- United States

- /

- Banks

- /

- NasdaqGS:HOPE

Hope Bancorp (HOPE) Valuation Update After Fed Signals Potential Shift on Interest Rates

Reviewed by Simply Wall St

Hope Bancorp (HOPE) grabbed attention after Federal Reserve Chair Jerome Powell’s dovish comments at the recent Jackson Hole symposium, which signaled a possible pivot towards lower interest rates. Investors quickly weighed how this could reshape the banking landscape, especially for regional players like Hope. Powell’s remarks eased some market anxiety about drawn-out rate hikes. This kind of shift often gets value seekers scanning the sector for overlooked opportunities.

Following this policy outlook, bank stocks as a group moved higher, and Hope Bancorp was part of the trend. The company has seen a 7% bounce over the past three months, reversing part of its mid-year dip, although the stock remains down about 9% over the past twelve months. Recent annual results showed healthy top- and bottom-line growth, with annual net income nearly doubling. Still, investors have remained cautious lately, mindful of economic risks and shifting rate cycles.

With recent gains and a new policy backdrop, investors may be weighing whether Hope Bancorp is a bargain as the tides of interest rates shift, or if the market is already looking ahead to brighter days and factoring in the upside.

Most Popular Narrative: 9.9% Undervalued

According to community narrative, Hope Bancorp is seen as trading below its fair value, with analysts expecting key earnings and operational drivers to unlock future upside.

Significant ongoing investment in digital platform enhancements and fintech partnerships is poised to improve operational efficiency and customer retention. This could translate into a sustainably lower cost-to-income ratio and improved net margins over time.

Curious about what powers this bullish valuation? The numbers behind this narrative hint at industry-beating growth rates and a bold shift in the profit outlook. What are the real assumptions that justify this much higher price? Find out which game-changing variables analysts are betting on.

Result: Fair Value of $12.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, concentrated exposure to commercial real estate loans and ongoing integration challenges could quickly test the optimism surrounding Hope's long-term growth narrative.

Find out about the key risks to this Hope Bancorp narrative.Another View: Is Market Value Telling a Different Story?

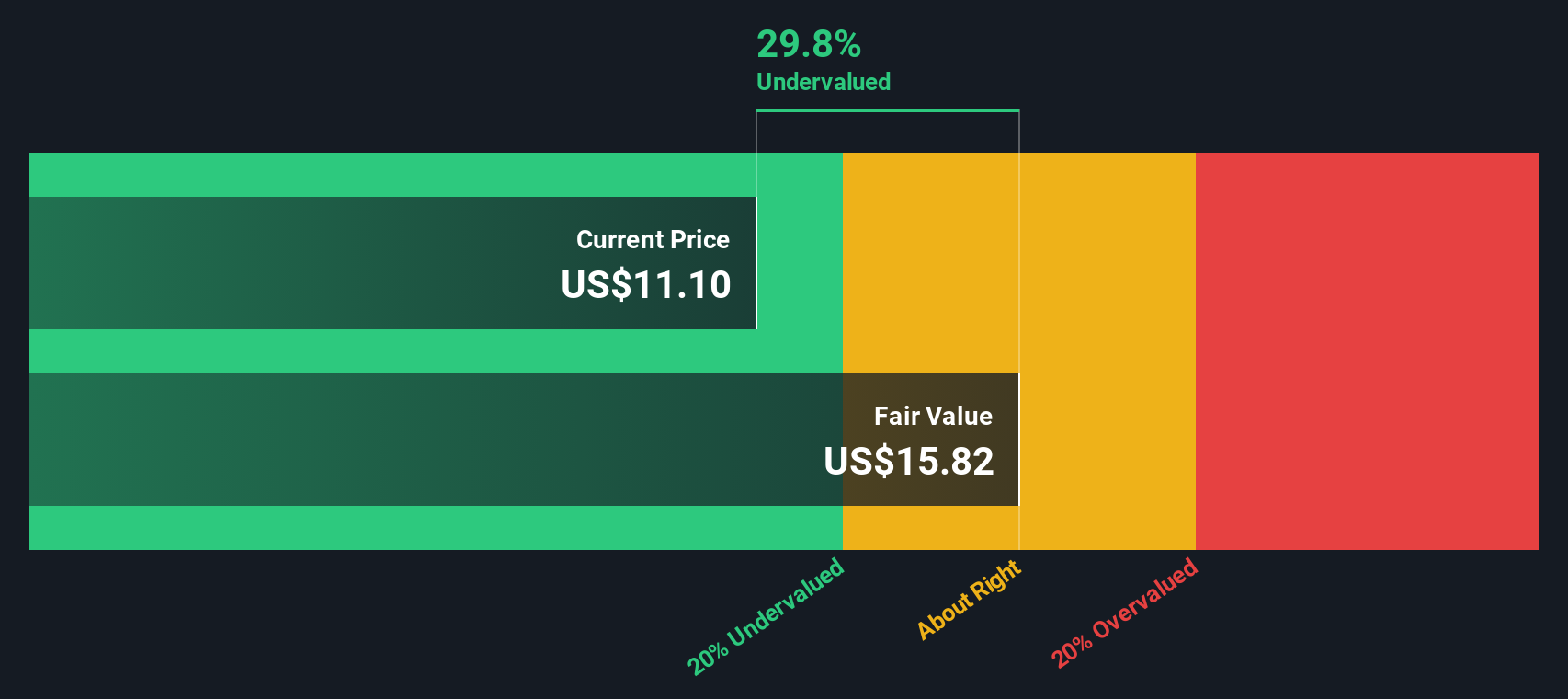

While analyst forecasts suggest Hope Bancorp is trading below its fair value, our DCF model comes to a similar conclusion and supports the case for potential upside. Are both methods pointing to the same opportunity for investors, or could there be something overlooked beneath the surface?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Hope Bancorp Narrative

If you have a different perspective or want to examine the numbers for yourself, you can shape your own story in just a few minutes, or simply do it your way.

A great starting point for your Hope Bancorp research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Do not let valuable opportunities pass you by just because one stock caught your eye. Take advantage of tools that spotlight tomorrow’s leaders, resilient dividend payers, and hidden value plays, all in one place. Make your next move count with these tailored stock lists:

- Tap into growth by scanning for AI penny stocks, which are harnessing artificial intelligence to redefine industries and set tomorrow’s pace.

- Secure reliable income streams with dividend stocks with yields > 3%. This list showcases companies offering strong yields above 3% for your portfolio’s stability.

- Uncover hidden gems by searching for undervalued stocks based on cash flows. These are companies the market has overlooked based on their future cash flows and underlying worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hope Bancorp might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HOPE

Hope Bancorp

Operates as the bank holding company for Bank of Hope that provides retail and commercial banking services for businesses and individuals in the United States.

Flawless balance sheet with high growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives