Stock Analysis

- United States

- /

- Diversified Financial

- /

- NYSE:BLX

FirstSun Capital Bancorp And Two More Undiscovered Gems In The US Market

Reviewed by Simply Wall St

Amid a buoyant atmosphere in the U.S. markets, with small-cap stocks like those in the Russell 2000 experiencing significant gains, investors are witnessing broad-based rallies spurred by optimistic economic indicators and potential rate cuts. In such a market, identifying stocks that have not yet caught the wider public's attention can offer unique opportunities for growth.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| River Financial | 131.04% | 17.59% | 20.70% | ★★★★★★ |

| Morris State Bancshares | 14.93% | 0.44% | 7.74% | ★★★★★★ |

| Omega Flex | NA | 2.13% | 4.77% | ★★★★★★ |

| First Northern Community Bancorp | NA | 6.68% | 9.08% | ★★★★★★ |

| Teekay | NA | -8.88% | 49.65% | ★★★★★★ |

| Mission Bancorp | 25.37% | 16.23% | 20.16% | ★★★★★★ |

| FirstSun Capital Bancorp | 27.36% | 10.54% | 30.73% | ★★★★★★ |

| Gravity | NA | 15.31% | 24.42% | ★★★★★★ |

| CSP | 2.17% | -5.57% | 73.73% | ★★★★★☆ |

| FRMO | 0.19% | 6.49% | 15.82% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

FirstSun Capital Bancorp (NasdaqGS:FSUN)

Simply Wall St Value Rating: ★★★★★★

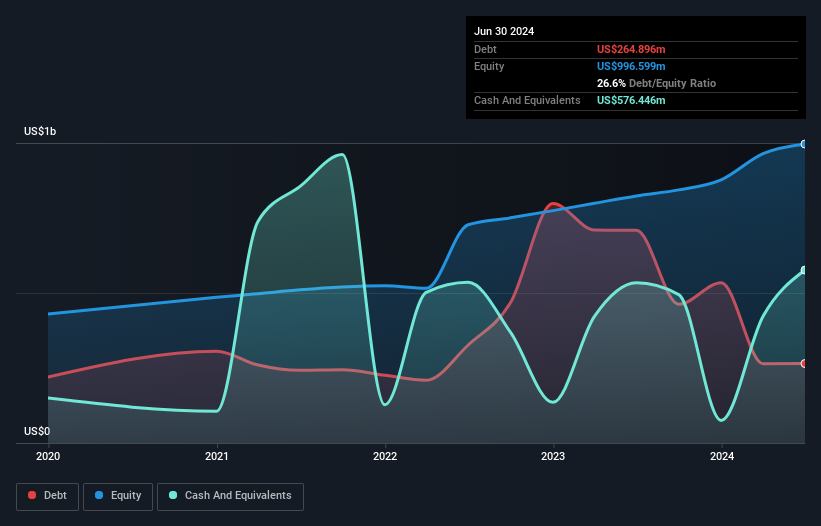

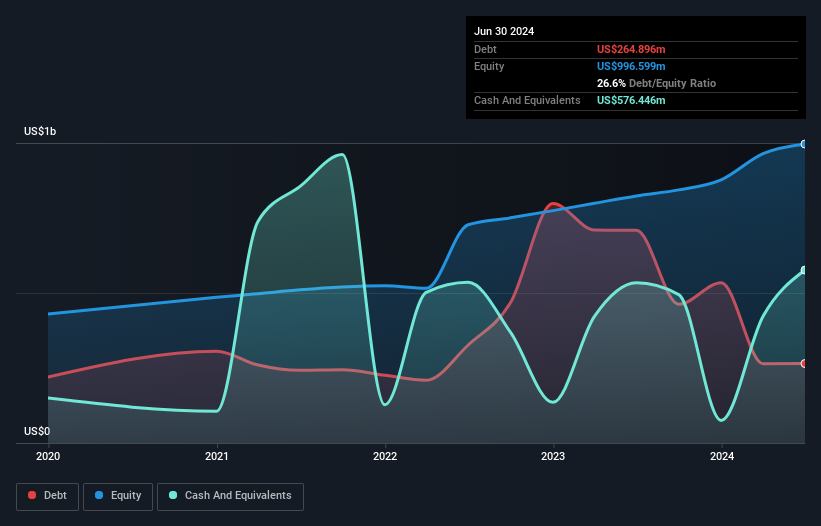

Overview: FirstSun Capital Bancorp, operating as a bank holding company for Sunflower Bank, offers commercial and consumer banking services to small and medium-sized businesses across Texas, Kansas, Colorado, New Mexico, and Arizona with a market cap of $1.01 billion.

Operations: The company primarily generates its revenue through banking and mortgage operations, contributing $303.81 million and $42.89 million respectively, while corporate activities resulted in a loss of $4.99 million. It consistently achieves a gross profit margin of 100%, with recent net income margins showing an upward trend, reaching as high as 29.32% by the end of 2023.

FirstSun Capital Bancorp, recently added to the NASDAQ Composite Index, showcases robust financial health with total assets of $7.8B and a strong net interest margin of 4.3%. With earnings growth outpacing the industry at 15.1%, and a solid bad loan coverage at 0.9% of total loans, FirstSun stands out in asset management and risk control. The company's strategic movements include a pending merger with HomeStreet, enhancing its competitive edge in the banking sector.

FirstSun Capital Bancorp (NasdaqGS:FSUN)

Simply Wall St Value Rating: ★★★★★★

Overview: FirstSun Capital Bancorp, operating as a bank holding company for Sunflower Bank, offers commercial and consumer banking services to small and medium-sized businesses across Texas, Kansas, Colorado, New Mexico, and Arizona with a market cap of $1.01 billion.

Operations: The company primarily generates its revenue through banking and mortgage operations, contributing $303.81 million and $42.89 million respectively, while corporate activities resulted in a loss of $4.99 million. It consistently achieves a gross profit margin of 100%, with recent net income margins showing an upward trend, reaching as high as 29.32% by the end of 2023.

FirstSun Capital Bancorp, recently added to the NASDAQ Composite Index, showcases robust financial health with total assets of $7.8B and a strong net interest margin of 4.3%. With earnings growth outpacing the industry at 15.1%, and a solid bad loan coverage at 0.9% of total loans, FirstSun stands out in asset management and risk control. The company's strategic movements include a pending merger with HomeStreet, enhancing its competitive edge in the banking sector.

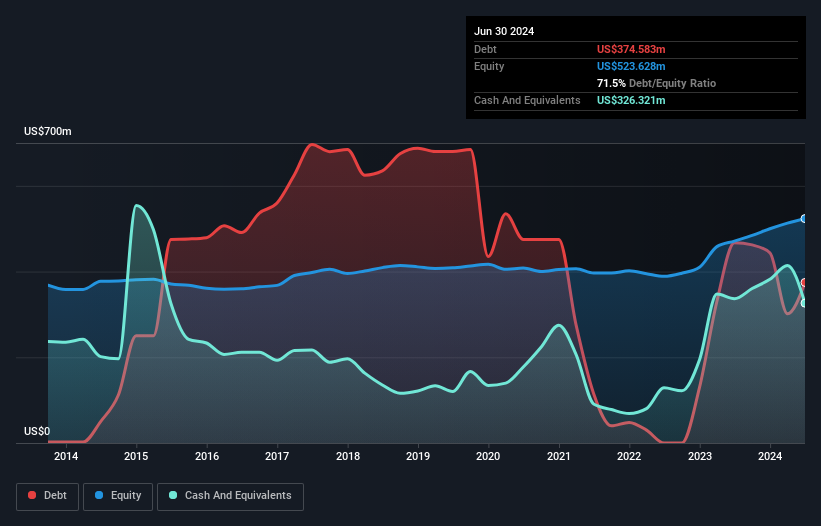

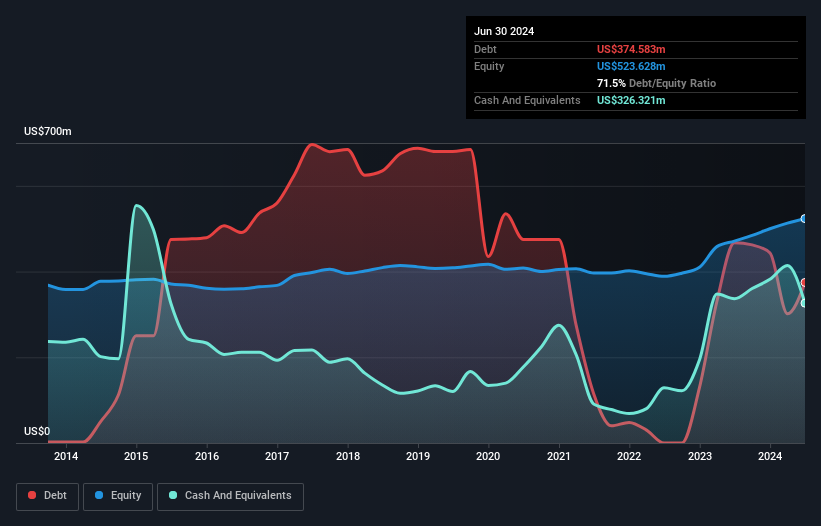

HomeTrust Bancshares (NasdaqGS:HTBI)

Simply Wall St Value Rating: ★★★★★★

Overview: HomeTrust Bancshares, Inc., functioning as the bank holding company for HomeTrust Bank, offers a variety of retail and commercial banking products and services with a market capitalization of approximately $608.41 million.

Operations: The business generates revenue through banking operations, consistently achieving a gross profit margin of 100%. It has seen a net income margin increase from 17.03% to 33.35% over the observed periods, reflecting improved profitability despite rising operating expenses.

HomeTrust Bancshares, a lesser-known entity in the banking sector, recently announced significant executive changes aimed at enhancing its digital strategy. With total assets of $4.7B and a robust allowance for bad loans at 235%, HTBI shows strong financial health. The bank's earnings surged by 82.4% last year, outpacing the industry's decline of 14.4%. Despite recent drops from several Russell indexes, HTBI's focus on low-risk funding (91% from customer deposits) and strategic leadership appointments position it as an intriguing prospect in the evolving financial landscape.

- Click to explore a detailed breakdown of our findings in HomeTrust Bancshares' health report.

Understand HomeTrust Bancshares' track record by examining our Past report.

HomeTrust Bancshares (NasdaqGS:HTBI)

Simply Wall St Value Rating: ★★★★★★

Overview: HomeTrust Bancshares, Inc., functioning as the bank holding company for HomeTrust Bank, offers a variety of retail and commercial banking products and services with a market capitalization of approximately $608.41 million.

Operations: The business generates revenue through banking operations, consistently achieving a gross profit margin of 100%. It has seen a net income margin increase from 17.03% to 33.35% over the observed periods, reflecting improved profitability despite rising operating expenses.

HomeTrust Bancshares, a lesser-known entity in the banking sector, recently announced significant executive changes aimed at enhancing its digital strategy. With total assets of $4.7B and a robust allowance for bad loans at 235%, HTBI shows strong financial health. The bank's earnings surged by 82.4% last year, outpacing the industry's decline of 14.4%. Despite recent drops from several Russell indexes, HTBI's focus on low-risk funding (91% from customer deposits) and strategic leadership appointments position it as an intriguing prospect in the evolving financial landscape.

- Click to explore a detailed breakdown of our findings in HomeTrust Bancshares' health report.

Understand HomeTrust Bancshares' track record by examining our Past report.

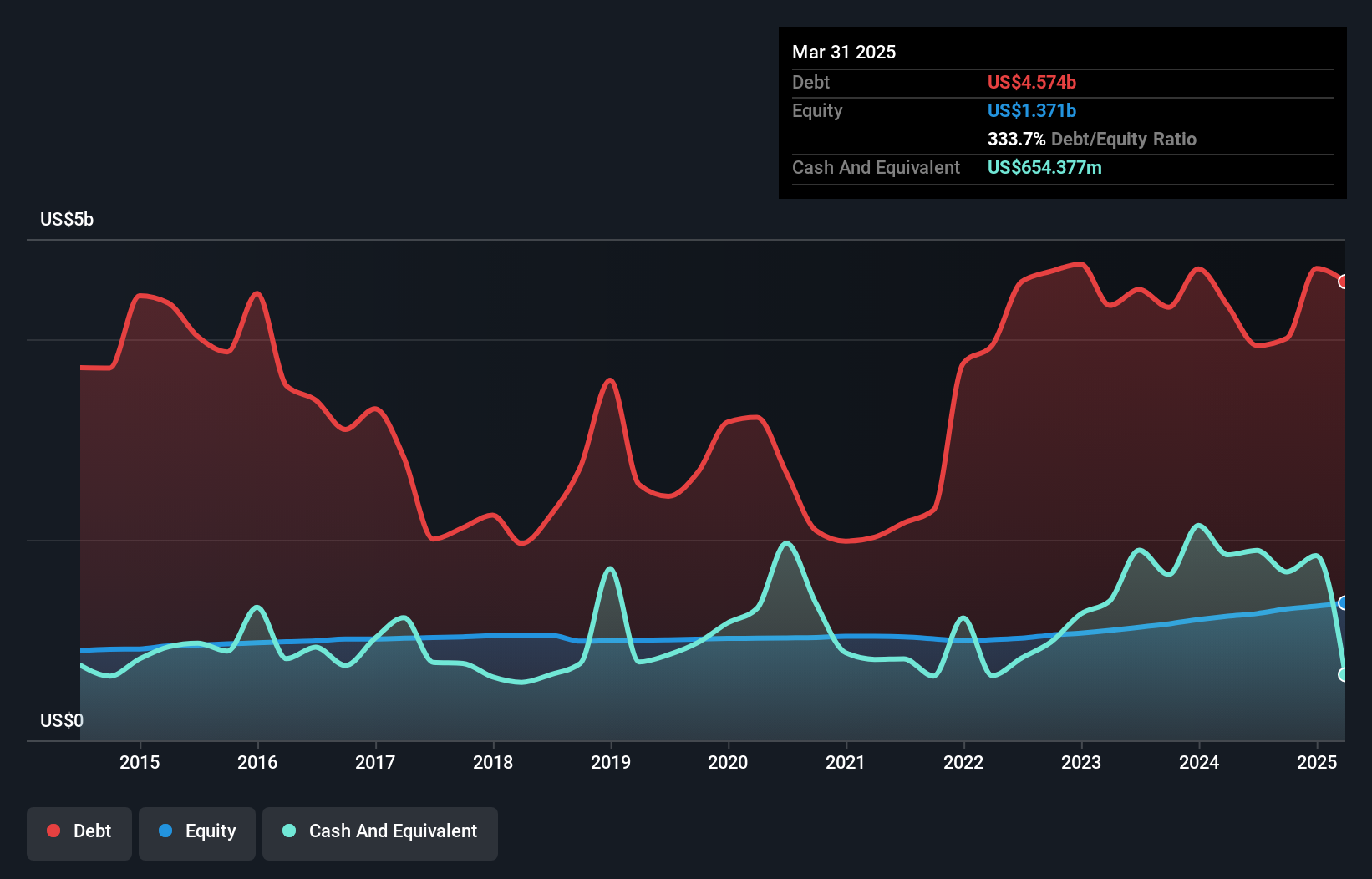

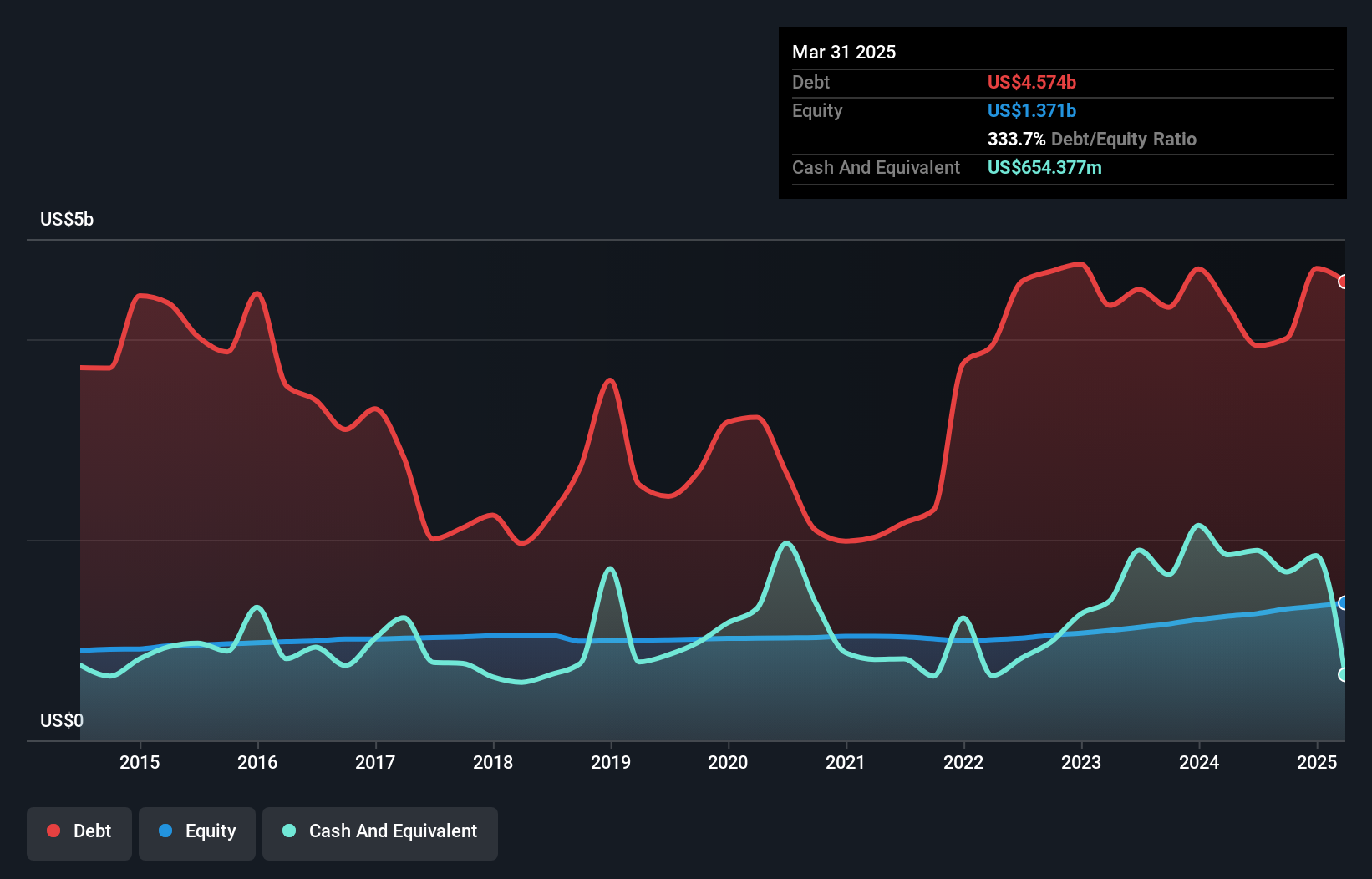

Banco Latinoamericano de Comercio Exterior S. A (NYSE:BLX)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Banco Latinoamericano de Comercio Exterior, S.A. (BLX) is a Panama-based financial institution specializing in trade finance in Latin America and the Caribbean, with a market capitalization of $1.20 billion.

Operations: The company generates its revenue primarily through commercial and treasury services, with recent data showing $227.20 million from Commercial activities and $28.17 million from Treasury operations. It maintains a high gross profit margin, consistently above 98%, highlighting efficient cost management relative to its revenue generation.

Banco Latinoamericano de Comercio Exterior S.A., a distinguished player in the financial sector, has demonstrated robust performance with a 53.1% earnings growth surpassing its industry's average of 6.6%. With total assets of $10.7 billion and a strong bad loan allowance covering 589% of total loans, the company maintains resilience in asset quality. Its P/E ratio at 6.7x, significantly below the market average, coupled with recent strategic deals such as a $100 million syndicated facility, underscores its potential as an attractive investment opportunity amidst lesser-known entities.

Banco Latinoamericano de Comercio Exterior S. A (NYSE:BLX)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Banco Latinoamericano de Comercio Exterior, S.A. (BLX) is a Panama-based financial institution specializing in trade finance in Latin America and the Caribbean, with a market capitalization of $1.20 billion.

Operations: The company generates its revenue primarily through commercial and treasury services, with recent data showing $227.20 million from Commercial activities and $28.17 million from Treasury operations. It maintains a high gross profit margin, consistently above 98%, highlighting efficient cost management relative to its revenue generation.

Banco Latinoamericano de Comercio Exterior S.A., a distinguished player in the financial sector, has demonstrated robust performance with a 53.1% earnings growth surpassing its industry's average of 6.6%. With total assets of $10.7 billion and a strong bad loan allowance covering 589% of total loans, the company maintains resilience in asset quality. Its P/E ratio at 6.7x, significantly below the market average, coupled with recent strategic deals such as a $100 million syndicated facility, underscores its potential as an attractive investment opportunity amidst lesser-known entities.

Seize The Opportunity

- Access the full spectrum of 226 US Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Banco Latinoamericano de Comercio Exterior S. A is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BLX

Banco Latinoamericano de Comercio Exterior S. A

Banco Latinoamericano de Comercio Exterior, S.

Solid track record with adequate balance sheet and pays a dividend.