- United States

- /

- Banks

- /

- NasdaqGS:MOFG

Three Days Left Until MidWestOne Financial Group, Inc. (NASDAQ:MOFG) Trades Ex-Dividend

Some investors rely on dividends for growing their wealth, and if you're one of those dividend sleuths, you might be intrigued to know that MidWestOne Financial Group, Inc. (NASDAQ:MOFG) is about to go ex-dividend in just three days. The ex-dividend date is one business day before a company's record date, which is the date on which the company determines which shareholders are entitled to receive a dividend. The ex-dividend date is important because any transaction on a stock needs to have been settled before the record date in order to be eligible for a dividend. Therefore, if you purchase MidWestOne Financial Group's shares on or after the 1st of December, you won't be eligible to receive the dividend, when it is paid on the 15th of December.

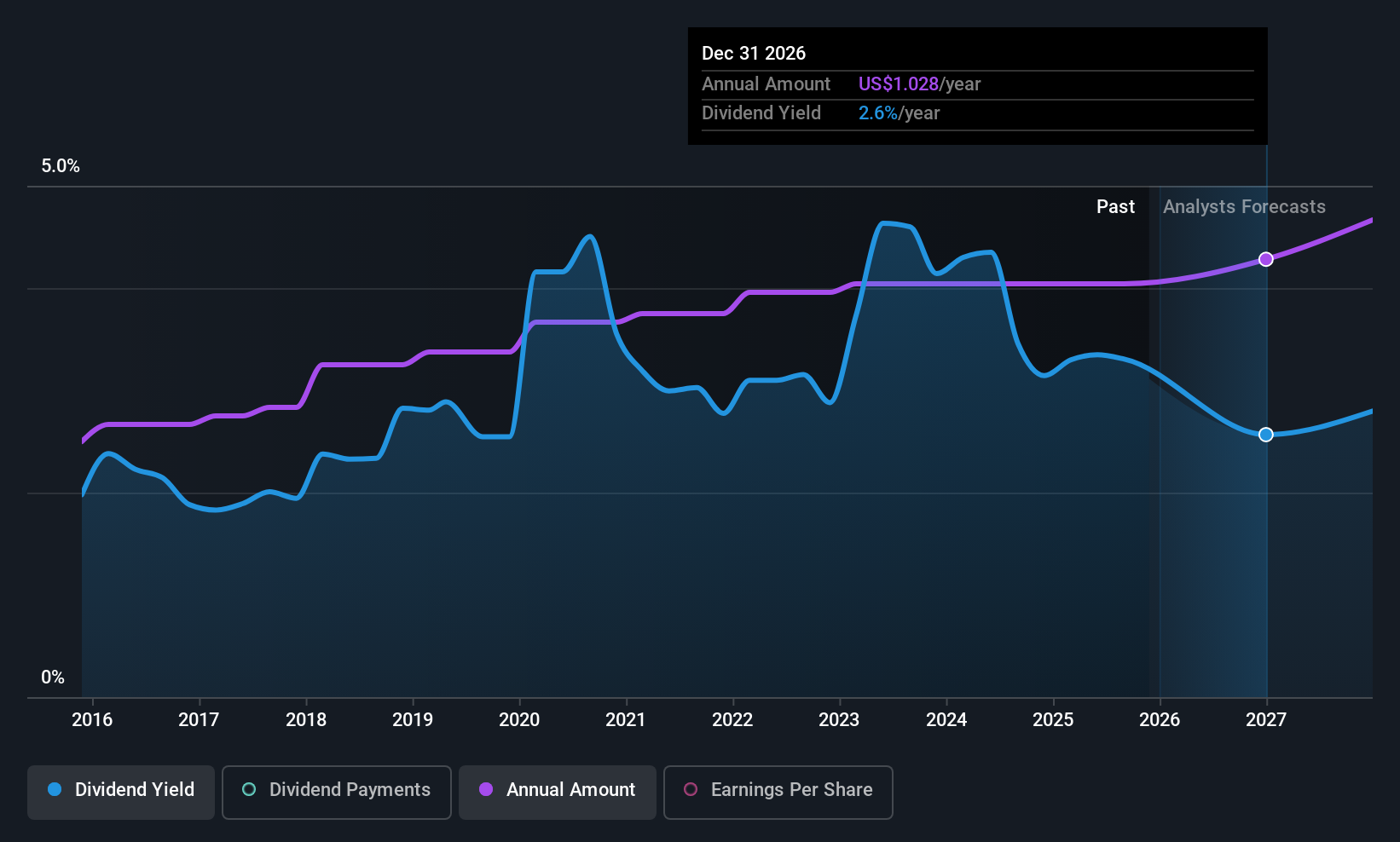

The company's next dividend payment will be US$0.2425 per share, and in the last 12 months, the company paid a total of US$0.97 per share. Based on the last year's worth of payments, MidWestOne Financial Group has a trailing yield of 2.4% on the current stock price of US$40.03. Dividends are a major contributor to investment returns for long term holders, but only if the dividend continues to be paid. So we need to check whether the dividend payments are covered, and if earnings are growing.

Dividends are usually paid out of company profits, so if a company pays out more than it earned then its dividend is usually at greater risk of being cut. That's why it's good to see MidWestOne Financial Group paying out a modest 34% of its earnings.

Generally speaking, the lower a company's payout ratios, the more resilient its dividend usually is.

View our latest analysis for MidWestOne Financial Group

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Stocks with flat earnings can still be attractive dividend payers, but it is important to be more conservative with your approach and demand a greater margin for safety when it comes to dividend sustainability. If earnings decline and the company is forced to cut its dividend, investors could watch the value of their investment go up in smoke. It's not encouraging to see that MidWestOne Financial Group's earnings are effectively flat over the past five years. It's better than seeing them drop, certainly, but over the long term, all of the best dividend stocks are able to meaningfully grow their earnings per share.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. MidWestOne Financial Group has delivered 4.9% dividend growth per year on average over the past 10 years.

The Bottom Line

Has MidWestOne Financial Group got what it takes to maintain its dividend payments? MidWestOne Financial Group's earnings per share are basically flat over the past five years, although it has the cushion of a low payout ratio, which would suggest a cut to the dividend is relatively unlikely. It doesn't appear an outstanding opportunity, but could be worth a closer look.

If you're not too concerned about MidWestOne Financial Group's ability to pay dividends, you should still be mindful of some of the other risks that this business faces. Our analysis shows 1 warning sign for MidWestOne Financial Group and you should be aware of it before buying any shares.

If you're in the market for strong dividend payers, we recommend checking our selection of top dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:MOFG

MidWestOne Financial Group

Operates as the bank holding company for MidWestOne Bank that provides commercial and retail banking products and services to individuals, businesses, governmental units, and institutional customers.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success