unique screens designed to help you spot the next breakout opportunity before others catch on.

- Uncover potential market movers and spot overlooked gems by checking out these 908 undervalued stocks based on cash flows for companies trading below their true worth.

- Tap into future-defining sectors and locate innovators with strong medical breakthroughs in these 31 healthcare AI stocks, which blends healthcare and AI for transformative growth.

- Boost your income strategy and identify stocks paying reliable above-average yields by exploring these 18 dividend stocks with yields > 3% in one simple short list.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ONB

Old National Bancorp

Operates as the bank holding company for Old National Bank that provides consumer and commercial banking services in the United States.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives