- United States

- /

- Banks

- /

- NasdaqGS:MSBI

Midland States Bancorp (MSBI) Value Discount Persists Despite Forecast 106% Annual Earnings Growth

Reviewed by Simply Wall St

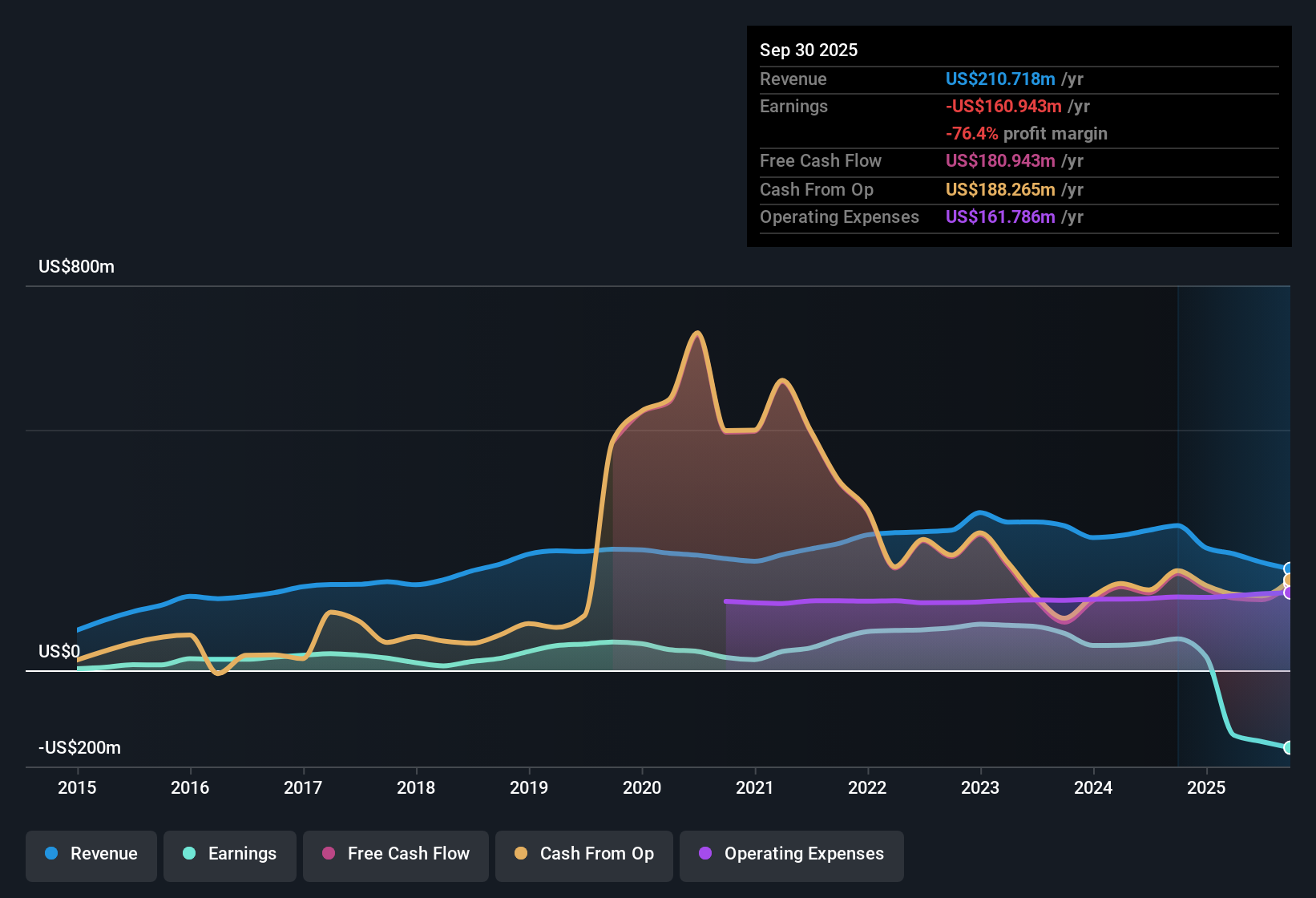

Midland States Bancorp (MSBI) remains unprofitable, with losses increasing at an annual rate of 24% over the past five years. However, investors are paying close attention as earnings are forecast to grow by a remarkable 106.16% annually, and the company is on track to reach profitability within the next three years. Revenue is projected to expand at 13.7% per year, outpacing the broader US market. The stock’s current price of $14.64 trades at a notable discount to its estimated fair value of $31.32. With solid growth prospects and strong value signals, the situation raises intriguing questions for shareholders monitoring the company’s trajectory.

See our full analysis for Midland States Bancorp.The next section examines how these headline results compare with the narratives shaping market sentiment, highlighting which expectations might be reinforced and where surprises could emerge.

Curious how numbers become stories that shape markets? Explore Community Narratives

Price-to-Book Ratio Sits at 0.7x

- Midland States Bancorp’s Price-to-Book ratio is 0.7x, below the US Banks industry average of 1x and the peer average of 1.2x. This highlights a notable valuation discount to its direct competitors.

- The prevailing market view draws attention to how this steep discount may reflect both skepticism around ongoing losses and optimism about future recovery prospects.

- Compared to the estimated DCF fair value of $28.94, shares trade at nearly half that valuation. This intensifies the focus on whether current pessimism is overdone or simply tracking persistent unprofitability.

- It is notable that despite market skepticism, analysts forecast annual earnings growth of 106.16% and project a return to profitability within three years. This suggests potential upside if the turnaround proceeds as expected.

- See why some investors are watching for a reversal if shares close the gap to book value. 📊 Read the full Midland States Bancorp Consensus Narrative.

Dividend Sustainability Questions After Losses

- The main risk flagged is around dividend sustainability, as the company remains unprofitable and continues to post annual losses increasing at 24%. This puts pressure on its ability to maintain shareholder payouts over time.

- The prevailing market view recognizes that, even with anticipated revenue and profit growth, longstanding unprofitability raises clear doubts among bears about whether current dividends can be maintained.

- Bears argue that losses may ultimately force a reduction or suspension of future payouts if fundamentals do not improve as quickly as expected.

- On the other hand, the current valuation discount could offer some protection if the company reins in losses and begins to deliver on its growth forecasts soon.

Revenue Growth Projected to Outpace US Market

- Revenue is expected to expand at 13.7% per year, faster than the US market average of 10.3% per year. This positions Midland States Bancorp as a potential growth outlier in its sector.

- The prevailing market view weighs this rapid forecasted revenue expansion against the reality of ongoing losses, highlighting the tension for investors who want to see top-line growth translate into sustainable profits.

- If revenue consistently beats the industry, the bank could bridge its current valuation gap and overcome market skepticism.

- However, until this accelerated topline growth drives meaningful profitability, the stock is likely to be watched warily for execution risk rather than just potential.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Midland States Bancorp's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite fast revenue growth, Midland States Bancorp’s persistent losses and pressure on dividend sustainability remain unresolved. This casts doubt on reliable shareholder returns.

If dependable income is your priority, take advantage of these 2009 dividend stocks with yields > 3% to find companies with stronger track records of maintaining dividends through changing market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MSBI

Midland States Bancorp

Operates as a financial holding company for Midland States Bank that provides various banking products and services to individuals, businesses, municipalities, and other entities.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion