- United States

- /

- Banks

- /

- NasdaqGS:FCNC.A

With EPS Growth And More, First Citizens BancShares (NASDAQ:FCNC.A) Makes An Interesting Case

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like First Citizens BancShares (NASDAQ:FCNC.A). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

View our latest analysis for First Citizens BancShares

How Quickly Is First Citizens BancShares Increasing Earnings Per Share?

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Impressively, First Citizens BancShares has grown EPS by 18% per year, compound, in the last three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be beaming.

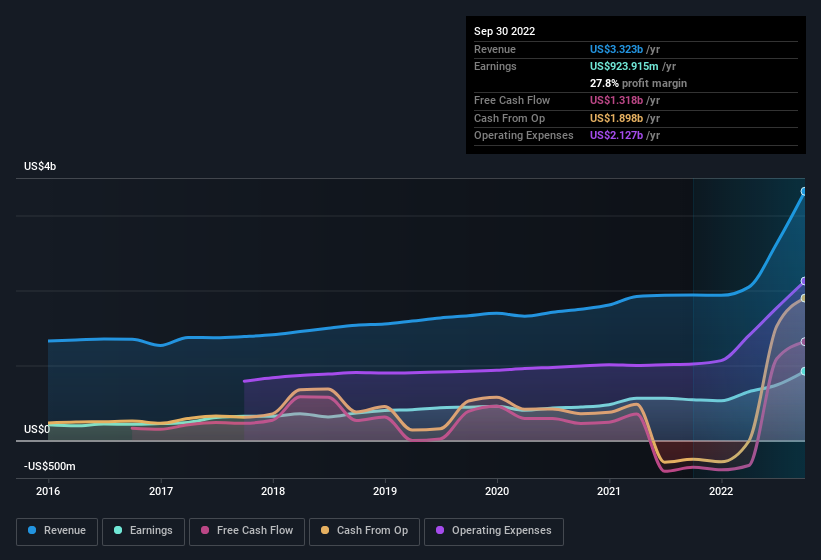

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Our analysis has highlighted that First Citizens BancShares' revenue from operations did not account for all of their revenue in the previous 12 months, so our analysis of its margins might not accurately reflect the underlying business. First Citizens BancShares maintained stable EBIT margins over the last year, all while growing revenue 71% to US$3.3b. That's a real positive.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. While crystal balls don't exist, you can check our visualization of consensus analyst forecasts for First Citizens BancShares' future EPS 100% free.

Are First Citizens BancShares Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Despite US$553k worth of sales, First Citizens BancShares insiders have overwhelmingly been buying the stock, spending US$1.1m on purchases in the last twelve months. You could argue that level of buying implies genuine confidence in the business. Zooming in, we can see that the biggest insider purchase was by Lead Independent Director Robert Newcomb for US$502k worth of shares, at about US$670 per share.

The good news, alongside the insider buying, for First Citizens BancShares bulls is that insiders (collectively) have a meaningful investment in the stock. Indeed, they have a considerable amount of wealth invested in it, currently valued at US$2.7b. Coming in at 24% of the business, that holding gives insiders a lot of influence, and plenty of reason to generate value for shareholders. Very encouraging.

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. That's because on our analysis the CEO, Frank Holding, is paid less than the median for similar sized companies. The median total compensation for CEOs of companies similar in size to First Citizens BancShares, with market caps over US$8.0b, is around US$13m.

The CEO of First Citizens BancShares only received US$5.6m in total compensation for the year ending December 2021. That looks like a modest pay packet, and may hint at a certain respect for the interests of shareholders. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of a culture of integrity, in a broader sense.

Should You Add First Citizens BancShares To Your Watchlist?

For growth investors, First Citizens BancShares' raw rate of earnings growth is a beacon in the night. Furthermore, company insiders have been adding to their significant stake in the company. Astute investors will want to keep this stock on watch. We don't want to rain on the parade too much, but we did also find 2 warning signs for First Citizens BancShares that you need to be mindful of.

Keen growth investors love to see insider buying. Thankfully, First Citizens BancShares isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:FCNC.A

First Citizens BancShares

Operates as the holding company for First-Citizens Bank & Trust Company that provides retail and commercial banking services to individuals, businesses, and professionals.

Flawless balance sheet and undervalued.