- United States

- /

- Banks

- /

- NasdaqGS:FSUN

FirstSun Capital Bancorp (FSUN): Margin Moderation Tempers Bullish Narratives Despite Deep Value

Reviewed by Simply Wall St

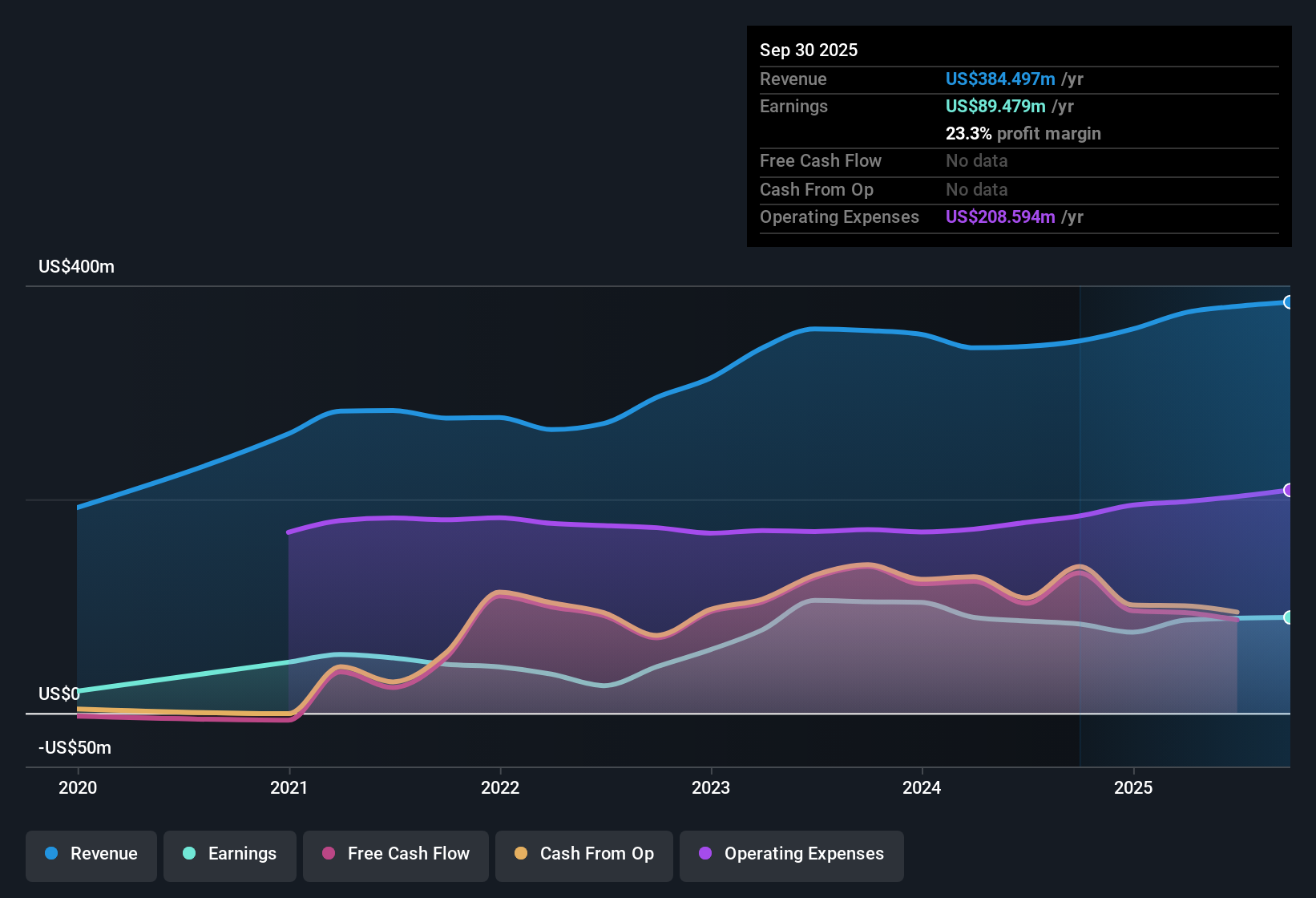

FirstSun Capital Bancorp (FSUN) reported a net profit margin of 23.3% for the latest period, slightly down from last year’s 23.9%, alongside annual earnings growth of 7.4%. Over the past five years, FSUN has grown earnings at 17.6% per year, with forecasts pointing to ongoing annual earnings growth of 7.7% and revenue growth of 10.1%. With a Price-to-Earnings ratio of 10.4x, trading below both peer and industry averages, FSUN’s strong earnings quality and relative value stand out. Investors are viewing this as a reward-heavy story with no identified risks in the current period.

See our full analysis for FirstSun Capital Bancorp.Next, we will see how the latest numbers stack up against the most widely followed narratives around FirstSun Capital Bancorp, and where the community view might come into question.

See what the community is saying about FirstSun Capital Bancorp

Efficiency Ratio Strengthens Margins Outlook

- FirstSun’s stable or improving efficiency ratio, paired with positive operating leverage, highlights the company’s ability to keep costs in check even as profit margins moderate from 23.9% last year to 23.3% now.

- Analysts' consensus view notes that operational efficiency and focus on fee-based income (now over 25% of revenue) are expected to support steady long-term margin resilience.

- Fee-based services provide diversification and potential insulation from interest rate swings, which reinforces profitability.

- Stable efficiency helps align with analysts' projection for profit margins to remain competitive at 22.2% over the next three years even in the face of market volatility.

- To see which narrative best fits these trends, compare the full consensus narrative next.

Deposit Growth Powers Expansion Plans

- Deposit growth has accelerated in both consumer and business segments, giving FirstSun flexibility to expand in high-growth Southwestern and California markets.

- Consensus narrative highlights that robust deposit inflows are fueling new loans and positioning the bank to benefit from demographic shifts:

- Consistent double-digit growth in new loan originations puts FirstSun in a strong spot to capture economic tailwinds from Sun Belt urban migration.

- This growth trajectory aligns with the analysts’ expectation of $512.8 million in revenue by 2028 and anchors higher net interest income projections.

Valuation Still Sits Below DCF Fair Value

- At a share price of $33.51 and a Price-to-Earnings ratio of 10.4x, FirstSun trades below both the peer average (12.7x) and DCF fair value of $68.94. This suggests a compelling value opportunity when compared to the industry and fundamental fair value metrics.

- According to analysts' consensus view, the market price could have 11.2% upside to the price target of $44.25 if revenue meets forecasts and margins remain stable:

- For this upside to materialize, consensus assumes only a moderate decline in profit margins and a rise in forward PE to 12.9x, above the current US Banks industry average.

- This scenario depends on FirstSun maintaining deposit momentum and growing non-interest income in new markets, which supports long-term valuation potential.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for FirstSun Capital Bancorp on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have your own take on these results? Shape your perspective into a unique narrative in just minutes, and Do it your way.

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding FirstSun Capital Bancorp.

See What Else Is Out There

FirstSun’s value appeal and earnings momentum are offset by moderating profit margins. This could pressure future returns if efficiency slips or market conditions shift.

Concerned about margin erosion? Focus your search on stable growth stocks screener (2116 results) to discover companies that consistently deliver reliable earnings and resilient performance across economic cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FSUN

FirstSun Capital Bancorp

Operates as the bank holding company for Sunflower Bank, National Association that provides commercial and consumer banking and financial services to small and medium-sized companies in Texas, Kansas, Colorado, New Mexico, Arizona, California, and Washington.

Very undervalued with flawless balance sheet.

Market Insights

Community Narratives