- United States

- /

- Banks

- /

- NasdaqGS:FHB

First Hawaiian (FHB): What the Latest Results Reveal About its Valuation and Investor Optimism

Reviewed by Simply Wall St

First Hawaiian (FHB) delivered a solid set of quarterly numbers this season, as both net interest income and net income moved higher compared to a year ago. Management credited cost discipline, balance sheet strength, and steady deposit growth for the improved results.

See our latest analysis for First Hawaiian.

First Hawaiian’s stock has shown steady momentum lately, with the share price climbing 4.7% over the past 90 days as investors react to the company’s solid growth in net income, continued buybacks, and maintaining its dividend. While the 1-year total shareholder return is still down 8.9%, the long-term view appears far more positive. The cumulative 46.2% total shareholder return over five years suggests growing confidence in the bank’s resilience and growth prospects.

If you’re watching First Hawaiian’s progress and want to broaden your search, this is a great moment to discover fast growing stocks with high insider ownership.

The question now is whether First Hawaiian’s impressive recent gains and positive outlook have already been reflected in its share price, or if investors are still overlooking a potential buying opportunity as the bank enters its next phase of growth.

Most Popular Narrative: 7.9% Undervalued

First Hawaiian’s widely followed narrative suggests its fair value is $26.89, compared to the last close of $24.76. This sets up a debate about whether strong recent trends justify even greater upside for the stock.

The bank's robust deposit franchise, supported by a strong local brand and deep customer relationships, has allowed for stable deposit growth and maintained a high proportion of noninterest-bearing deposits. This puts First Hawaiian in a favorable position to benefit from net interest margin expansion as interest rates normalize.

What’s fueling this premium? This narrative is banking on a sharp uptick in margin power and deposit strength, plus a surprising financial conviction about future earnings. The real story lies in the profit assumptions. Find out what’s driving these numbers beneath the surface.

Result: Fair Value of $26.89 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, continued declines in deposits or rising credit losses could quickly challenge the optimistic earnings expectations that are driving the current valuation story.

Find out about the key risks to this First Hawaiian narrative.

Another View: Market Ratios Challenge the Undervaluation Story

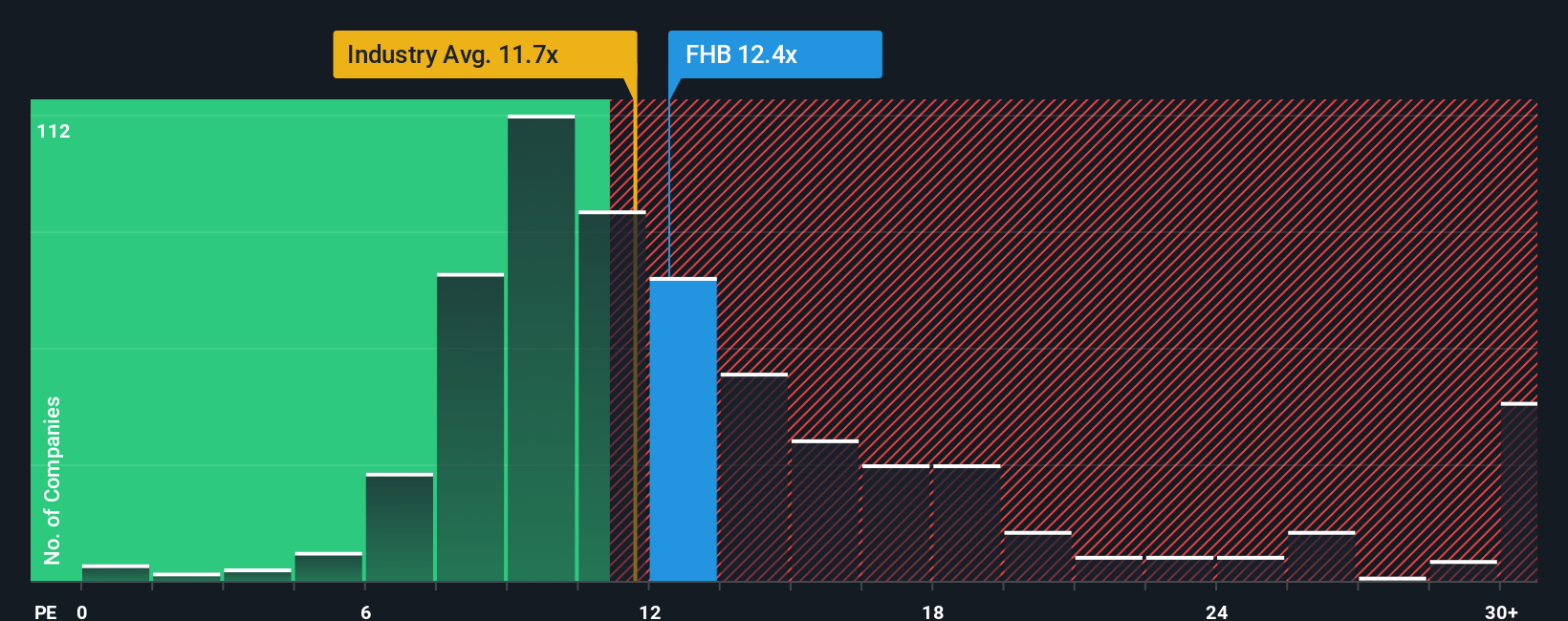

While our analysis points to First Hawaiian being undervalued, market-based price-to-earnings ratios tell a different story. The company trades at 11.8x earnings, which is a premium compared to the US Banks industry average of 11x and the peer average of 11.3x. The fair ratio is estimated at just 10.4x. This gap suggests investors may be paying a higher price for perceived strengths, creating potential downside risk if expectations shift. Could current enthusiasm be outpacing fundamentals?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own First Hawaiian Narrative

If you see the story differently or prefer diving into the data on your own terms, it’s quick and easy to build your own perspective in just minutes. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding First Hawaiian.

Looking for More Investment Ideas?

Ready to take your investing to the next level? Don't let standout opportunities slip by. Use these powerful tools and see what else is possible right now.

- Unleash your portfolio’s potential through these 835 undervalued stocks based on cash flows and spot companies trading below their true worth for long-term gains.

- Fuel your income goals by tapping into these 20 dividend stocks with yields > 3% for reliable stocks offering attractive yields that help grow your wealth steadily.

- Catch early movers benefiting from artificial intelligence with these 25 AI penny stocks and stake your claim in tomorrow’s leading businesses today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FHB

First Hawaiian

Operates as a bank holding company for First Hawaiian Bank that provides a range of banking products and services to consumer and commercial customers in the United States.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives