- United States

- /

- Banks

- /

- NasdaqCM:FXNC

First National (FXNC): One-Off $6.1M Loss Complicates Profit Growth Narrative

Reviewed by Simply Wall St

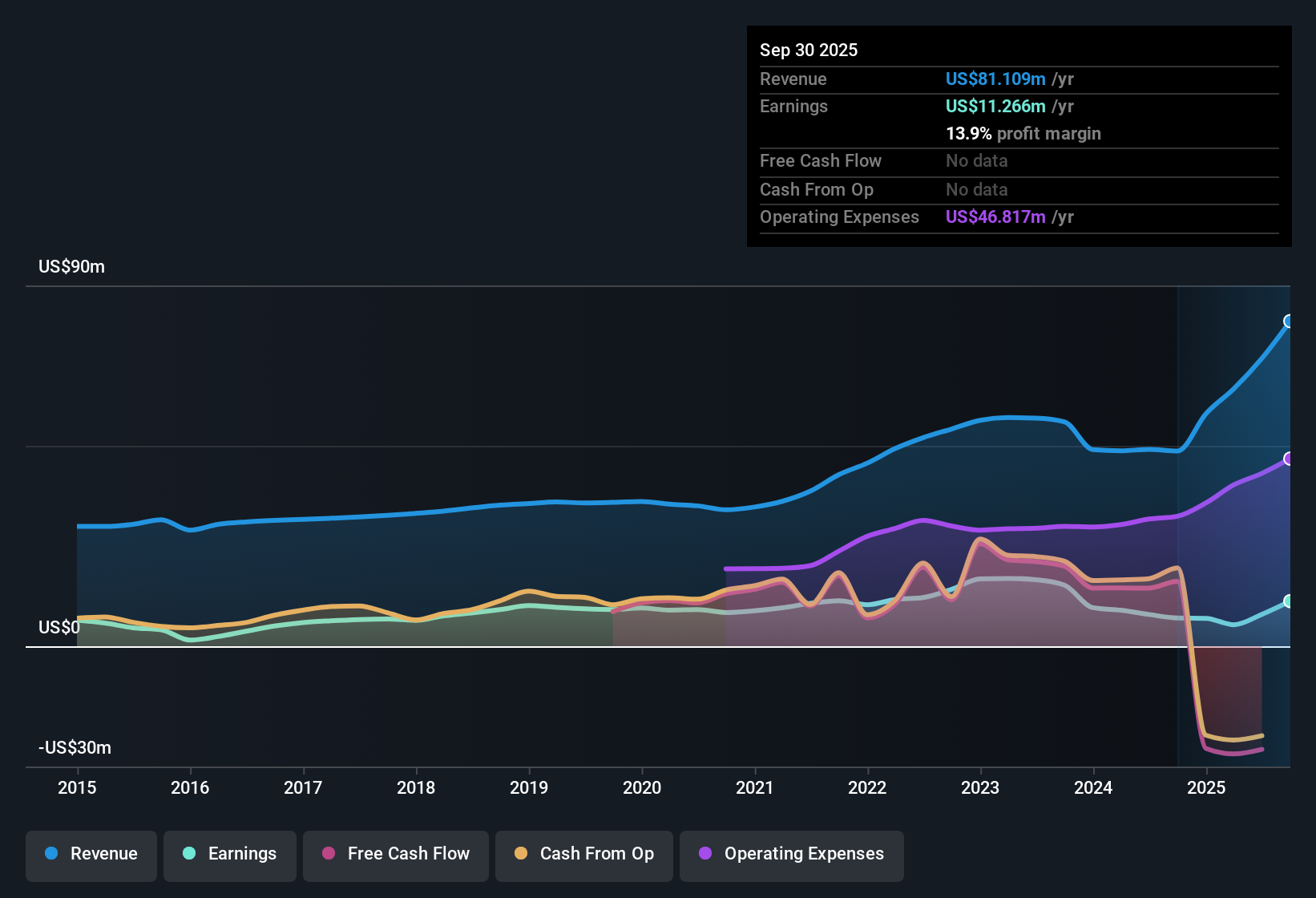

First National (FXNC) posted net profit margins of 13.9%, slightly below last year’s 14.5%, with a notable 59.8% earnings growth over the past year that stands in sharp contrast to its five-year average annual decline of -4.5%. Shares are trading at $22.52, which is above the company’s internal fair value estimate of $20.92. The P/E ratio of 17.8x sits well above both industry and peer averages. Despite the backdrop of a significant one-off $6.1 million loss impacting reported earnings, robust revenue and profit expansion forecasts, along with attractive dividends, are keeping investor interest high.

See our full analysis for First National.The real test is how these headline numbers stack up against the prevailing market narratives. Some views will get reinforced, while others may be challenged.

Curious how numbers become stories that shape markets? Explore Community Narratives

Forecasted Earnings Outpace Market Growth

- FXNC is expecting annual earnings growth of 42.5%, easily ahead of the broader US market’s 15.9% estimate for the same period.

- What stands out in the prevailing market view is that even with this significant projected growth, the company’s recent record includes a five-year average annual decline of -4.5%. Analysts will be watching closely to see if this reversal is sustained.

- This robust forecast contrasts with a net profit margin that slipped to 13.9% from last year’s 14.5%, highlighting a tension between longer-term margin trends and forward expectations.

- Analysts often emphasize that such high growth projections attract investor attention, but the follow-through will depend on whether the quality of earnings improves considering that recent profit numbers were impacted by a major one-off $6.1 million loss.

- Momentum in forecasted growth combined with margin pressure makes future results pivotal for validating bullish scenarios.

One-Off Loss Clouds Earnings Quality

- The latest financials include the impact of a significant $6.1 million one-time loss, which has dampened reported earnings and complicates a clean read on core profitability.

- The prevailing analysis highlights that despite a substantial 59.8% annual earnings increase, the unusual item means investors may be cautious about assuming the trend is repeatable.

- Such non-recurring losses make it challenging for bullish investors to argue that recent momentum will translate into future quarters, putting extra focus on normalized results going forward.

- This creates a narrative tension. The company appears fundamentally strong on growth, but skeptics note that not all of last year’s gains may be sustainable when quality is adjusted for non-recurring items.

Valuation Premium Stands Out Amid Sector Peers

- Shares trade above DCF fair value at $22.52, with a P/E ratio of 17.8x compared to industry (11.2x) and peer (10.9x) averages, pointing to a noticeable premium.

- According to the prevailing view, this premium likely reflects optimism about First National’s future profit expansion and attractive dividends.

- However, the gap to DCF fair value ($20.92) and the sector’s lower multiples mean that expectations are high and any miss on forecasts could magnify downside risk in the short term.

- Investors often debate whether such pricing is justified. While healthy growth estimates support the case, quality concerns following the recent one-off loss add extra scrutiny to the valuation argument.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on First National's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

First National’s growth story is clouded by volatile margins, a one-off loss, and a valuation premium that might not be fully justified by fundamentals.

If you want to compare with companies trading below fair value and offering a stronger margin of safety, check out these 833 undervalued stocks based on cash flows for better-aligned opportunities.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:FXNC

First National

Operates as the bank holding company for First Bank that provides various commercial banking services to small and medium-sized businesses, individuals, estates, local governmental entities, and non-profit organizations in Virginia.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives