- United States

- /

- Banks

- /

- NasdaqGS:KRNY

Kearny Financial (KRNY) Returns to Profit, Challenging Bearish Narratives on Core Resilience

Reviewed by Simply Wall St

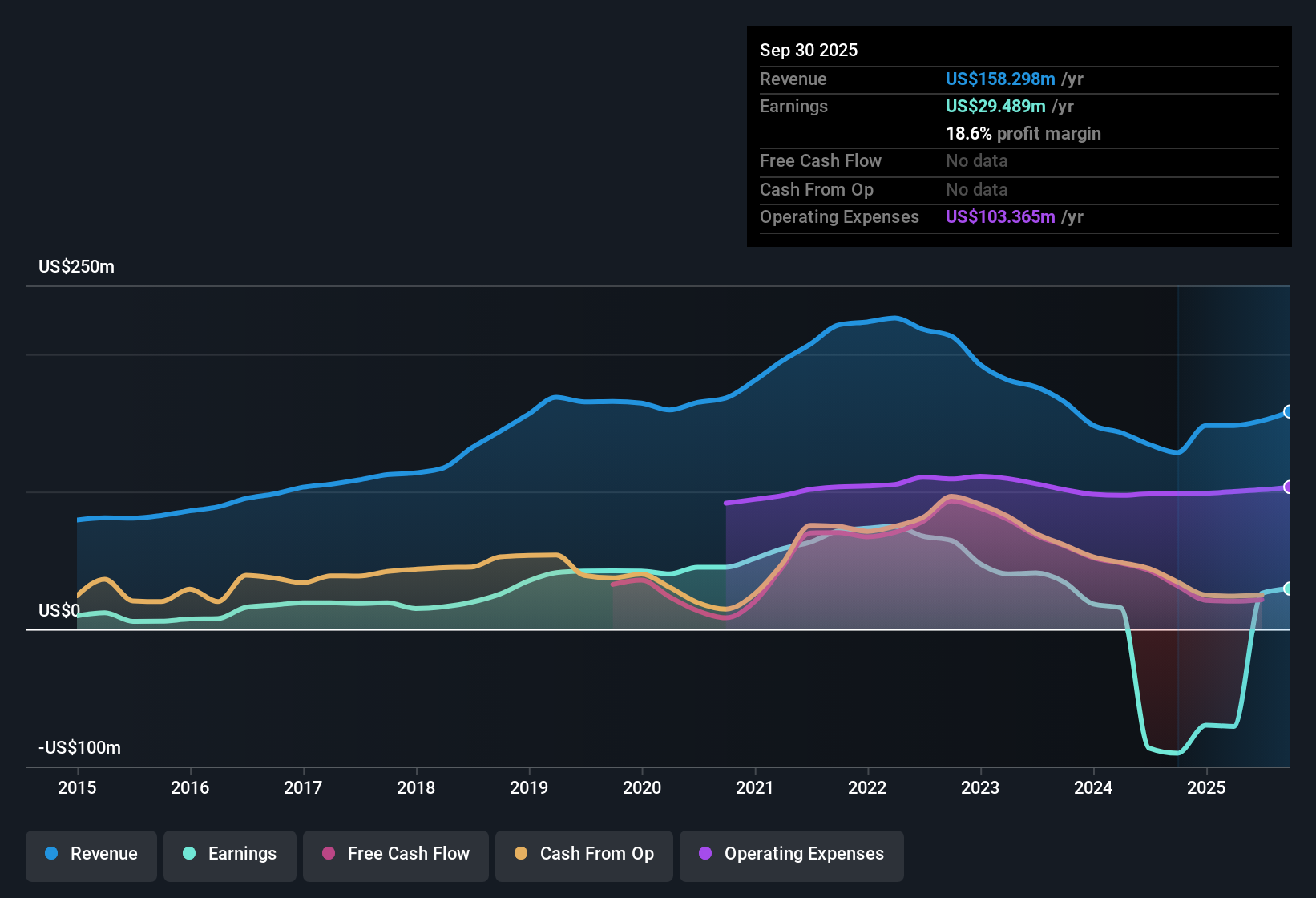

Kearny Financial (KRNY) has turned a corner this year, reporting profitability after a long stretch of declining earnings. Over the past five years, its earnings dropped by a steep 50.2% per year, but a recent uptick in net profit margin and a return to positive earnings mark a notable shift in its track record. With high quality earnings now back on the table, investors are weighing this improvement in margins against a valuation that looks rich compared to sector averages and the underlying risks around future growth and dividend sustainability.

See our full analysis for Kearny Financial.Now, let’s see how the latest results measure up against the broader market narrative, where some assumptions may hold, and others could be up for debate.

Curious how numbers become stories that shape markets? Explore Community Narratives

Net Profit Margin Edges Higher

- The net profit margin improved in the latest reporting period, moving from loss-making to profitability after five years of annual earnings declines at 50.2% per year.

- What is surprising is that, despite such a prolonged fall in earnings, the company’s shift to high quality profits now lends credibility to the view that its core business remains resilient, even if past performance painted a different picture.

- Market participants may still be cautious, since this profitable period is short compared to the long-term downtrend.

- Some may view this as the first step in a longer positive shift, but others could be skeptical without further evidence of sustained profit.

Dividend Sustainability Remains a Watchpoint

- Continued profitability supports the ongoing payment of dividends; however, sustainability is not guaranteed as there is no explicit expectation of revenue and earnings growth going forward.

- Critics highlight that while the dividend may appeal to income investors, its durability is closely tied to maintaining these recent profitability gains and is still at risk if growth remains muted.

- Any slip in earnings could quickly reignite concerns about future payouts.

- This tension keeps the dividend both a reward and a potential risk for shareholders relying on stable income.

Valuation: Premium to Peers Persists

- Kearny Financial trades at a price-to-earnings ratio of 15.8x, a clear premium to both its peer group (12.2x) and the broader US Banks industry (11.3x), despite recent improvement in profitability.

- What stands out is the market’s willingness to pay extra for the stock, even in the face of lagging growth and sector uncertainty. This indicates that the improved margin story is currently outweighing concerns of flat earnings and dividend reliability.

- This valuation tension suggests that investors must weigh the premium price carefully against sector averages and the risks of slow future growth.

- If future results do not continue to validate this premium, shares could be vulnerable to a reset toward industry norms.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Kearny Financial's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Kearny Financial’s premium valuation looks risky given its patchy profit history and lingering doubts over the long-term sustainability of growth and dividends.

If you want to focus on stocks where the market price better reflects underlying value, check out these 876 undervalued stocks based on cash flows and discover companies trading at more compelling levels today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kearny Financial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:KRNY

Kearny Financial

Operates as the holding company for Kearny Bank that provides various banking products and services in the United States.

Flawless balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives