- United States

- /

- Banks

- /

- NasdaqGS:MCHB

Mechanics Bancorp (MCHB): Examining Valuation After Recent Share Price Pullback

Reviewed by Kshitija Bhandaru

Mechanics Bancorp (MCHB) shares have slipped over the past week, reflecting a modest pullback after recent gains in the stock price. Investors may be weighing the current valuation in relation to the company’s performance this year.

See our latest analysis for Mechanics Bancorp.

Mechanics Bancorp’s share price has seen some impressive momentum recently, with a year-to-date share price return of nearly 77%, even after the slight dip this week. That kind of performance suggests investors are increasingly confident about the company's long-term growth story, and the strong five-year total shareholder return of 245% shows just how much value has been created for patient investors.

If you want to see what other companies have been producing standout results, now's the perfect time to broaden your search with our fast growing stocks with high insider ownership

With shares up so strongly after this year’s rally, investors are left wondering whether Mechanics Bancorp is still trading at a bargain or if the market has already factored in all of its future potential.

Price-to-Earnings of 16.2x: Is it justified?

Mechanics Bancorp is currently trading at a price-to-earnings (P/E) ratio of 16.2x, which places it above the industry average and may signal the market is expecting more growth ahead.

The price-to-earnings ratio is a popular valuation metric that compares a company's stock price to its per-share earnings. For banks, it provides insight into how much investors are willing to pay for underlying profitability. A higher P/E might suggest confidence in future earnings or higher quality results, but it can also signal potential overvaluation if future growth does not materialize.

Compared to the broader US Banks industry average P/E of 11.6x, Mechanics Bancorp looks expensive on this measure. However, it remains cheaper than its direct peer average of 19.2x. This means the market is pricing in stronger performance relative to the industry, but less optimism than the company’s closest peer group. There isn't enough information available to assess whether this P/E is above or below a "fair" level based on regression analysis, so investors should think carefully about whether recent growth or other unique company factors justify a premium price.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 16.2x (OVERVALUED)

However, risks remain, including shifts in market sentiment or unexpected company setbacks. These factors could quickly dampen investor confidence despite recent gains.

Find out about the key risks to this Mechanics Bancorp narrative.

Another View: Discounted Cash Flow Suggests Upside

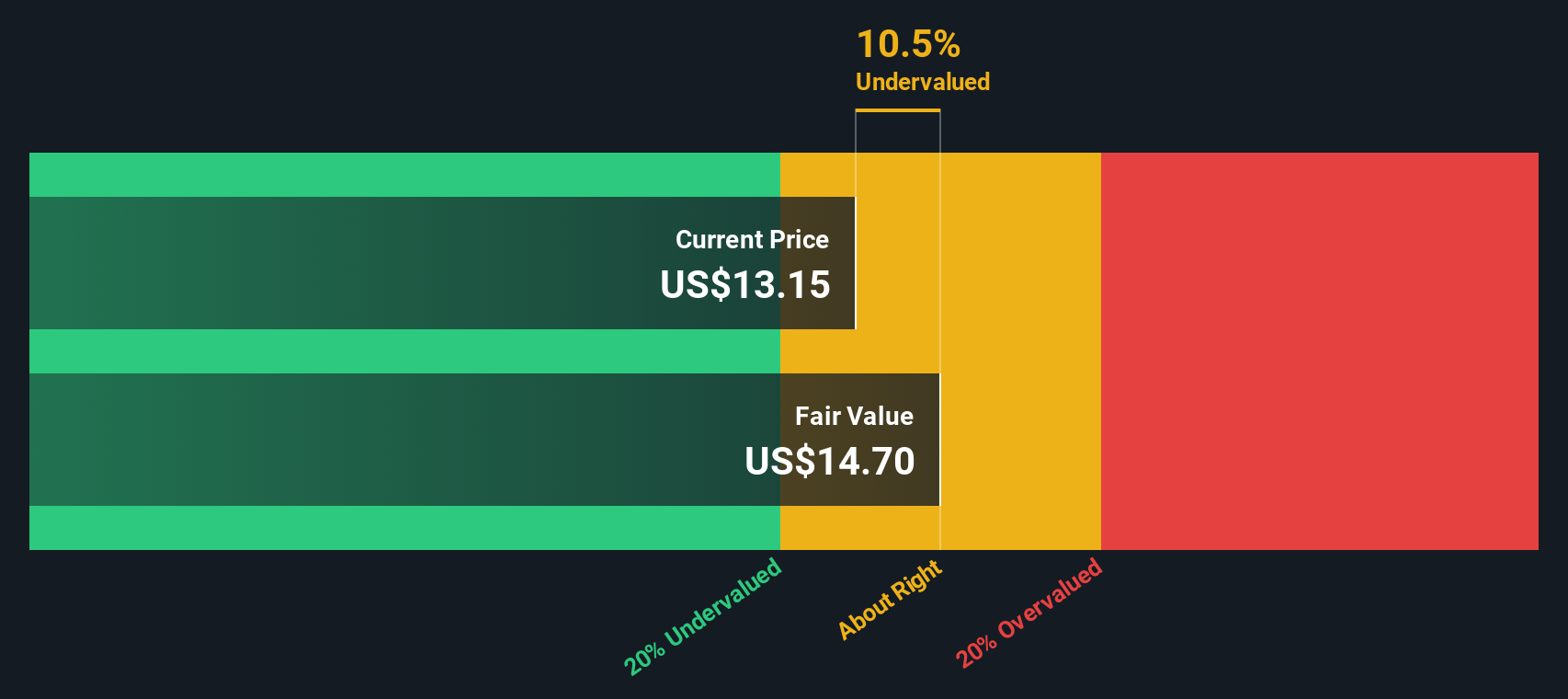

While the market may appear to be pricing Mechanics Bancorp above the industry on earnings, our DCF model tells a different story. It estimates fair value at $14.70 per share, which is around 11% higher than the current price. Is the market still underestimating future cash flows?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Mechanics Bancorp for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Mechanics Bancorp Narrative

If you see the data differently or want to form your own perspective, you can easily create your own narrative in just a few minutes. Do it your way.

A great starting point for your Mechanics Bancorp research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Widen your opportunity set by checking out other standout stocks and strategies on Simply Wall Street. There’s a world of exciting possibilities beyond Mechanics Bancorp waiting for you to uncover.

- Tap into the world of digital assets and track the momentum with these 79 cryptocurrency and blockchain stocks as companies capitalize on blockchain innovation and decentralized finance.

- Pursue steady income streams and financial resilience through these 20 dividend stocks with yields > 3% which consistently deliver attractive yields above 3%.

- Position yourself at the cutting edge of medicine by searching for breakthroughs in these 33 healthcare AI stocks, where artificial intelligence is transforming healthcare outcomes.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MCHB

Mechanics Bancorp

Operates as the holding company for Mechanics Bank that provides banking services.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives