- United States

- /

- Banks

- /

- NasdaqGS:HONE

Shareholders May Not Be So Generous With HarborOne Bancorp, Inc.'s (NASDAQ:HONE) CEO Compensation And Here's Why

CEO Jim Blake has done a decent job of delivering relatively good performance at HarborOne Bancorp, Inc. (NASDAQ:HONE) recently. This is something shareholders will keep in mind as they cast their votes on company resolutions such as executive remuneration in the upcoming AGM on 26 May 2021. However, some shareholders may still be hesitant of being overly generous with CEO compensation.

Check out our latest analysis for HarborOne Bancorp

How Does Total Compensation For Jim Blake Compare With Other Companies In The Industry?

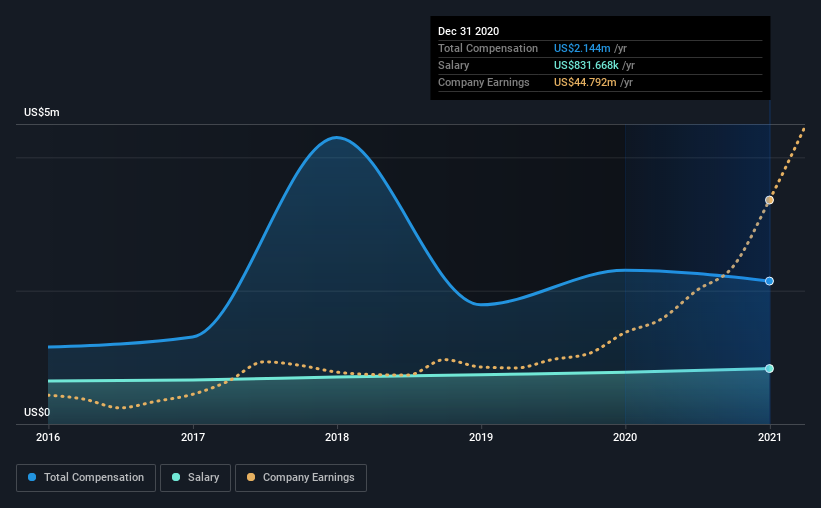

Our data indicates that HarborOne Bancorp, Inc. has a market capitalization of US$767m, and total annual CEO compensation was reported as US$2.1m for the year to December 2020. That's a slight decrease of 7.1% on the prior year. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at US$832k.

On comparing similar companies from the same industry with market caps ranging from US$400m to US$1.6b, we found that the median CEO total compensation was US$1.6m. Hence, we can conclude that Jim Blake is remunerated higher than the industry median. What's more, Jim Blake holds US$6.1m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | US$832k | US$777k | 39% |

| Other | US$1.3m | US$1.5m | 61% |

| Total Compensation | US$2.1m | US$2.3m | 100% |

Speaking on an industry level, nearly 42% of total compensation represents salary, while the remainder of 58% is other remuneration. There isn't a significant difference between HarborOne Bancorp and the broader market, in terms of salary allocation in the overall compensation package. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

HarborOne Bancorp, Inc.'s Growth

HarborOne Bancorp, Inc.'s earnings per share (EPS) grew 85% per year over the last three years. It achieved revenue growth of 47% over the last year.

This demonstrates that the company has been improving recently and is good news for the shareholders. Most shareholders would be pleased to see strong revenue growth combined with EPS growth. This combo suggests a fast growing business. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has HarborOne Bancorp, Inc. Been A Good Investment?

We think that the total shareholder return of 44%, over three years, would leave most HarborOne Bancorp, Inc. shareholders smiling. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

In Summary...

Given that the company's overall performance has been reasonable, the CEO remuneration policy might not be shareholders' central point of focus in the upcoming AGM. However, if the board proposes to increase the compensation, some shareholders might have questions given that the CEO is already being paid higher than the industry.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. That's why we did our research, and identified 3 warning signs for HarborOne Bancorp (of which 1 doesn't sit too well with us!) that you should know about in order to have a holistic understanding of the stock.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

If you’re looking to trade HarborOne Bancorp, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if HarborOne Bancorp might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:HONE

HarborOne Bancorp

Provides financial services to individuals, families, small and mid-size businesses, and municipalities.

Flawless balance sheet with proven track record.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion