- United States

- /

- Banks

- /

- NasdaqCM:NSTS

Further weakness as NSTS Bancorp (NASDAQ:NSTS) drops 11% this week, taking one-year losses to 22%

It's easy to match the overall market return by buying an index fund. But if you buy individual stocks, you can do both better or worse than that. That downside risk was realized by NSTS Bancorp, Inc. (NASDAQ:NSTS) shareholders over the last year, as the share price declined 22%. That contrasts poorly with the market decline of 7.3%. We wouldn't rush to judgement on NSTS Bancorp because we don't have a long term history to look at. More recently, the share price has dropped a further 12% in a month. We do note, however, that the broader market is down 6.2% in that period, and this may have weighed on the share price.

Since NSTS Bancorp has shed US$6.0m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

See our latest analysis for NSTS Bancorp

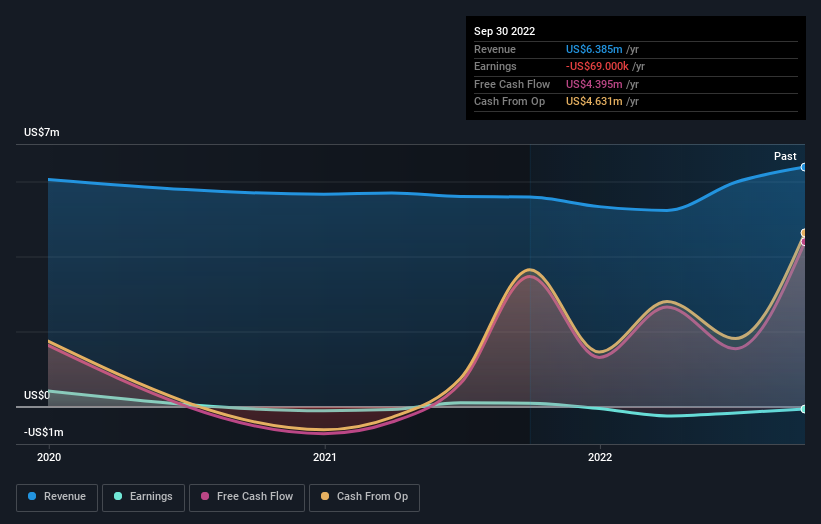

Given that NSTS Bancorp didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

In the last twelve months, NSTS Bancorp increased its revenue by 14%. That's definitely a respectable growth rate. Unfortunately that wasn't good enough to stop the share price dropping 22%. This implies the market was expecting better growth. However, that's in the past now, and it's the future that matters most.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. This free interactive report on NSTS Bancorp's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

We doubt NSTS Bancorp shareholders are happy with the loss of 22% over twelve months. That falls short of the market, which lost 7.3%. That's disappointing, but it's worth keeping in mind that the market-wide selling wouldn't have helped. With the stock down 6.7% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Given the relatively short history of this stock, we'd remain pretty wary until we see some strong business performance. It's always interesting to track share price performance over the longer term. But to understand NSTS Bancorp better, we need to consider many other factors. Even so, be aware that NSTS Bancorp is showing 1 warning sign in our investment analysis , you should know about...

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you're looking to trade NSTS Bancorp, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if NSTS Bancorp might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:NSTS

NSTS Bancorp

Operates as a savings and loan holding company for North Shore Trust and Savings that provides banking products and services in Illinois.

Flawless balance sheet very low.

Similar Companies

Market Insights

Community Narratives