- United States

- /

- Banks

- /

- OTCPK:MSVB

We Discuss Why Mid-Southern Bancorp, Inc.'s (NASDAQ:MSVB) CEO May Deserve A Higher Pay Packet

Shareholders will probably not be disappointed by the robust results at Mid-Southern Bancorp, Inc. (NASDAQ:MSVB) recently and they will be keeping this in mind as they go into the AGM on 26 May 2021. This would also be a chance for them to hear the board review the financial results, discuss future company strategy to further improve the business and vote on any resolutions such as executive remuneration. We have prepared some analysis below and we show why we think CEO compensation looks decent with even the possibility for a raise.

See our latest analysis for Mid-Southern Bancorp

How Does Total Compensation For Alex Babey Compare With Other Companies In The Industry?

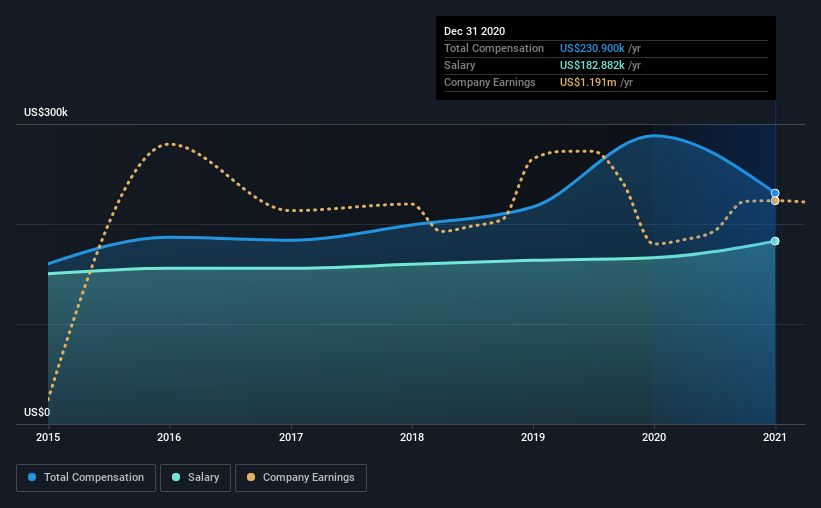

Our data indicates that Mid-Southern Bancorp, Inc. has a market capitalization of US$46m, and total annual CEO compensation was reported as US$231k for the year to December 2020. That's a notable decrease of 20% on last year. Notably, the salary which is US$182.9k, represents most of the total compensation being paid.

In comparison with other companies in the industry with market capitalizations under US$200m, the reported median total CEO compensation was US$534k. That is to say, Alex Babey is paid under the industry median. Moreover, Alex Babey also holds US$474k worth of Mid-Southern Bancorp stock directly under their own name.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | US$183k | US$166k | 79% |

| Other | US$48k | US$122k | 21% |

| Total Compensation | US$231k | US$288k | 100% |

On an industry level, total compensation is equally proportioned between salary and other compensation, that is, they each represent approximately 50% of the total compensation. It's interesting to note that Mid-Southern Bancorp pays out a greater portion of remuneration through salary, compared to the industry. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at Mid-Southern Bancorp, Inc.'s Growth Numbers

Mid-Southern Bancorp, Inc. has seen its earnings per share (EPS) increase by 8.9% a year over the past three years. In the last year, its revenue is down 2.3%.

We would argue that the lack of revenue growth in the last year is less than ideal, but the modest improvement in EPS is good. These two metrics are moving in different directions, so while it's hard to be confident judging performance, we think the stock is worth watching. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Mid-Southern Bancorp, Inc. Been A Good Investment?

Most shareholders would probably be pleased with Mid-Southern Bancorp, Inc. for providing a total return of 38% over three years. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

In Summary...

Overall, the company hasn't done too poorly performance-wise, but we would like to see some improvement. If it continues on the same road, shareholders might feel even more confident about their investment, and have little to no objections concerning CEO pay. Instead, investors might be more interested in discussions that would help manage their longer-term growth expectations such as company business strategies and future growth potential.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. That's why we did our research, and identified 2 warning signs for Mid-Southern Bancorp (of which 1 is potentially serious!) that you should know about in order to have a holistic understanding of the stock.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

If you decide to trade Mid-Southern Bancorp, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

If you're looking to trade Mid-Southern Bancorp, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OTCPK:MSVB

Mid-Southern Bancorp

Operates as the holding company for Mid-Southern Savings Bank, FSB that provides various banking products and services to individuals and business customers.

Flawless balance sheet with questionable track record.

Market Insights

Community Narratives