- United States

- /

- Banks

- /

- NasdaqGS:INDB

Independent Bank (INDB): Assessing Valuation as Share Price Cools Following Recent Gains

Reviewed by Simply Wall St

See our latest analysis for Independent Bank.

After a strong climb earlier in the year, Independent Bank's share price has cooled in the past month, easing back 2.45 percent after recent investor enthusiasm. Still, its 13.56 percent total shareholder return over the past year suggests that optimism about its growth potential and improving fundamentals has not disappeared, even as momentum has slowed in the short term.

If you’re interested in finding more opportunities beyond regional banks, now is a good time to broaden your horizons and discover fast growing stocks with high insider ownership

Given solid annual revenue and net income growth, alongside a share price still trading below analyst targets, is Independent Bank currently undervalued, or is the market already pricing in all of its future upside?

Most Popular Narrative: 18% Undervalued

Independent Bank's most popular narrative pegs its fair value well above the last close, suggesting optimism about future growth and margin improvements. The gap between narrative fair value and the current share price could indicate market skepticism or a sharp analyst outlook. Here is what is driving that view.

Sustained investment in core banking technology and a major platform conversion (FIS IBS scheduled for May 2026), paired with a commitment to digital delivery, should enhance operational efficiency and scalability. This supports improved net margins and cost-to-income ratios over time.

Ready for a peek under the hood? The narrative’s valuation leans on a sweeping forecast of surging profits and revenue fueled by tech upgrades and integration payoffs. What confident growth projections are hidden behind this bullish stance? Dive in and discover what makes the numbers so bold.

Result: Fair Value of $82.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing exposure to commercial real estate and integration risks from recent acquisitions could challenge Independent Bank’s growth outlook if these factors are not carefully managed.

Find out about the key risks to this Independent Bank narrative.

Another View: What Do Market Comparisons Suggest?

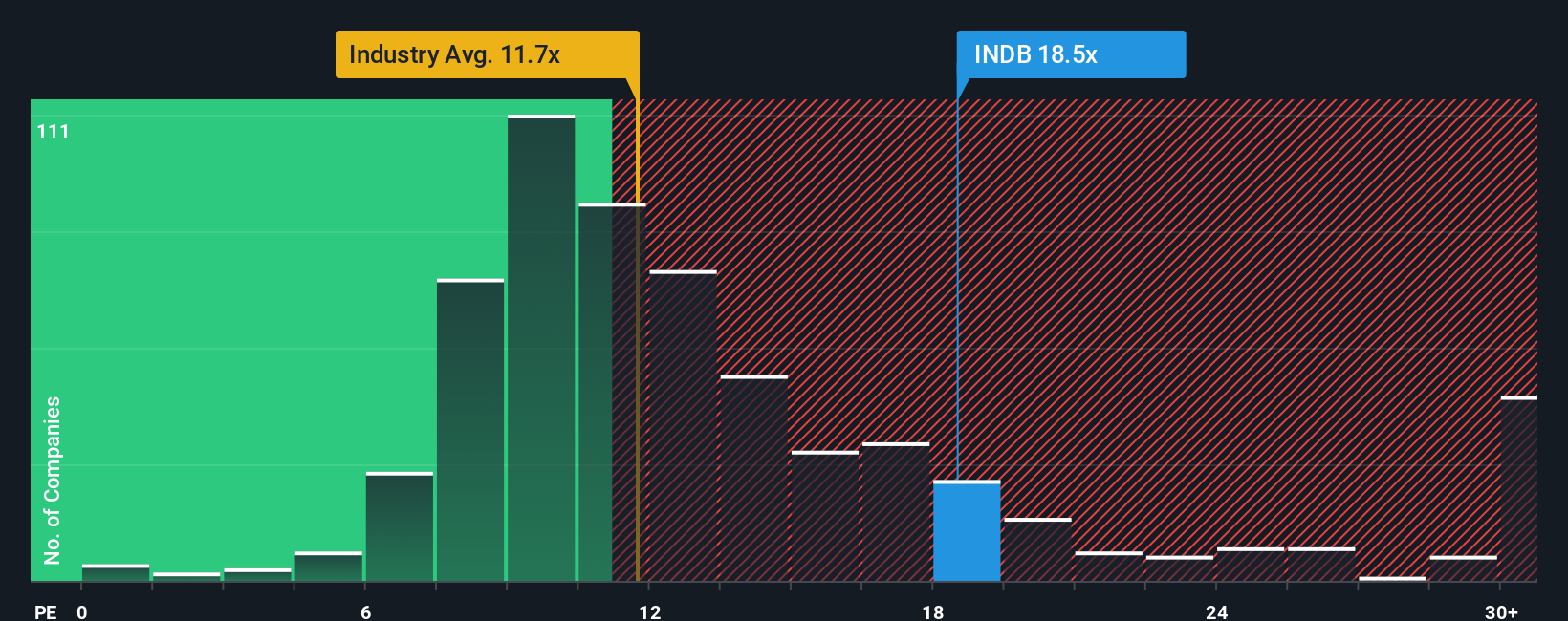

While the narrative case sees Independent Bank as undervalued, a glance at its price-to-earnings ratio tells a different story. The current ratio stands at 18.8 times, which is notably higher than both the industry average of 11 times and a fair ratio of 17.7. This raises questions about how much near-term optimism is already priced in. Could investors end up paying too much for the future?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Independent Bank Narrative

If you see the numbers differently or want to craft your own perspective, you can shape your own narrative on Independent Bank in just a few minutes. Do it your way.

A great starting point for your Independent Bank research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Make your portfolio stand out by choosing stocks with the strongest potential. Uncover exceptional opportunities backed by real data. Don't let the market's best ideas pass you by.

- Get ahead of the mainstream by tapping into these 3598 penny stocks with strong financials poised for significant growth and overlooked by larger investors.

- Capitalize on the AI revolution by finding these 26 AI penny stocks that are leading breakthroughs in automation and intelligent innovation.

- Unlock real value by targeting these 843 undervalued stocks based on cash flows where market prices don't reflect true future potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:INDB

Independent Bank

Operates as the bank holding company for Rockland Trust Company that provides commercial banking products and services to individuals and small-to-medium sized businesses in the United States.

Flawless balance sheet with high growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives