- United States

- /

- Banks

- /

- NasdaqGS:IBOC

Assessing International Bancshares (IBOC) Valuation: Does the Discount Signal Opportunity for Investors?

Reviewed by Simply Wall St

International Bancshares (IBOC) has recently caught investors’ attention on valuation grounds. With the stock trading well below its estimated intrinsic value, many are taking a closer look at the company’s fundamentals and future prospects.

See our latest analysis for International Bancshares.

Despite a solid run over the last three years, with International Bancshares delivering a total shareholder return of 35.7%, the past year has seen sentiment cool as the 1-year total shareholder return dipped to -6.9%. Recent share price moves suggest momentum is still a bit uncertain; however, the bank’s longer-term performance and recent valuation disconnect are starting to turn heads again for patient investors willing to look past short-term volatility.

If you’re eager to see what other strong performers might be flying under the radar, it’s a great time to broaden your search and discover fast growing stocks with high insider ownership

That leaves investors with a key question: Is International Bancshares truly undervalued with room for upside, or has the market already factored in all the potential growth ahead?

Price-to-Earnings of 9.8x: Is it justified?

International Bancshares trades at a price-to-earnings (P/E) ratio of 9.8x, suggesting shares are valued at less than 10 times the company's trailing earnings. This is noticeably cheaper than both peers and the industry average.

The P/E ratio is a widely used metric showing what investors are willing to pay for each dollar of a company’s earnings. For banks, this multiple provides a useful benchmark to compare profitability and market expectations.

With International Bancshares’ 9.8x P/E significantly below the peer average of 14x, the market appears to be pricing in slower growth or higher risk relative to industry counterparts. If sentiment recovers or performance matches that of peers, there could be room for a rerating.

Likewise, the company's P/E is also below the US Banks industry average of 11.4x, which reinforces the notion that current market pricing is on the conservative side.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 9.8x (UNDERVALUED)

However, persistent share price volatility and uncertain growth prospects could limit upside. This reminds investors that discounted valuations do not guarantee future outperformance.

Find out about the key risks to this International Bancshares narrative.

Another View: SWS DCF Model Shows Deeper Discount

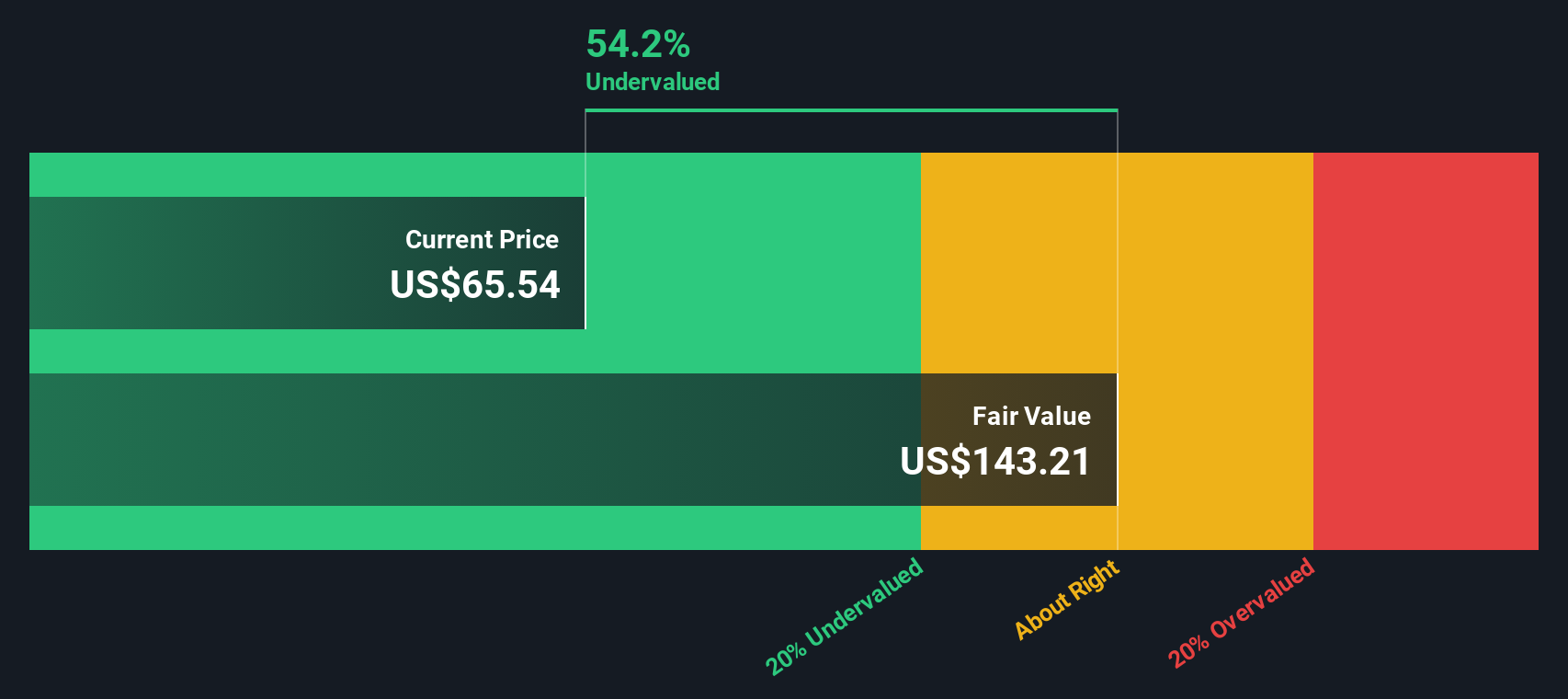

Taking a different approach, our SWS DCF model estimates International Bancshares' fair value at $142.08. The stock is currently trading at $66.5. This suggests shares are trading at a 53.2% discount. Does this sizable gap truly represent a value opportunity, or are there risks the market is seeing that this model does not?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out International Bancshares for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 928 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own International Bancshares Narrative

If you see the numbers differently or want to dive deeper, try building your own investment assessment. It's quick, simple, and entirely up to you. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding International Bancshares.

Looking for more investment ideas?

Smart investors never stand still. Get ahead by searching for unique opportunities. Right now you could be missing out on stocks that are primed for outsized returns using Simply Wall Street’s powerful Screener tools.

- Uncover income potential and put cash to work with these 15 dividend stocks with yields > 3% that offer yields above 3% for steady, reliable returns.

- Ride the wave of artificial intelligence by targeting these 25 AI penny stocks making headlines for their innovation and growth in the space.

- Capitalize on mispriced companies by snapping up these 928 undervalued stocks based on cash flows that screen as attractive bargains based on cash flows and fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IBOC

International Bancshares

A multibank financial holding company, provides a range of commercial and retail banking services in Texas and the State of Oklahoma.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success