- United States

- /

- Banks

- /

- NasdaqCM:MBCN

How Do Analysts See Middlefield Banc Corp. (NASDAQ:MBCN) Performing In The Next Couple Of Years?

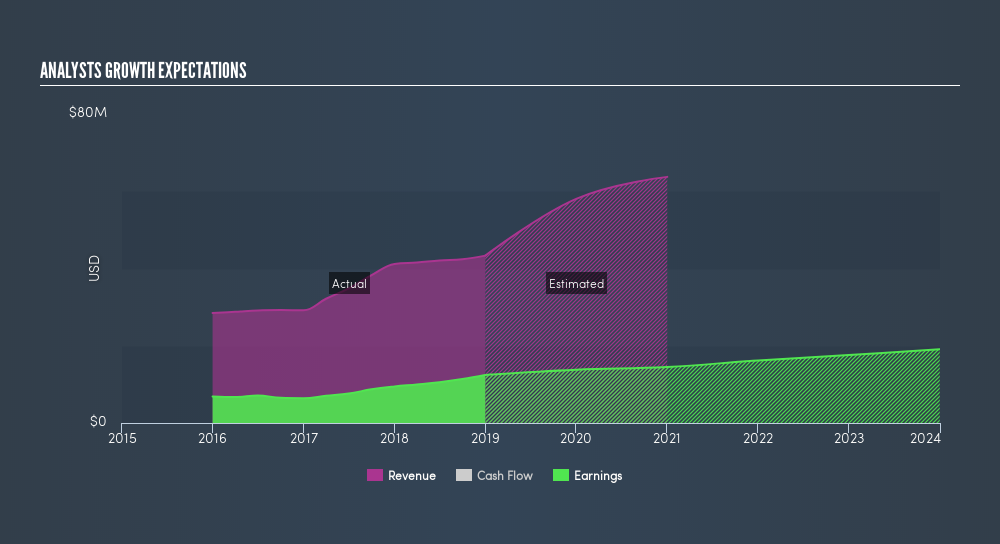

In December 2018, Middlefield Banc Corp. (NASDAQ:MBCN) released its latest earnings announcement, which revealed that the company benefited from a robust tailwind, eventuating to a double-digit earnings growth of 31%. Investors may find it useful to understand how market analysts predict Middlefield Banc's earnings growth outlook over the next few years and whether the future looks even brighter than the past. Note that I will be looking at net income excluding extraordinary items to get a better understanding of the underlying drivers of earnings.

See our latest analysis for Middlefield Banc

Analysts' outlook for this coming year seems optimistic, with earnings rising by a robust 11%. This growth seems to continue into the following year with rates arriving at double digit 17% compared to today’s earnings, and finally hitting US$16m by 2022.

While it’s informative knowing the growth rate each year relative to today’s figure, it may be more insightful to gauge the rate at which the earnings are moving every year, on average. The benefit of this technique is that we can get a bigger picture of the direction of Middlefield Banc's earnings trajectory over the long run, irrespective of near term fluctuations, which may be more relevant for long term investors. To compute this rate, I put a line of best fit through analyst consensus of forecasted earnings. The slope of this line is the rate of earnings growth, which in this case is 8.4%. This means, we can expect Middlefield Banc will grow its earnings by 8.4% every year for the next few years.

Next Steps:

For Middlefield Banc, I've put together three fundamental aspects you should further examine:

- Financial Health: Does it have a healthy balance sheet? Take a look at our free balance sheet analysis with six simple checks on key factors like leverage and risk.

- Valuation: What is MBCN worth today? Is the stock undervalued, even when its growth outlook is factored into its intrinsic value? The intrinsic value infographic in our free research report helps visualize whether MBCN is currently mispriced by the market.

- Other High-Growth Alternatives: Are there other high-growth stocks you could be holding instead of MBCN? Explore our interactive list of stocks with large growth potential to get an idea of what else is out there you may be missing!

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqCM:MBCN

Middlefield Banc

Operates as the bank holding company for The Middlefield Banking Company that provides various commercial banking services to small and medium-sized businesses, professionals, small business owners, and retail customers in northeastern and central Ohio.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion