- United States

- /

- Banks

- /

- NasdaqCM:NECB

Northeast Community Bancorp (NECB): High 42.7% Margins Test Bullish Valuation Narrative

Reviewed by Simply Wall St

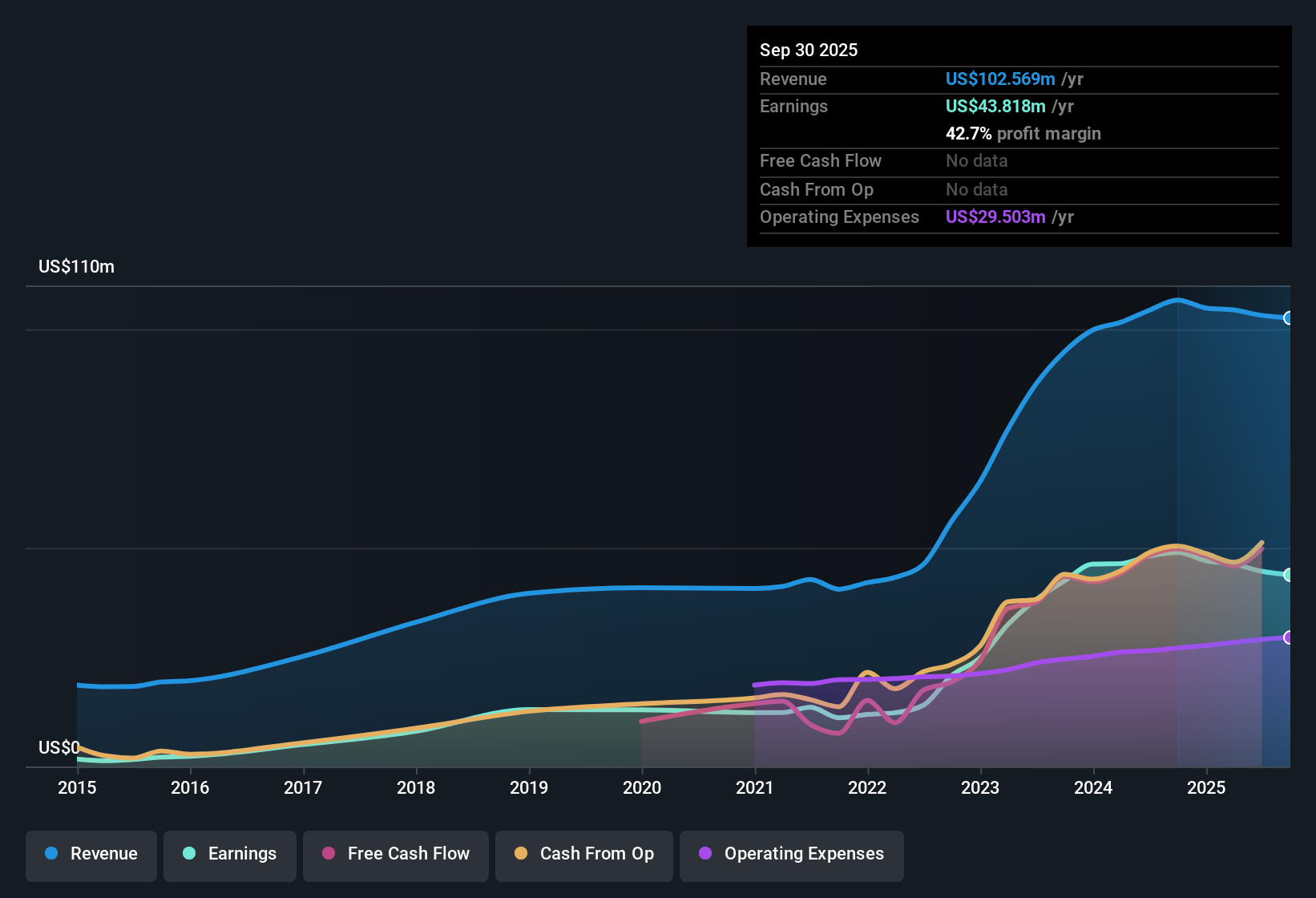

Northeast Community Bancorp (NECB) posted net profit margins of 42.7% this year, down from 45.9% last year. Annual revenue is forecast to grow at 7.8%, and EPS is projected to increase by 3.1% per year, both trailing the broader US market. Over the last five years, earnings growth averaged a robust 31.6% per year, but the most recent year saw a decline, setting a nuanced backdrop for investors. With the company trading at a Price-To-Earnings ratio of 5.6x, well below both industry and peer averages, the market's attention now turns to valuation, earnings quality, and how these numbers fit into the story going forward.

See our full analysis for Northeast Community Bancorp.Next, we will see how these fresh results measure up against the ongoing narratives shaping market sentiment and investor expectations.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margins Remain Elevated at 42.7%

- Net profit margins for NECB currently stand at 42.7%, a slight decrease from last year's 45.9%, but still impressively high for a community bank facing softer growth forecasts than the US market average.

- While recent trends introduce caution, the prevailing narrative focuses on NECB’s ability to maintain robust profitability in a challenging environment.

- The company’s five-year earnings growth averaged 31.6% annually, heavily supporting the idea that even moderate, sustained margins like these provide significant cushion versus sector peers.

- What is surprising is that despite negative earnings growth in the most recent year, margins remain far above typical industry levels, which tends to anchor the bullish case that NECB’s core business is resilient even when growth moderates.

Discount Valuation: P/E at 5.6x

- NECB trades at a Price-To-Earnings ratio of just 5.6x, materially below the US Banks industry average of 11.2x and peer average of 11.6x. This continues to signal market skepticism despite high historical earnings quality.

- The market’s prevailing analysis weighs this valuation gap as a strong potential reward, with several points reinforcing the investment case:

- The current share price of $20.97 is well under both the peer average and the DCF fair value of $54.69, which heavily supports the “good value” argument. This is even as recent growth estimates remain behind the market-wide pace.

- Other supportive features for the bull case include stable profit margins, no major insider selling, and an attractive dividend profile. These factors strengthen the perception of upside if NECB can meet or beat its earnings guidance going forward.

Growth Forecasts Trail Market Leaders

- Northeast Community Bancorp’s revenue is forecast to grow at 7.8% per year and earnings at 3.1% per year. Both are meaningfully lower than broader US market forecasts of 10.1% for revenue and 15.5% for earnings growth.

- The prevailing assessment points to a more cautious interpretation here, as these moderate projections challenge expectations for rapid upside and put the focus squarely on execution:

- Bears will note the drop in earnings growth versus the five-year 31.6% annual pace, using it to argue that future outperformance is less likely unless something fundamentally changes in NECB’s growth model.

- What stands out is that, even with average revenue and earnings growth metrics, NECB’s steady profit margins and value pricing mean the market could quickly re-rate the stock if there are signs of renewed momentum.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Northeast Community Bancorp's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

NECB’s slower revenue and earnings forecasts highlight its struggle to keep pace with higher-growth US market leaders. This raises doubts about its future upside.

If you’re seeking companies set to deliver rapid earnings expansion, check out high growth potential stocks screener (58 results) where strong growth prospects drive outsized returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Northeast Community Bancorp might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:NECB

Northeast Community Bancorp

Operates as the holding company for NorthEast Community Bank that provides financial services for individuals and businesses.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives