- United States

- /

- Banks

- /

- NasdaqGS:NBTB

Did NBT Bancorp's (NBTB) 13th Dividend Hike Signal a Shift in Capital Allocation Priorities?

Reviewed by Simply Wall St

- On July 28, 2025, NBT Bancorp reported second-quarter results showing a year-over-year rise in net interest income to US$124.22 million but a drop in net income to US$22.51 million and announced its thirteenth consecutive annual dividend increase, raising the third-quarter payout to US$0.37 per share.

- While earnings were lower, the company’s continued commitment to dividend growth highlights its focus on returning capital to shareholders despite changing earnings metrics.

- We’ll explore how the latest dividend hike underscores NBT Bancorp’s priorities and influences the investment narrative going forward.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

NBT Bancorp Investment Narrative Recap

Staying invested in NBT Bancorp means believing in its ability to balance growth opportunities, such as regional expansion and the upstate New York semiconductor ecosystem, with disciplined capital returns to shareholders. The latest earnings report, showing net interest income growth but lower net income, does not materially shift the short-term focus on the successful completion of the Evans Bancorp merger, though ongoing commercial real estate exposure remains the largest risk to earnings stability right now.

Of the recent announcements, the thirteenth consecutive annual dividend increase stands out, reinforcing the company’s aim to reward shareholders even as quarterly earnings fluctuate. This move aligns with NBT Bancorp’s broader efforts to manage funding costs and deliver consistent, reliable returns, which are central to the current investment thesis and key catalysts identified by analysts.

However, despite management’s confidence, it is important to keep in mind that challenges related to commercial real estate exposure could still...

Read the full narrative on NBT Bancorp (it's free!)

NBT Bancorp's outlook anticipates $975.7 million in revenue and $272.3 million in earnings by 2028. This projection is based on an expected annual revenue growth rate of 19.7% and a $128.7 million increase in earnings from the current $143.6 million.

Uncover how NBT Bancorp's forecasts yield a $49.83 fair value, a 16% upside to its current price.

Exploring Other Perspectives

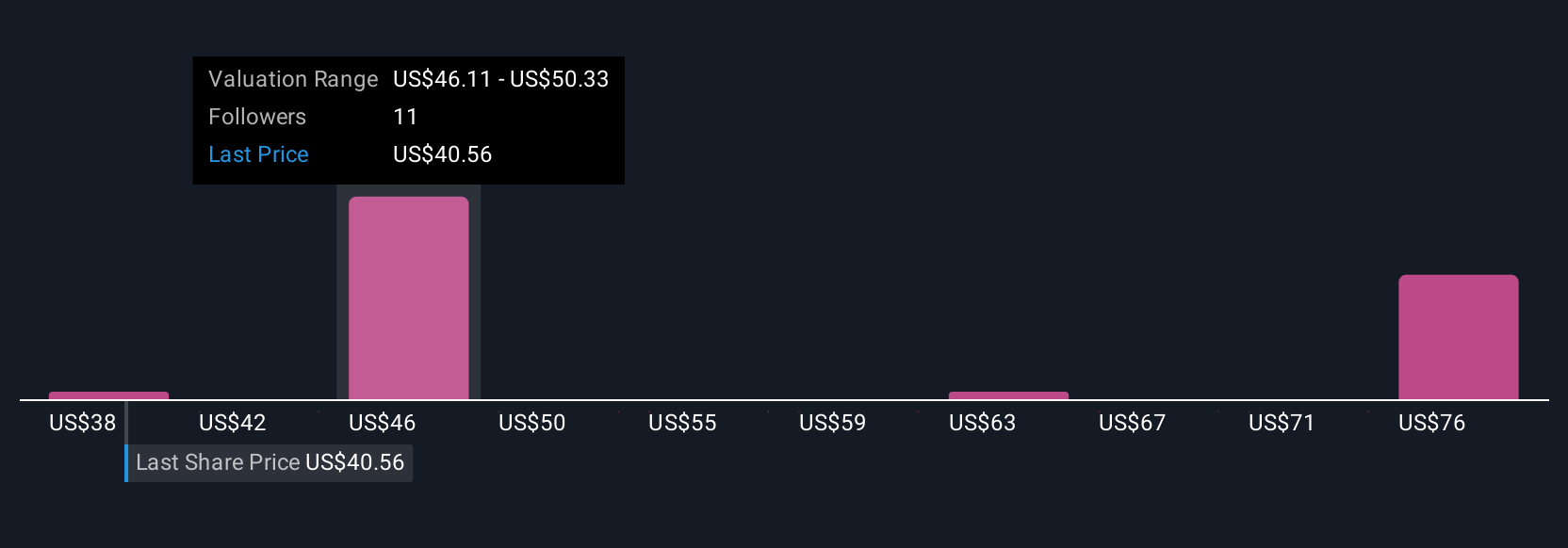

Four private investors in the Simply Wall St Community placed NBT Bancorp’s fair value between US$37.67 and US$76.41 per share. While merger benefits drive future optimism, views on risk to earnings remain highly varied, see how your opinion compares.

Explore 4 other fair value estimates on NBT Bancorp - why the stock might be worth as much as 78% more than the current price!

Build Your Own NBT Bancorp Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NBT Bancorp research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free NBT Bancorp research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NBT Bancorp's overall financial health at a glance.

Searching For A Fresh Perspective?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 25 companies in the world exploring or producing it. Find the list for free.

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NBT Bancorp might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NBTB

NBT Bancorp

A financial holding company, provides commercial banking, retail banking, and wealth management services.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives