- United States

- /

- Banks

- /

- NasdaqGS:FITB

Potential Fed Rate Cut Could Be a Game Changer for Fifth Third Bancorp (FITB)

Reviewed by Sasha Jovanovic

- New York Federal Reserve President John Williams recently indicated that there is potential for further interest rate adjustments in the near future, raising market expectations for a possible rate cut at the Federal Reserve's December meeting.

- This has boosted optimism across the banking sector, highlighting the sensitive relationship between central bank policy signals and investor confidence in regional banks like Fifth Third Bancorp.

- We’ll examine how increased hopes for a near-term rate cut could shape Fifth Third Bancorp’s investment narrative moving forward.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

Fifth Third Bancorp Investment Narrative Recap

To be a shareholder in Fifth Third Bancorp, you need to believe in steady loan and deposit growth fueled by regional expansion and digital investments, as well as resilience to shifting interest rates. The latest signal from the Federal Reserve heightened investor optimism for a rate cut, temporarily boosting the share price, but the biggest short-term catalyst, rebounding commercial loan demand, remains largely dependent on wider economic confidence rather than central bank action alone. The main risk continues to be lackluster commercial lending activity, which could limit both revenue and earnings if it persists.

Against the backdrop of renewed rate-cut hopes, Fifth Third's Q3 2025 results underscore the importance of net interest income, which rose to US$1,520 million, supporting improved earnings. While positive market sentiment can lift shares, ongoing growth in this area will rely on core business momentum rather than short-term monetary expectations.

However, it’s equally important for investors to stay alert to the risk that lower commercial loan demand could persist well into 2026, especially if...

Read the full narrative on Fifth Third Bancorp (it's free!)

Fifth Third Bancorp's narrative projects $10.4 billion in revenue and $2.6 billion in earnings by 2028. This requires 9.1% yearly revenue growth and a $0.4 billion earnings increase from $2.2 billion today.

Uncover how Fifth Third Bancorp's forecasts yield a $50.25 fair value, a 18% upside to its current price.

Exploring Other Perspectives

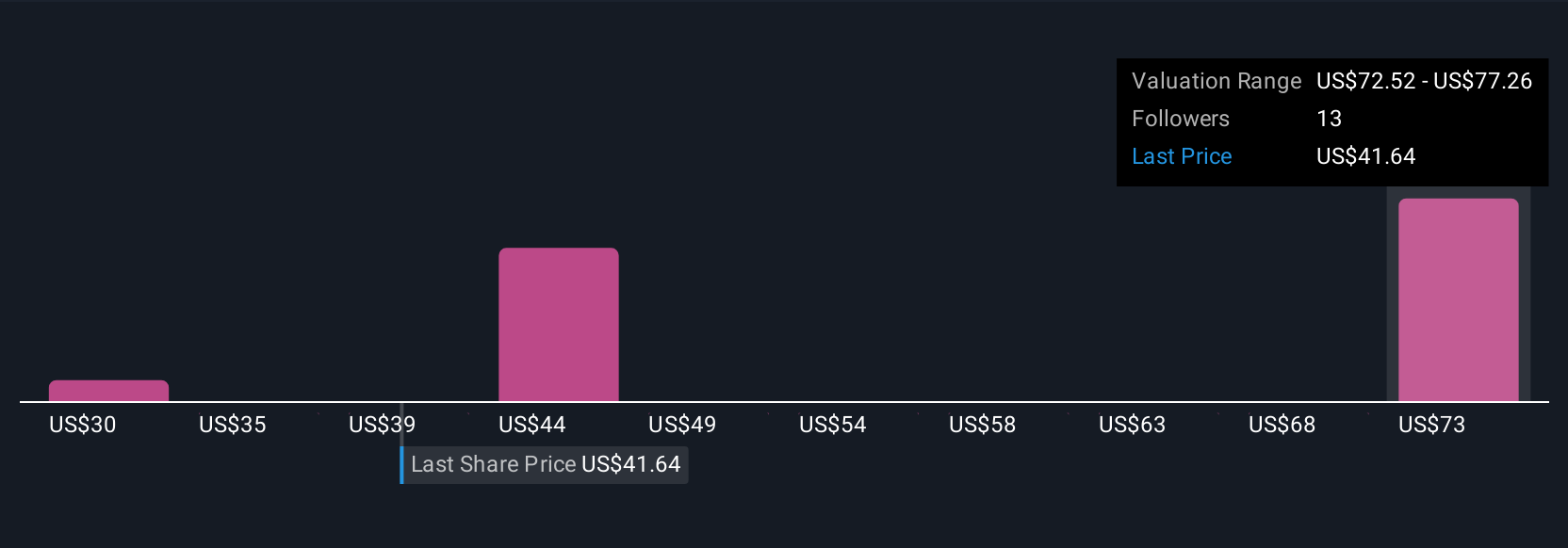

Five distinct fair value estimates from the Simply Wall St Community range widely, from US$29.85 to US$83.68 per share. With commercial lending still facing headwinds, you’ll find investor opinions differ sharply on the company’s path forward, explore several approaches to see what fits your view.

Explore 5 other fair value estimates on Fifth Third Bancorp - why the stock might be worth as much as 97% more than the current price!

Build Your Own Fifth Third Bancorp Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Fifth Third Bancorp research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Fifth Third Bancorp research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Fifth Third Bancorp's overall financial health at a glance.

Want Some Alternatives?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FITB

Fifth Third Bancorp

Operates as the bank holding company for Fifth Third Bank, National Association that engages in the provision of a range of financial products and services in the United States.

Flawless balance sheet with high growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives