- United States

- /

- Banks

- /

- NasdaqGS:FCNC.A

Should You Be Adding First Citizens BancShares (NASDAQ:FCNC.A) To Your Watchlist Today?

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in First Citizens BancShares (NASDAQ:FCNC.A). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

Check out our latest analysis for First Citizens BancShares

How Fast Is First Citizens BancShares Growing?

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. It certainly is nice to see that First Citizens BancShares has managed to grow EPS by 21% per year over three years. If the company can sustain that sort of growth, we'd expect shareholders to come away satisfied.

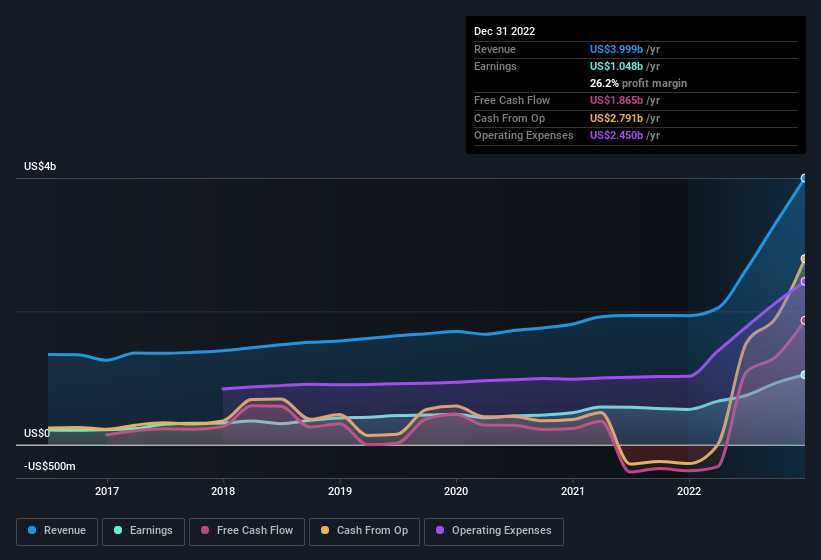

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. Not all of First Citizens BancShares' revenue this year is revenue from operations, so keep in mind the revenue and margin numbers used in this article might not be the best representation of the underlying business. EBIT margins for First Citizens BancShares remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 107% to US$4.0b. That's encouraging news for the company!

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for First Citizens BancShares' future profits.

Are First Citizens BancShares Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Even though some insiders sold down their holdings, their actions speak louder than words with US$301k more invested than sold by people who know they company best. An optimistic sign for those with First Citizens BancShares in their watchlist. We also note that it was the Lead Independent Director, Robert Newcomb, who made the biggest single acquisition, paying US$502k for shares at about US$670 each.

On top of the insider buying, it's good to see that First Citizens BancShares insiders have a valuable investment in the business. Indeed, they have a considerable amount of wealth invested in it, currently valued at US$3.3b. That equates to 23% of the company, making insiders powerful and aligned with other shareholders. So there is opportunity here to invest in a company whose management have tangible incentives to deliver.

While insiders are apparently happy to hold and accumulate shares, that is just part of the big picture. That's because on our analysis the CEO, Frank Holding, is paid less than the median for similar sized companies. The median total compensation for CEOs of companies similar in size to First Citizens BancShares, with market caps over US$8.0b, is around US$13m.

First Citizens BancShares offered total compensation worth US$8.0m to its CEO in the year to December 2022. That is actually below the median for CEO's of similarly sized companies. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Does First Citizens BancShares Deserve A Spot On Your Watchlist?

You can't deny that First Citizens BancShares has grown its earnings per share at a very impressive rate. That's attractive. On top of that, insiders own a significant stake in the company and have been buying more shares. So it's fair to say that this stock may well deserve a spot on your watchlist. However, before you get too excited we've discovered 1 warning sign for First Citizens BancShares that you should be aware of.

Keen growth investors love to see insider buying. Thankfully, First Citizens BancShares isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:FCNC.A

First Citizens BancShares

Operates as the holding company for First-Citizens Bank & Trust Company that provides retail and commercial banking services to individuals, businesses, and professionals.

Flawless balance sheet and undervalued.