- United States

- /

- Banks

- /

- NasdaqGS:INTR

Inter & Co (NasdaqGS:INTR) Valuation in Focus Following Strong Q3 Earnings Growth

Reviewed by Simply Wall St

Inter & Co (NasdaqGS:INTR) just announced its third-quarter results, drawing attention to solid growth in net income and earnings per share compared to the same period last year. Investors are watching closely as these numbers come in.

See our latest analysis for Inter & Co.

The upbeat earnings news added to an already impressive run for Inter & Co, with the share price now at $8.46 after climbing more than 100% since the start of the year. This surge, along with a 62.65% one-year total shareholder return and a 252% gain over three years, suggests momentum is still firmly in play as investors reassess the company’s long-term growth story.

If you’re wondering where the next big opportunity could be, now is the perfect time to expand your research and discover fast growing stocks with high insider ownership

With this momentum and a persistent run-up in price, the central question now is whether Inter & Co is still trading below its true value or if all of its future growth has already been factored into the stock.

Most Popular Narrative: 9.1% Undervalued

With Inter & Co’s fair value estimate at $9.30, the latest close of $8.46 puts the stock below this widely followed target, setting a scene where growth and margins are dictating value more than ever.

“Expanding cross-sell of high-margin financial products (insurance, investments, credit), aided by hyper-personalization and integrated platform features like My Piggy Bank and My Credit, is lifting per-customer revenues and supporting net margin expansion via greater product adoption and customer lifetime value.”

Curious what powers this valuation call? There is a pivotal forecast behind it, with accelerating revenue, robust margins, and strategic product innovation. Find out which bold financial assumptions analysts used to craft this price target.

Result: Fair Value of $9.30 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, stiffening competition or a spike in credit losses could quickly challenge optimistic projections. This would remind investors that risks remain front and center.

Find out about the key risks to this Inter & Co narrative.

Another View: Are Multiples Sending a Different Signal?

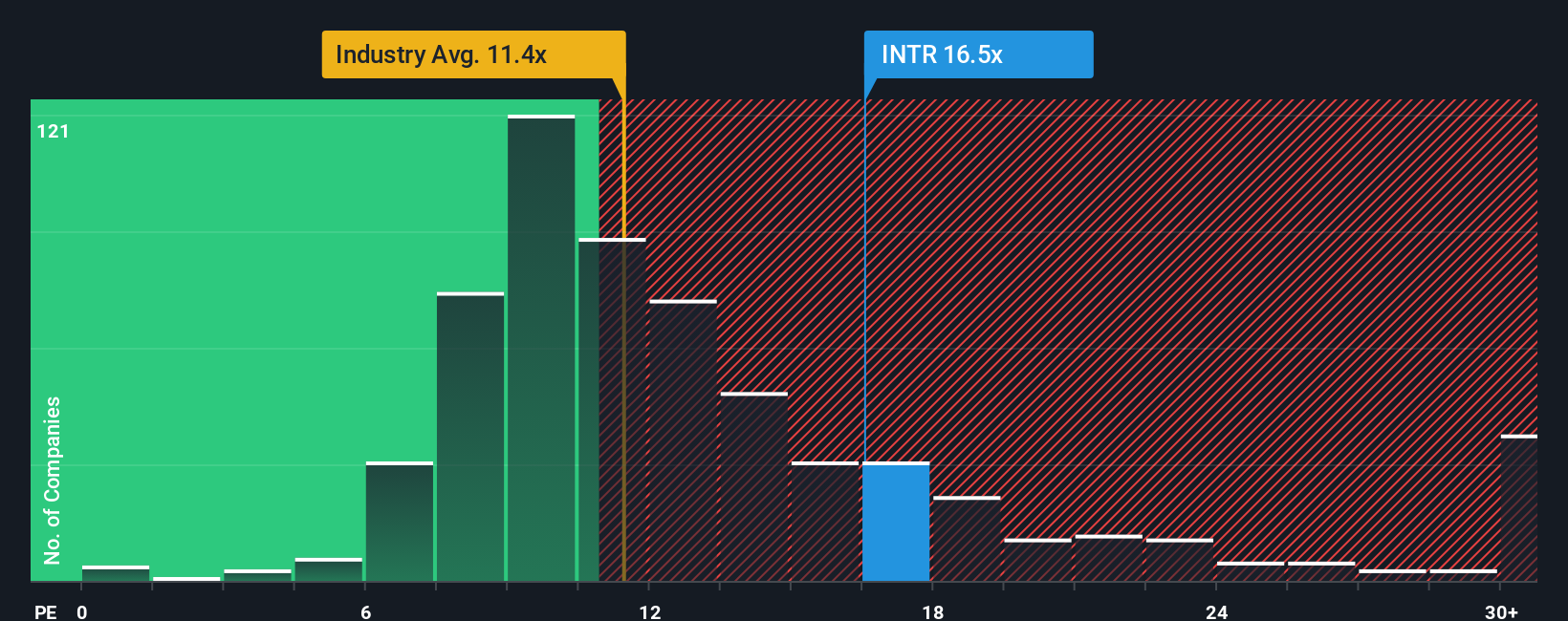

While the fair value approach suggests Inter & Co is undervalued, the current price-to-earnings ratio stands at 16.5x. That is higher than the US banks industry average of 11.2x and the peer average of 10.9x, but just below the fair ratio of 16.9x. This suggests investors are paying a premium, but how long will the optimism last if growth slows?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Inter & Co for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 923 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Inter & Co Narrative

If you have your own perspective or want to dive deeper into the data, it only takes a few minutes to create your personal narrative and see how your view stacks up. Do it your way

A great starting point for your Inter & Co research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let powerful opportunities slip by while you focus on just one stock. Take the next step and uncover standout companies shaping the market right now.

- Expand your search for high potential companies by evaluating these 923 undervalued stocks based on cash flows, which offer significant upside based on their future cash flows and market position.

- Jump on trends in healthcare innovation and spot opportunities among these 30 healthcare AI stocks that are driving advancements in patient care and medical technology.

- Lock in consistent income by targeting these 14 dividend stocks with yields > 3%, delivering solid yields for resilient portfolio growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:INTR

Inter & Co

Through its subsidiaries, engages in the banking and spending, investments, insurance brokerage, and inter shop businesses in Brazil and the United States.

High growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success