- United States

- /

- Banks

- /

- NasdaqGS:HOPE

Hope Bancorp’s Dividend Boost and Revenue Beat Could Be a Game Changer for HOPE

Reviewed by Sasha Jovanovic

- Hope Bancorp, Inc. recently reported its third quarter results, posting net interest income of US$126.64 million and net income of US$30.84 million, alongside announcing a quarterly dividend of US$0.14 per common share payable in November 2025.

- An interesting highlight is that the company's revenue surpassed analyst forecasts despite earnings per share coming in just below consensus estimates, signaling resilient growth and continued board confidence through dividend reaffirmation.

- Next, we’ll examine how strong net interest income growth and the dividend declaration could influence Hope Bancorp’s investment narrative.

This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

Hope Bancorp Investment Narrative Recap

To be a Hope Bancorp shareholder, you need to believe the bank can balance profitable lending growth, geographic expansion, and disciplined risk management, especially as it concentrates assets in commercial real estate and regional markets. The recent Q3 results, with stronger-than-expected revenue and another quarterly dividend, positively support confidence in Hope Bancorp’s board and near-term outlook, but do not meaningfully alter the fundamental risk: a heavy reliance on commercial real estate loans that exposes earnings to economic slowdowns.

Of all the recent announcements, the board’s continued US$0.14 per share quarterly dividend declaration stands out. This action reiterates management’s intent to reward shareholders and signals resilience after a period of earnings volatility, yet ongoing dividend payments remain closely tied to maintaining stable net interest income amid shifting rate conditions and credit risk.

However, investors should be aware that despite revenue strength, reliance on commercial real estate lending continues to leave Hope exposed if market conditions shift...

Read the full narrative on Hope Bancorp (it's free!)

Hope Bancorp's narrative projects $828.8 million in revenue and $392.4 million in earnings by 2028. This requires 26.2% yearly revenue growth and a $350.7 million increase in earnings from the current $41.7 million.

Uncover how Hope Bancorp's forecasts yield a $12.25 fair value, a 14% upside to its current price.

Exploring Other Perspectives

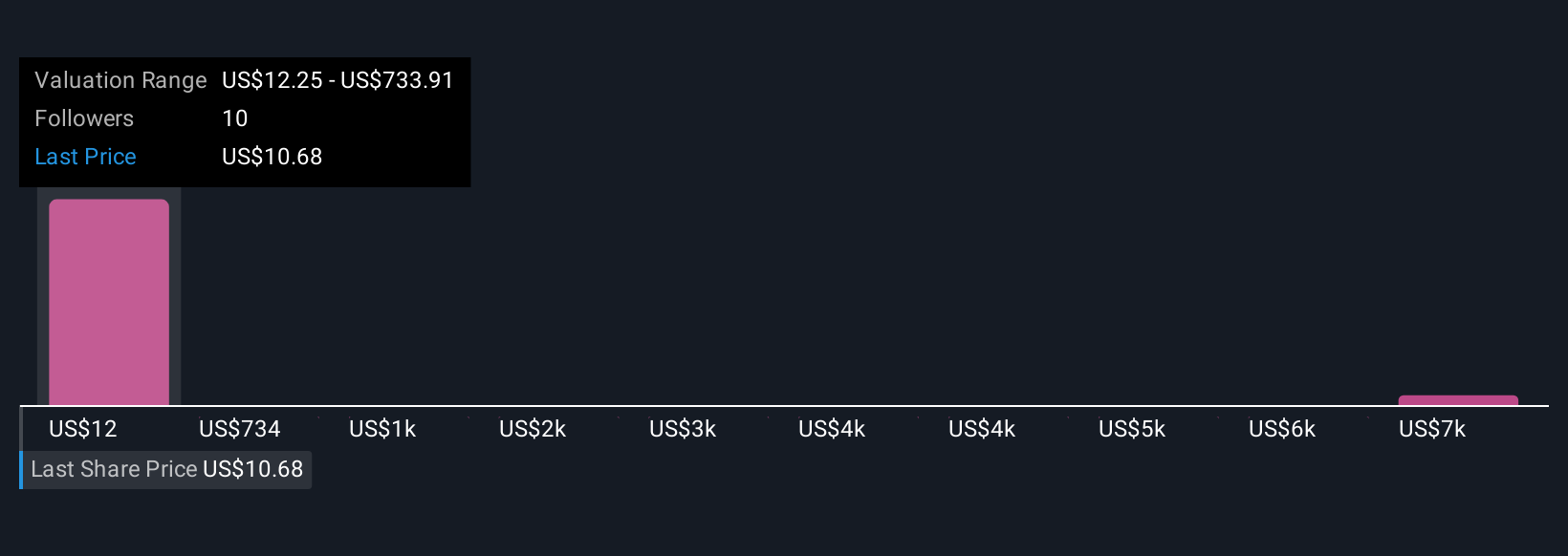

Four Simply Wall St Community members place fair value estimates between US$12.25 and US$7,228.80, showing sharp differences in outlook. As loan portfolio mix remains a key factor for profitability and risk, you can find a spectrum of views to compare and contrast before making decisions.

Explore 4 other fair value estimates on Hope Bancorp - why the stock might be worth just $12.25!

Build Your Own Hope Bancorp Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hope Bancorp research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Hope Bancorp research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hope Bancorp's overall financial health at a glance.

Looking For Alternative Opportunities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- We've found 20 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hope Bancorp might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HOPE

Hope Bancorp

Operates as the bank holding company for Bank of Hope that provides retail and commercial banking services for businesses and individuals in the United States.

Flawless balance sheet with high growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives