- United States

- /

- Diversified Financial

- /

- NasdaqGS:HMPT

Results: Home Point Capital Inc. Delivered A Surprise Loss And Now Analysts Have New Forecasts

It's been a mediocre week for Home Point Capital Inc. (NASDAQ:HMPT) shareholders, with the stock dropping 12% to US$4.51 in the week since its latest quarterly results. It was a pretty bad result overall, with revenues coming in 61% lower than the analysts predicted. Unsurprisingly, the statutory profit the analysts had been forecasting evaporated, turning into a loss of US$0.53 per share. This is an important time for investors, as they can track a company's performance in its report, look at what experts are forecasting for next year, and see if there has been any change to expectations for the business. We thought readers would find it interesting to see the analysts latest (statutory) post-earnings forecasts for next year.

View our latest analysis for Home Point Capital

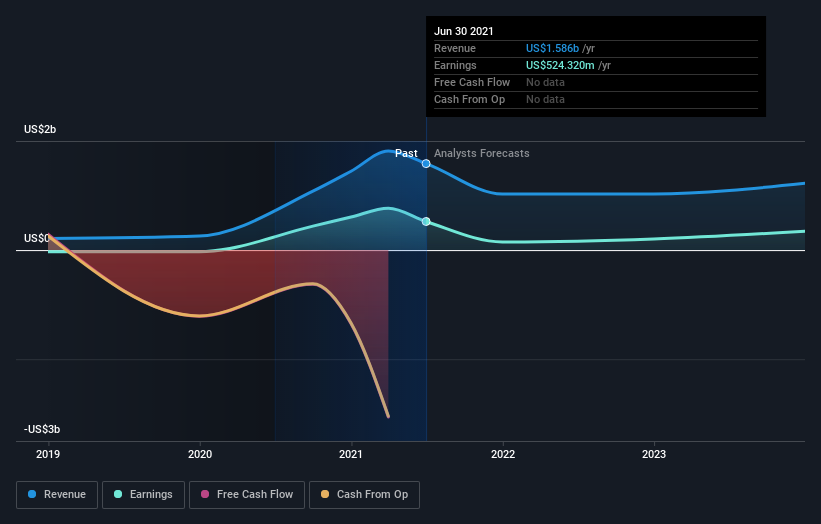

Taking into account the latest results, the seven analysts covering Home Point Capital provided consensus estimates of US$1.03b revenue in 2021, which would reflect a disturbing 35% decline on its sales over the past 12 months. Statutory earnings per share are forecast to nosedive 70% to US$1.13 in the same period. Before this earnings report, the analysts had been forecasting revenues of US$1.05b and earnings per share (EPS) of US$1.34 in 2021. The analysts seem less optimistic after the recent results, reducing their sales forecasts and making a real cut to earnings per share numbers.

It'll come as no surprise then, to learn that the analysts have cut their price target 14% to US$7.15. The consensus price target is just an average of individual analyst targets, so - it could be handy to see how wide the range of underlying estimates is. Currently, the most bullish analyst values Home Point Capital at US$12.50 per share, while the most bearish prices it at US$5.00. We would probably assign less value to the analyst forecasts in this situation, because such a wide range of estimates could imply that the future of this business is difficult to value accurately. As a result it might not be a great idea to make decisions based on the consensus price target, which is after all just an average of this wide range of estimates.

One way to get more context on these forecasts is to look at how they compare to both past performance, and how other companies in the same industry are performing. We would highlight that sales are expected to reverse, with a forecast 58% annualised revenue decline to the end of 2021. That is a notable change from historical growth of 97% over the last year. Yet aggregate analyst estimates for other companies in the industry suggest that industry revenues are forecast to decline 3.0% per year. So it's pretty clear that Home Point Capital's revenues are expected to shrink faster than the wider industry.

The Bottom Line

The most important thing to take away is that the analysts downgraded their earnings per share estimates, showing that there has been a clear decline in sentiment following these results. Unfortunately they also downgraded their revenue estimates, and our analysts estimates suggest that Home Point Capital is still expected to perform worse than the wider industry. Furthermore, the analysts also cut their price targets, suggesting that the latest news has led to greater pessimism about the intrinsic value of the business.

Keeping that in mind, we still think that the longer term trajectory of the business is much more important for investors to consider. We have forecasts for Home Point Capital going out to 2023, and you can see them free on our platform here.

Plus, you should also learn about the 1 warning sign we've spotted with Home Point Capital .

If you’re looking to trade Home Point Capital, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Home Point Capital might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:HMPT

Home Point Capital

Home Point Capital Inc., together with its subsidiaries, operates as a residential mortgage originator and service provider.

Limited growth with imperfect balance sheet.