The board of Horizon Bancorp, Inc. (NASDAQ:HBNC) has announced that it will pay a dividend on the 18th of July, with investors receiving $0.16 per share. Based on this payment, the dividend yield on the company's stock will be 4.0%, which is an attractive boost to shareholder returns.

Horizon Bancorp's Earnings Will Easily Cover The Distributions

A big dividend yield for a few years doesn't mean much if it can't be sustained.

Horizon Bancorp has established itself as a dividend paying company with over 10 years history of distributing earnings to shareholders. Taking data from its last earnings report, calculating for the company's payout ratio shows 62%, which means that Horizon Bancorp would be able to pay its last dividend without pressure on the balance sheet.

Over the next year, EPS is forecast to expand by 28.5%. If the dividend continues on this path, the future payout ratio could be 54% by next year, which we think can be pretty sustainable going forward.

View our latest analysis for Horizon Bancorp

Horizon Bancorp Has A Solid Track Record

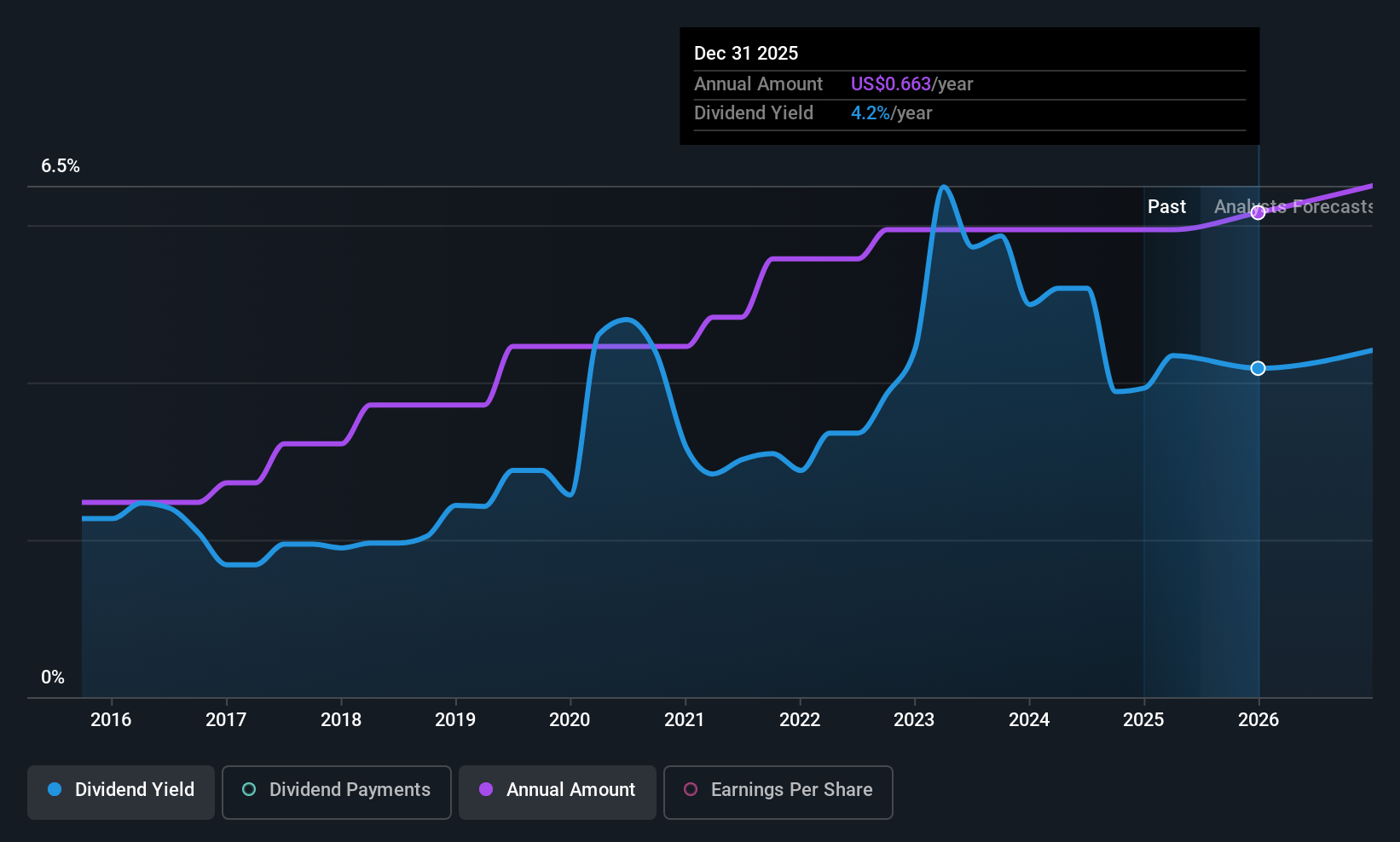

Even over a long history of paying dividends, the company's distributions have been remarkably stable. Since 2015, the annual payment back then was $0.231, compared to the most recent full-year payment of $0.64. This means that it has been growing its distributions at 11% per annum over that time. So, dividends have been growing pretty quickly, and even more impressively, they haven't experienced any notable falls during this period.

Dividend Growth Is Doubtful

The company's investors will be pleased to have been receiving dividend income for some time. Unfortunately things aren't as good as they seem. Horizon Bancorp has seen earnings per share falling at 7.2% per year over the last five years. Declining earnings will inevitably lead to the company paying a lower dividend in line with lower profits. Earnings are forecast to grow over the next 12 months and if that happens we could still be a little bit cautious until it becomes a pattern.

In Summary

Overall, we think Horizon Bancorp is a solid choice as a dividend stock, even though the dividend wasn't raised this year. While the payments look sustainable for now, earnings have been shrinking so the dividend could come under pressure in the future. The dividend looks okay, but there have been some issues in the past, so we would be a little bit cautious.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. Without at least some growth in earnings per share over time, the dividend will eventually come under pressure either from competition or inflation. See if the 6 analysts are forecasting a turnaround in our free collection of analyst estimates here. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

Valuation is complex, but we're here to simplify it.

Discover if Horizon Bancorp might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:HBNC

Horizon Bancorp

Operates as the bank holding company for Horizon Bank that engages in the provision of commercial and retail banking services.

Flawless balance sheet with high growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives