- United States

- /

- Banks

- /

- NasdaqGS:NRIM

Shareholders Will Probably Not Have Any Issues With Northrim BanCorp, Inc.'s (NASDAQ:NRIM) CEO Compensation

Under the guidance of CEO Joe Schierhorn, Northrim BanCorp, Inc. (NASDAQ:NRIM) has performed reasonably well recently. This is something shareholders will keep in mind as they cast their votes on company resolutions such as executive remuneration in the upcoming AGM on 27 May 2021. We present our case of why we think CEO compensation looks fair.

Check out our latest analysis for Northrim BanCorp

Comparing Northrim BanCorp, Inc.'s CEO Compensation With the industry

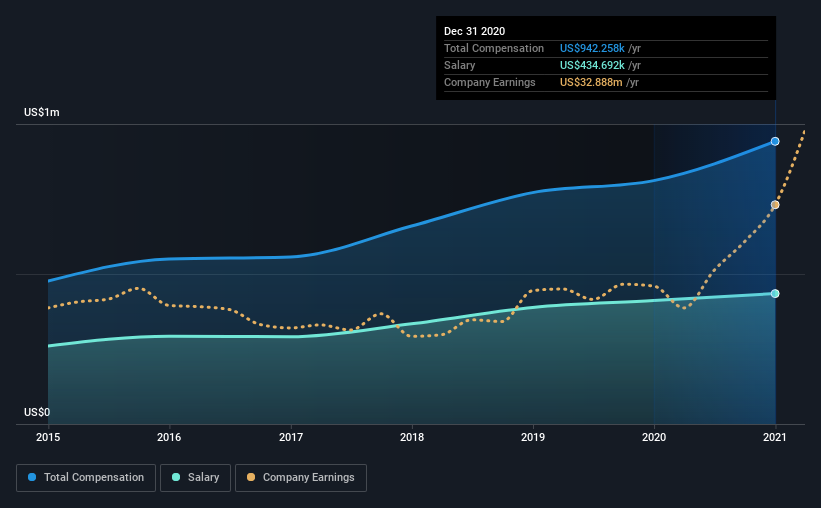

Our data indicates that Northrim BanCorp, Inc. has a market capitalization of US$278m, and total annual CEO compensation was reported as US$942k for the year to December 2020. We note that's an increase of 16% above last year. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at US$435k.

On comparing similar companies from the same industry with market caps ranging from US$100m to US$400m, we found that the median CEO total compensation was US$763k. This suggests that Northrim BanCorp remunerates its CEO largely in line with the industry average. Moreover, Joe Schierhorn also holds US$2.0m worth of Northrim BanCorp stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | US$435k | US$411k | 46% |

| Other | US$508k | US$400k | 54% |

| Total Compensation | US$942k | US$811k | 100% |

On an industry level, roughly 43% of total compensation represents salary and 57% is other remuneration. Although there is a difference in how total compensation is set, Northrim BanCorp more or less reflects the market in terms of setting the salary. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

Northrim BanCorp, Inc.'s Growth

Northrim BanCorp, Inc. has seen its earnings per share (EPS) increase by 53% a year over the past three years. In the last year, its revenue is up 48%.

This demonstrates that the company has been improving recently and is good news for the shareholders. It's great to see that revenue growth is strong, too. These metrics suggest the business is growing strongly. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Northrim BanCorp, Inc. Been A Good Investment?

Northrim BanCorp, Inc. has generated a total shareholder return of 26% over three years, so most shareholders would be reasonably content. But they would probably prefer not to see CEO compensation far in excess of the median.

In Summary...

Given that the company's overall performance has been reasonable, the CEO remuneration policy might not be shareholders' central point of focus in the upcoming AGM. However, we still think that any proposed increase in CEO compensation will be examined closely to make sure the compensation is appropriate and linked to performance.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. That's why we did some digging and identified 1 warning sign for Northrim BanCorp that you should be aware of before investing.

Important note: Northrim BanCorp is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

If you’re looking to trade Northrim BanCorp, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Northrim BanCorp might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:NRIM

Northrim BanCorp

Operates as the bank holding company for Northrim Bank that provides commercial banking products and services to businesses and professional individuals.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion