- United States

- /

- Banks

- /

- NasdaqGS:FIBK

First Interstate BancSystem (FIBK) Profit Margin Miss Challenges Bullish Narratives on Efficiency Gains

Reviewed by Simply Wall St

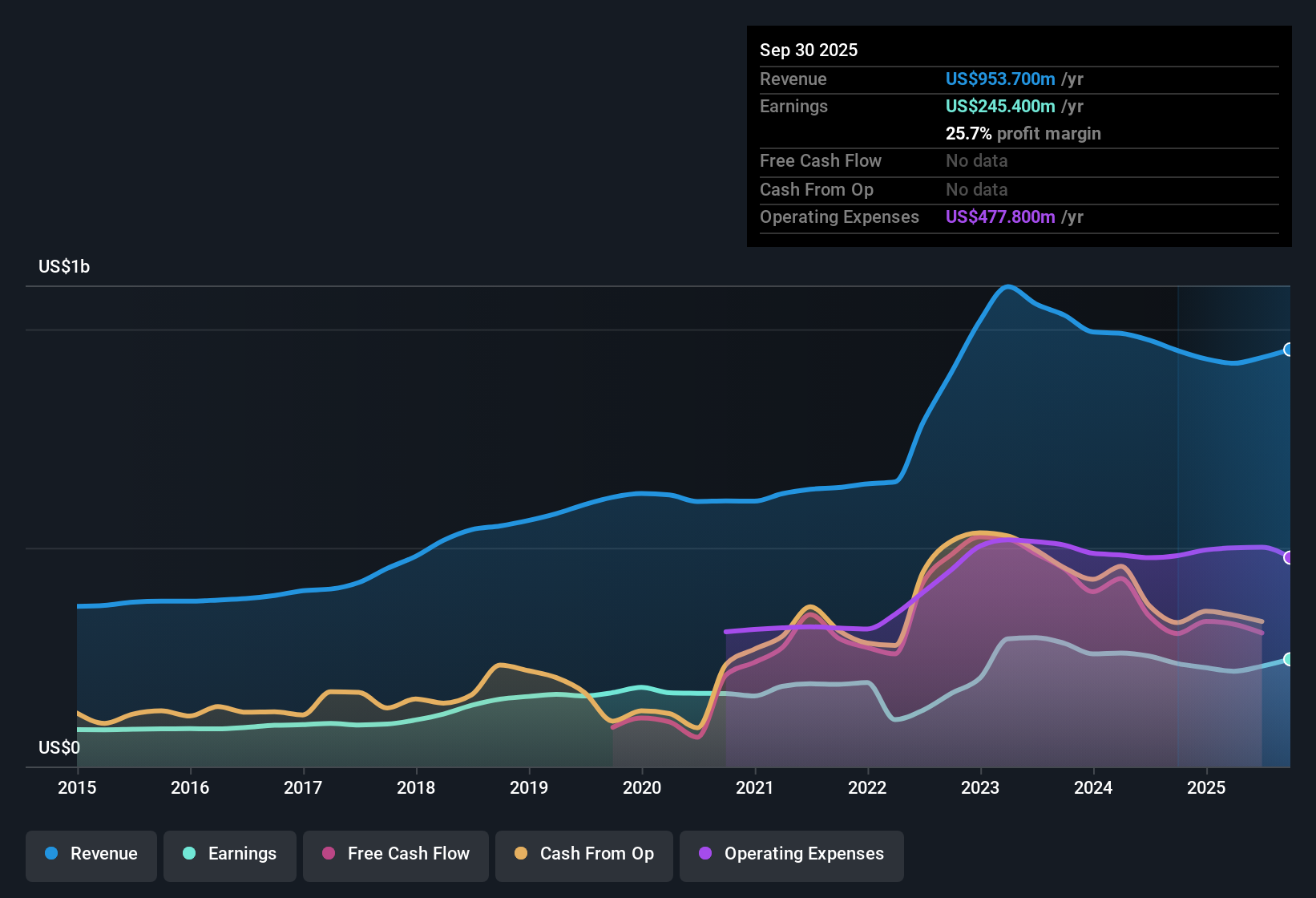

First Interstate BancSystem (FIBK) reported net profit margins of 24.5%, slightly below last year’s 25.9%. The company has delivered 10% average annual earnings growth over the past five years, and analysts project a sharp 42% annual earnings growth for the next three years. Investors are paying attention not only to the strong historical results but also to the blend of high profit margins, an attractive dividend, and upbeat growth forecasts as key drivers heading into this earnings season.

See our full analysis for First Interstate BancSystem.With the latest results in hand, it is time to see how the headline numbers measure up against the most widely held narratives in the market. Some long-standing assumptions may be reinforced, while others could face new challenges.

See what the community is saying about First Interstate BancSystem

Profit Margins Set for Major Lift

- Analysts predict that profit margins will leap from the current 24.5% to a striking 60.3% within three years, signaling a major shift in profitability outlook for First Interstate BancSystem.

- According to the analysts' consensus view, management’s focus on operational efficiency and digital banking is expected to drive long-term profitability and support ambitious margin expansion.

- Investments in branch optimization and mobile banking are designed to bolster net margins and solidify the company’s competitive edge.

- Consensus narrative highlights that these strategies should help First Interstate outperform peers in high-growth regional markets.

Some investors see this margin surge as a turning point and back the consensus narrative of efficiency gains delivering outperformance. See all sides of the forecast in the in-depth Consensus Narrative.

📊 Read the full First Interstate BancSystem Consensus Narrative.Revenue Growth Trails the Market

- Revenue is forecast to rise by just 3.4% per year, which is notably slower than the 10.3% average pace of the broader US market and signals a more measured top-line outlook despite positive earnings trends.

- The analysts' consensus view points to cautious optimism. While the expanding economic footprint in faster-growing regions could support organic growth, persistent declines in certain loan categories and overexposure to slower-growth markets remain key headwinds.

- Analysts emphasize diversification challenges, especially as some large loans are paid off and the company exits indirect and credit card lending.

- This measured growth, if not offset by new business development, could constrain potential revenue upside longer term.

Valuation Signals Mixed Messages

- The current price-to-earnings ratio of 14.4x places First Interstate BancSystem above both the US Banks industry average (11.2x) and direct peer average (10.9x), yet the share price of $31.48 sits below the DCF fair value estimate of $41.79. This indicates a market discount on intrinsic value but a premium compared to peers.

- Analysts' consensus view acknowledges this tension, noting that the stock looks expensive relative to competitors by traditional valuation multiples, but appears undervalued when focusing on discounted future cash flows and projected profit expansion.

- This paradox gives investors plenty to weigh, as incoming results and future loan growth will likely determine which valuation method prevails.

- Consensus narrative also flags that, with the current share price almost matching the analyst target of 34.38, the stock is broadly seen as fairly priced for now.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for First Interstate BancSystem on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Got a different take on the numbers? Share your viewpoint and build your unique narrative in just a few minutes with Do it your way.

A great starting point for your First Interstate BancSystem research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

First Interstate BancSystem’s tepid projected revenue growth and overexposure to slower-growth markets could limit its upside even as margins and profits climb.

For investors prioritizing steadier expansion, use stable growth stocks screener (2108 results) to discover companies delivering more consistent revenue and earnings momentum through changing market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FIBK

First Interstate BancSystem

Operates as the bank holding company for First Interstate Bank that provides a range of banking products and services in the United States.

Flawless balance sheet 6 star dividend payer.

Similar Companies

Market Insights

Community Narratives