- United States

- /

- Banks

- /

- NasdaqGM:FGBI

First Guaranty Bancshares (NASDAQ:FGBI) Is Paying Out A Dividend Of $0.16

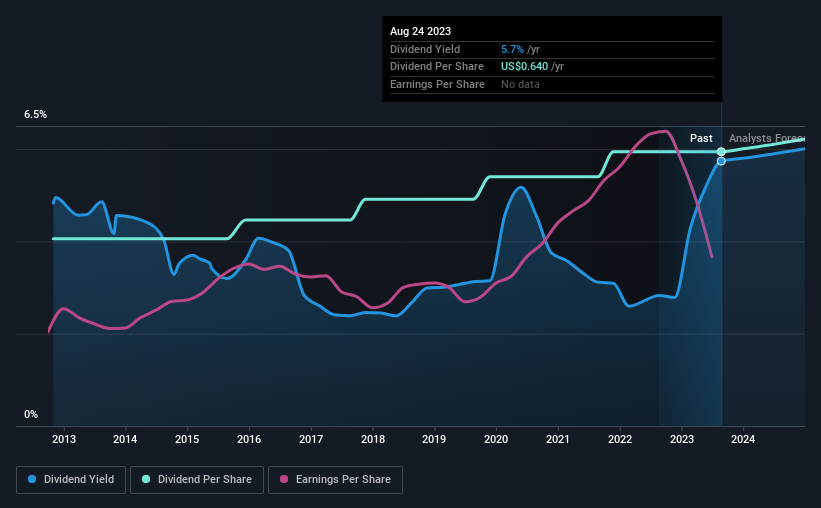

First Guaranty Bancshares, Inc. (NASDAQ:FGBI) will pay a dividend of $0.16 on the 29th of September. This makes the dividend yield 5.7%, which will augment investor returns quite nicely.

See our latest analysis for First Guaranty Bancshares

First Guaranty Bancshares' Payment Expected To Have Solid Earnings Coverage

Impressive dividend yields are good, but this doesn't matter much if the payments can't be sustained.

Having distributed dividends for at least 10 years, First Guaranty Bancshares has a long history of paying out a part of its earnings to shareholders. Taking data from its last earnings report, calculating for the company's payout ratio shows 41%, which means that First Guaranty Bancshares would be able to pay its last dividend without pressure on the balance sheet.

Over the next year, EPS is forecast to fall by 44.3%. Assuming the dividend continues along recent trends, we think the future payout ratio could reach 81%, which is definitely on the higher side.

First Guaranty Bancshares Has A Solid Track Record

The company has an extended history of paying stable dividends. Since 2013, the annual payment back then was $0.437, compared to the most recent full-year payment of $0.64. This means that it has been growing its distributions at 3.9% per annum over that time. While the consistency in the dividend payments is impressive, we think the relatively slow rate of growth is less attractive.

The Dividend's Growth Prospects Are Limited

Investors could be attracted to the stock based on the quality of its payment history. Earnings has been rising at 2.9% per annum over the last five years, which admittedly is a bit slow. The company has been growing at a pretty soft 2.9% per annum, and is paying out quite a lot of its earnings to shareholders. While this isn't necessarily a negative, it definitely signals that dividend growth could be constrained in the future unless earnings start to pick up again.

Our Thoughts On First Guaranty Bancshares' Dividend

Overall, we don't think this company makes a great dividend stock, even though the dividend wasn't cut this year. The company hasn't been paying a very consistent dividend over time, despite only paying out a small portion of earnings. We would be a touch cautious of relying on this stock primarily for the dividend income.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. For example, we've identified 3 warning signs for First Guaranty Bancshares (1 is potentially serious!) that you should be aware of before investing. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:FGBI

First Guaranty Bancshares

Operates as the holding company for First Guaranty Bank that provides commercial banking services in Louisiana and Texas.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

MicroVision will explode future revenue by 380.37% with a vision towards success

The Indispensable Artery for a New North American Economy

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026