- United States

- /

- Consumer Finance

- /

- NYSE:YRD

Hidden Opportunities in US Stocks for October 2024

Reviewed by Simply Wall St

In the last week, the United States market has remained flat, yet over the past 12 months, it has experienced a notable rise of 34%. With earnings expected to grow by 15% per annum over the next few years, identifying stocks with strong fundamentals and growth potential can uncover hidden opportunities in this dynamic environment.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| Teekay | NA | -6.48% | 55.79% | ★★★★★★ |

| Mission Bancorp | 25.37% | 16.23% | 20.16% | ★★★★★★ |

| Omega Flex | NA | 1.31% | 3.88% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.12% | 10.04% | ★★★★★★ |

| Banco Latinoamericano de Comercio Exterior S. A | 311.64% | 21.07% | 24.77% | ★★★★★☆ |

| United Bancorporation of Alabama | 13.34% | 18.86% | 25.45% | ★★★★★☆ |

| Valhi | 38.71% | 2.57% | -19.76% | ★★★★★☆ |

| Tiptree | 68.59% | 20.55% | 20.06% | ★★★★★☆ |

| FRMO | 0.17% | 12.99% | 23.62% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

First Internet Bancorp (NasdaqGS:INBK)

Simply Wall St Value Rating: ★★★★★★

Overview: First Internet Bancorp is the bank holding company for First Internet Bank of Indiana, offering a range of banking products and services to individuals and businesses across the United States, with a market cap of $287.86 million.

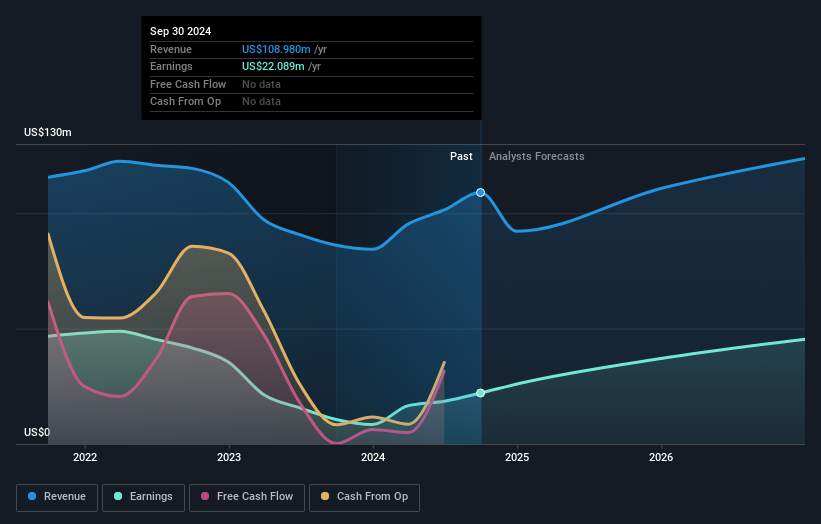

Operations: First Internet Bancorp generates revenue primarily through its commercial banking segment, which accounts for $101.42 million.

First Internet Bancorp, with total assets of US$5.3 billion and equity of US$372 million, stands out in the banking sector. Its earnings growth over the past year hit 18.2%, surpassing the industry's -15.9%. The company has a solid allowance for bad loans at 0.3% of total loans and boasts primarily low-risk funding sources, which make up 86% of liabilities through customer deposits. Recently, it declared a quarterly dividend of $0.06 per share payable in October 2024.

- Get an in-depth perspective on First Internet Bancorp's performance by reading our health report here.

Explore historical data to track First Internet Bancorp's performance over time in our Past section.

Centrus Energy (NYSEAM:LEU)

Simply Wall St Value Rating: ★★★★★☆

Overview: Centrus Energy Corp. is a company that supplies nuclear fuel components and services to the nuclear power industry globally, with a market cap of approximately $973.38 million.

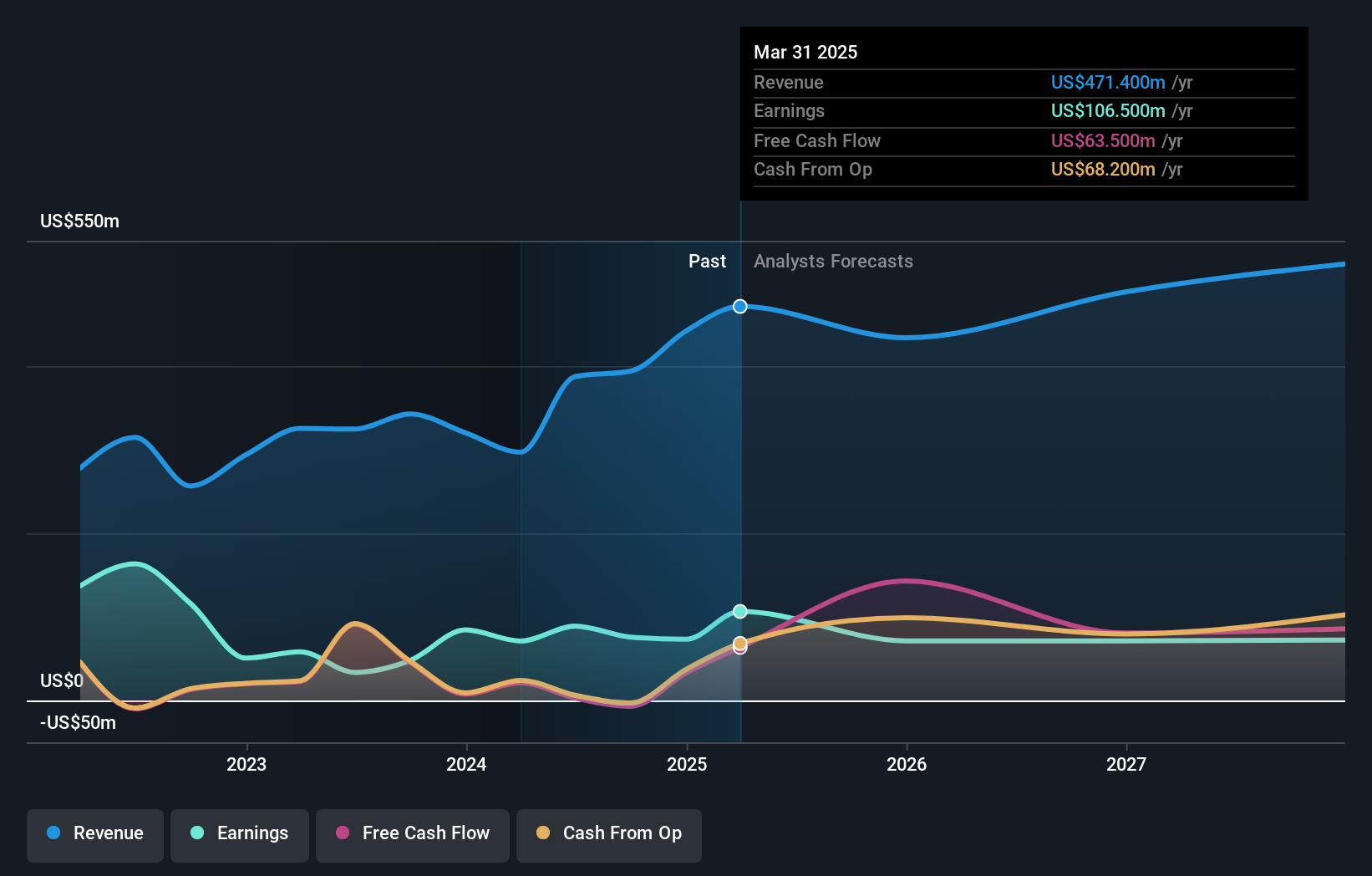

Operations: Centrus Energy generates revenue primarily from its Low-Enriched Uranium (LEU) segment, contributing $320.80 million, and Technical Solutions, adding $71.80 million. The company experienced a segment adjustment of -$5 million impacting overall revenue figures.

Centrus Energy, a dynamic player in the energy sector, has been making waves with its recent performance. The company saw its earnings skyrocket by 164.9% over the past year, outpacing the broader oil and gas industry. Trading at 60.8% below estimated fair value, it presents an intriguing opportunity for investors seeking undervalued stocks. Despite a volatile share price recently, Centrus remains profitable with more cash than total debt and reported net income of US$30.6 million in Q2 2024 compared to US$12.7 million last year.

Yiren Digital (NYSE:YRD)

Simply Wall St Value Rating: ★★★★★★

Overview: Yiren Digital Ltd. operates an AI-powered platform offering financial services in China with a market capitalization of $634.62 million.

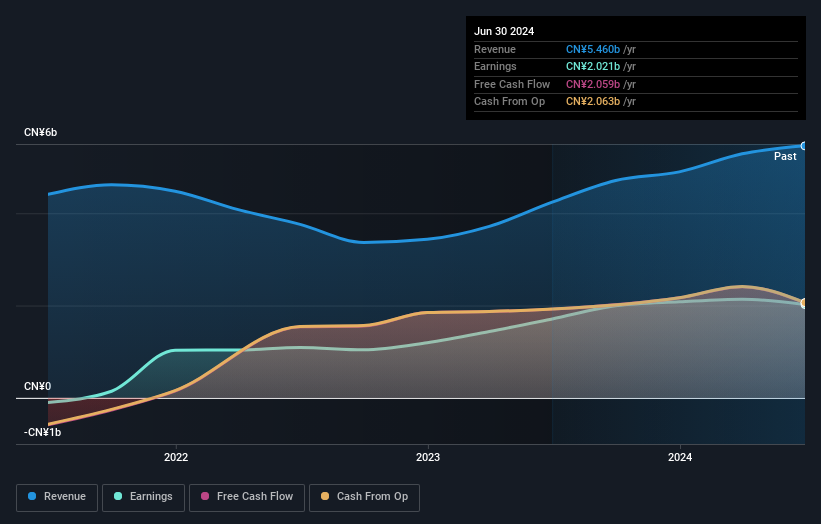

Operations: Yiren Digital generates revenue primarily from its Financial Services Business, contributing CN¥3.04 billion, and its Insurance Brokerage Business, adding CN¥579.22 million. The company also earns from its Consumption & Lifestyle Business with revenue of CN¥1.84 billion.

Yiren Digital, a nimble player in the finance sector, has been making waves with its debt-free status and impressive earnings growth of 18.2% over the past year, outpacing its industry peers. Trading at a significant discount of 68% below estimated fair value, it offers potential upside for investors. Recent buybacks saw the company repurchase over 4 million shares for $13.46 million, signaling confidence in future prospects. With high-quality earnings and a positive cash flow position, Yiren appears well-positioned amidst market volatility.

- Click to explore a detailed breakdown of our findings in Yiren Digital's health report.

Review our historical performance report to gain insights into Yiren Digital's's past performance.

Make It Happen

- Unlock more gems! Our US Undiscovered Gems With Strong Fundamentals screener has unearthed 212 more companies for you to explore.Click here to unveil our expertly curated list of 215 US Undiscovered Gems With Strong Fundamentals.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:YRD

Yiren Digital

Provides financial services through an AI-powered platform in China.

Flawless balance sheet and good value.