- United States

- /

- Banks

- /

- NasdaqCM:PKBK

3 Undiscovered Gems In The US Market With Strong Potential

Reviewed by Simply Wall St

As the U.S. stock market continues to experience robust growth, with major indices like the Nasdaq and S&P 500 posting impressive weekly and monthly gains, investors are increasingly on the lookout for opportunities beyond the well-trodden paths of large-cap giants. In this dynamic landscape, identifying promising small-cap stocks that demonstrate resilience and growth potential can be a rewarding strategy for those seeking to diversify their portfolios amidst broader market optimism.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Oakworth Capital | 40.91% | 15.96% | 11.47% | ★★★★★★ |

| Senstar Technologies | NA | -18.50% | 29.50% | ★★★★★★ |

| Metalpha Technology Holding | NA | 75.66% | 28.60% | ★★★★★★ |

| FineMark Holdings | 115.37% | 2.22% | -28.34% | ★★★★★★ |

| NameSilo Technologies | 14.73% | 14.50% | -1.32% | ★★★★★☆ |

| Valhi | 44.30% | 1.10% | -1.40% | ★★★★★☆ |

| ASA Gold and Precious Metals | NA | 13.18% | 16.77% | ★★★★★☆ |

| Pure Cycle | 5.02% | 4.35% | -2.25% | ★★★★★☆ |

| Gulf Island Fabrication | 20.48% | 3.25% | 43.31% | ★★★★★☆ |

| Greenfire Resources | 35.48% | -1.31% | -25.79% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Isabella Bank (ISBA)

Simply Wall St Value Rating: ★★★★★★

Overview: Isabella Bank Corporation is a bank holding company for Isabella Bank, offering banking and wealth management services to businesses, institutions, and individuals in Michigan, with a market cap of $262.71 million.

Operations: Isabella Bank Corporation generates revenue primarily through its retail banking operations, which contribute $76.49 million. The company's market capitalization stands at approximately $262.71 million.

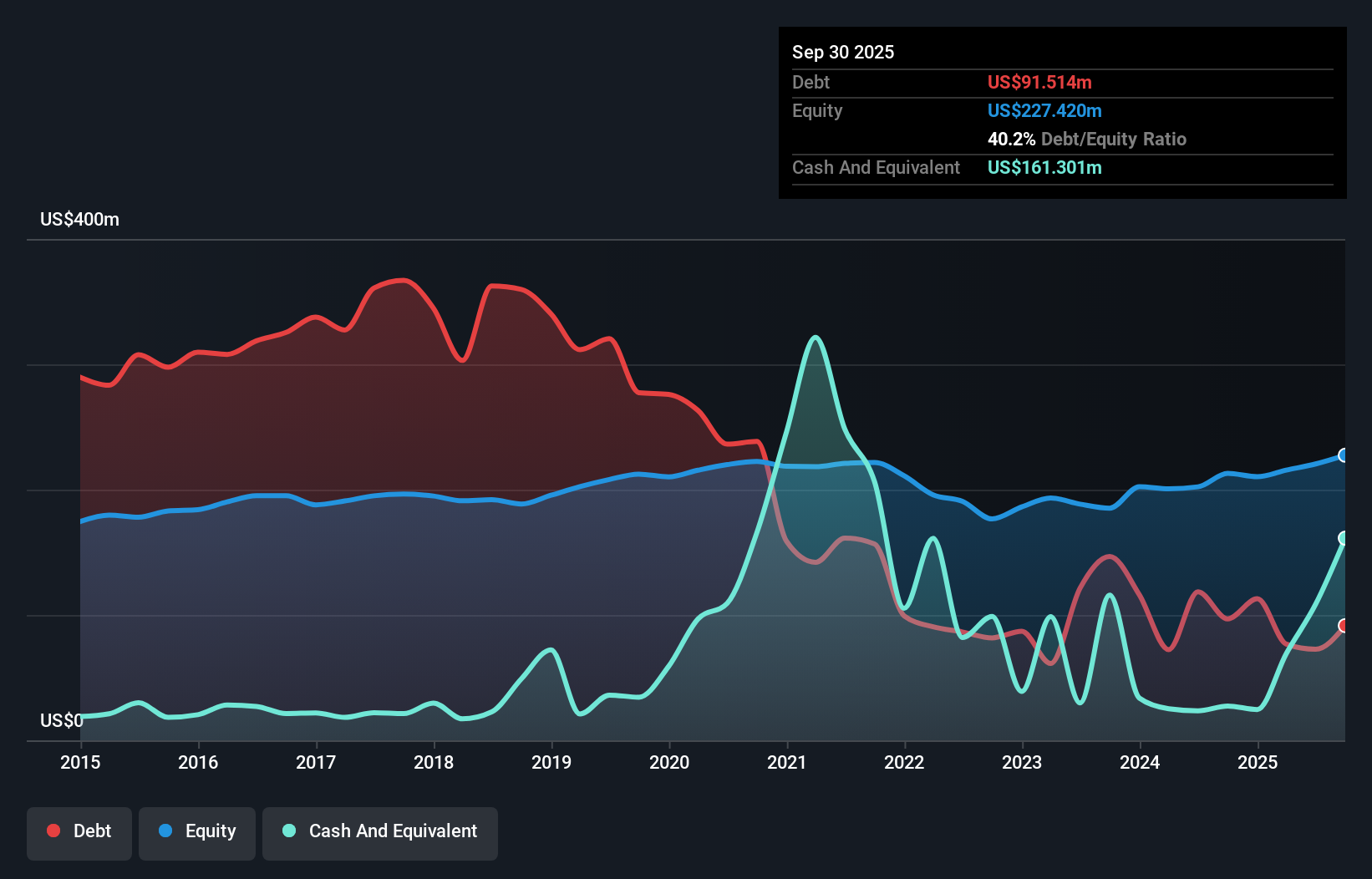

Isabella Bank, a small financial player with assets totaling US$2.3 billion and equity of US$227.4 million, showcases strong earnings growth of 33% over the past year, outpacing the industry average of 17.8%. The bank holds an appropriate level of bad loans at just 0.2%, supported by a robust allowance for bad loans at 382%. Its liabilities are primarily low-risk, with customer deposits accounting for 95%. Recent developments include appointing Brian Tessin to its board and repurchasing shares worth US$0.62 million in Q3 2025, alongside consistent dividend payouts reflecting stable shareholder returns.

- Unlock comprehensive insights into our analysis of Isabella Bank stock in this health report.

Examine Isabella Bank's past performance report to understand how it has performed in the past.

Orange County Bancorp (OBT)

Simply Wall St Value Rating: ★★★★★★

Overview: Orange County Bancorp, Inc. operates through its subsidiaries to offer commercial and consumer banking products and services, with a market cap of $326.82 million.

Operations: Orange County Bancorp generates revenue primarily through its commercial and consumer banking services. The company focuses on interest income from loans and investments, alongside fee-based income from various financial services. Its cost structure includes interest expenses related to deposits and borrowings, as well as operational costs for service delivery.

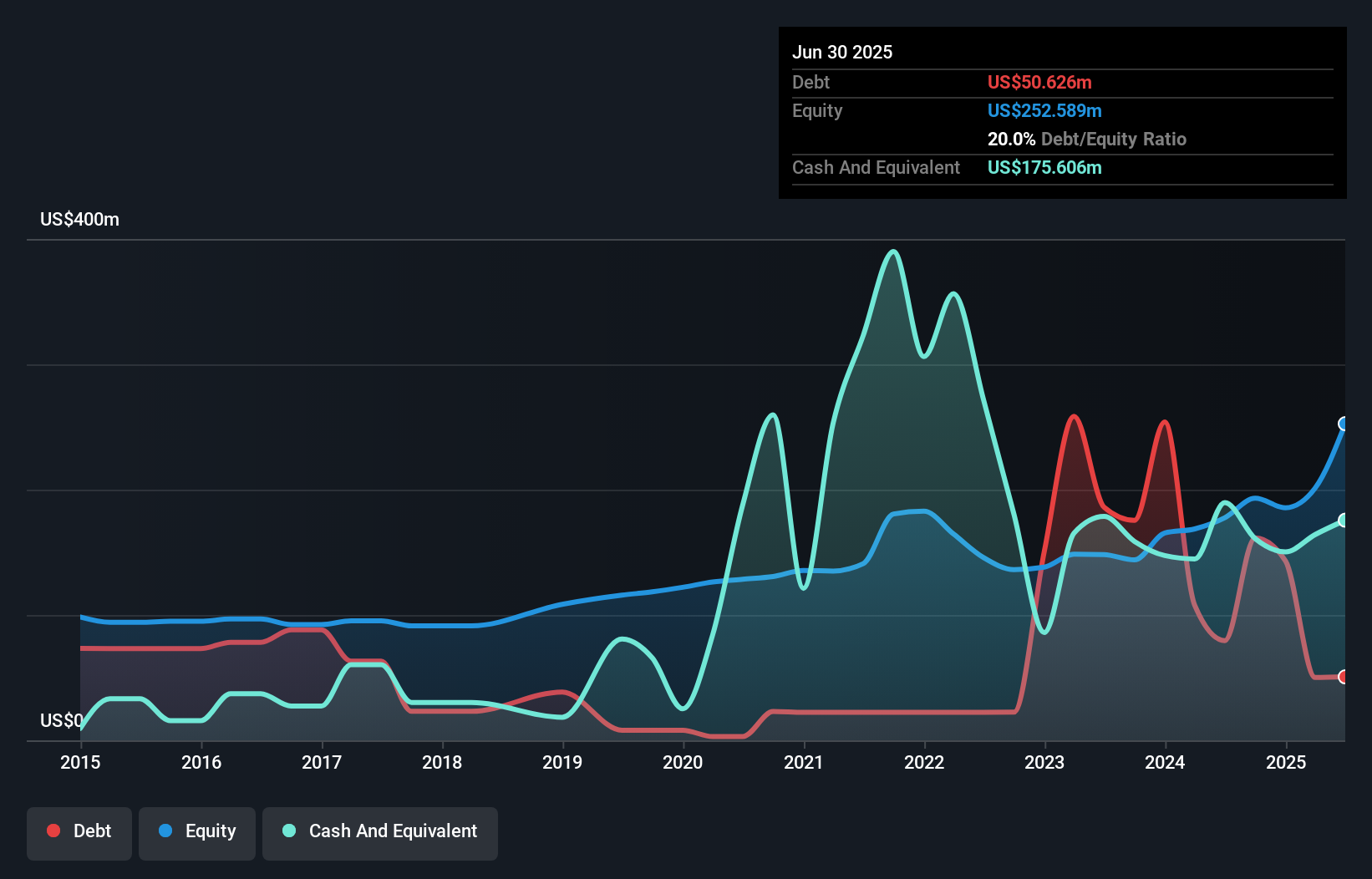

Orange County Bancorp, with assets totaling $2.6 billion and equity of $270.1 million, is a notable player in its sector. The company has total deposits of $2.3 billion and loans amounting to $1.9 billion, showcasing a solid lending base supported by sufficient bad loan allowances at 0.6%. Its earnings have grown by 26% over the past year, outpacing the industry growth rate of 17.8%, indicating robust performance and high-quality earnings potential. Recently, it issued $25 million in subordinated notes as part of strategic financial maneuvers aimed at enhancing capital structure while maintaining low-risk funding sources for its operations.

- Delve into the full analysis health report here for a deeper understanding of Orange County Bancorp.

Understand Orange County Bancorp's track record by examining our Past report.

Parke Bancorp (PKBK)

Simply Wall St Value Rating: ★★★★★★

Overview: Parke Bancorp, Inc. is the bank holding company for Parke Bank, offering personal and business financial services to individuals and small to mid-sized businesses, with a market cap of $256.02 million.

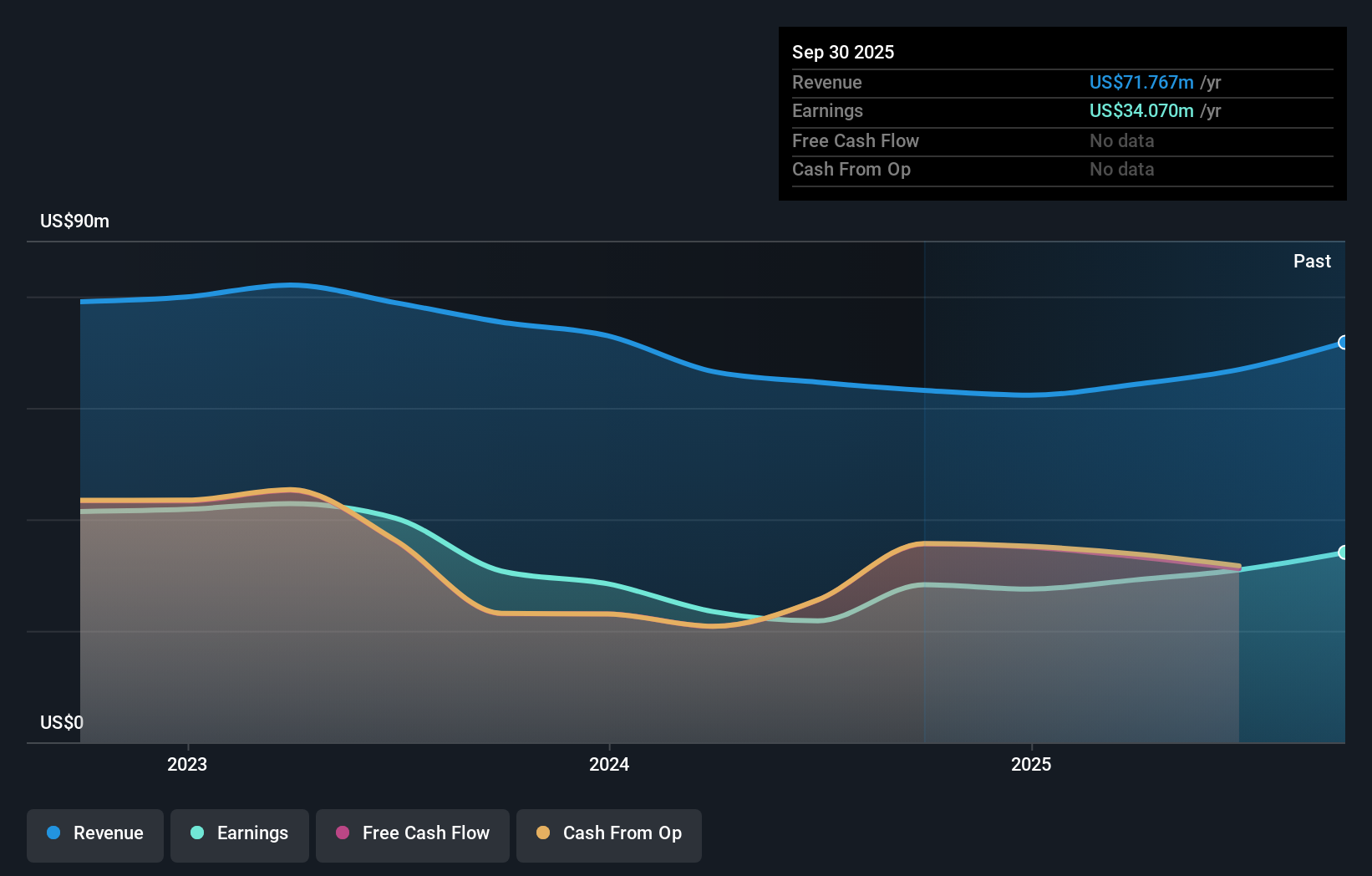

Operations: Parke Bancorp generates revenue primarily through its community banking segment, which accounts for $71.77 million. The company's net profit margin stands at 39.5%.

Parke Bancorp, with total assets of US$2.2 billion and equity of US$314.8 million, showcases its potential through a net interest margin of 3% and a robust allowance for bad loans at 0.6% of total loans. The bank's earnings growth over the past year outpaced the industry at 20.5%, while trading at 56.2% below estimated fair value suggests room for appreciation. Recent buybacks saw the company repurchase 499,332 shares for US$10.75 million, reflecting strong confidence in its valuation despite past five-year earnings declining by 4.2% annually.

- Click here and access our complete health analysis report to understand the dynamics of Parke Bancorp.

Gain insights into Parke Bancorp's historical performance by reviewing our past performance report.

Seize The Opportunity

- Dive into all 304 of the US Undiscovered Gems With Strong Fundamentals we have identified here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:PKBK

Parke Bancorp

Operates as the bank holding company for Parke Bank that provides personal and business financial services to individuals and small to mid-sized businesses.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives