- United States

- /

- Banks

- /

- NasdaqGS:FBNC

Assessing First Bancorp (FBNC) Valuation Following G. Adam Currie's Appointment to the Boards

Reviewed by Simply Wall St

First Bancorp (FBNC) has appointed G. Adam Currie, current CEO of First Bank, to the Boards of Directors for both entities. Investors are watching to see how Currie’s leadership might influence future growth and direction.

See our latest analysis for First Bancorp.

Investors appear to be taking notice of First Bancorp’s leadership shakeup, as shown by the stock’s recent momentum. A 5.3% share price return over the past week adds to a strong year-to-date climb of nearly 19%. Over the longer term, total shareholder returns have been solid, with an impressive 81.5% gain over the past five years, hinting at sustained progress as the company focuses on growth and governance improvements.

If you’re interested in what savvy insiders are backing next, now’s a great time to broaden your search and discover fast growing stocks with high insider ownership

With solid returns and new leadership in place, investors are now asking whether First Bancorp is trading below its true value or if the company’s positive outlook is already baked into the stock price. Is there a real buying opportunity here, or has the market fully priced in future growth?

Price-to-Earnings of 21.5x: Is it justified?

First Bancorp is trading at a price-to-earnings (P/E) ratio of 21.5x, which is nearly double the average of its peer group and the broader US Banks industry. This points to a valuation premium at the current price of $51.10.

The price-to-earnings ratio measures what investors are willing to pay today for a dollar of current or future earnings. In banking, this multiple reflects the market’s anticipation of future profitability and growth, as well as risk and sector confidence.

With First Bancorp’s P/E significantly above both the peer average (10.7x) and the US Banks industry average (11x), the market appears to be either pricing in robust future growth or attaching a premium for operational stability and leadership. However, compared to its estimated fair P/E ratio of 15.2x, the stock looks overvalued. This suggests that current optimism may be stretching valuations beyond what fundamentals and historical performance support.

Explore the SWS fair ratio for First Bancorp

Result: Price-to-Earnings of 21.5x (OVERVALUED)

However, ongoing valuation pressures and potential changes in earnings growth rates could quickly challenge the bullish outlook that investors currently have on First Bancorp.

Find out about the key risks to this First Bancorp narrative.

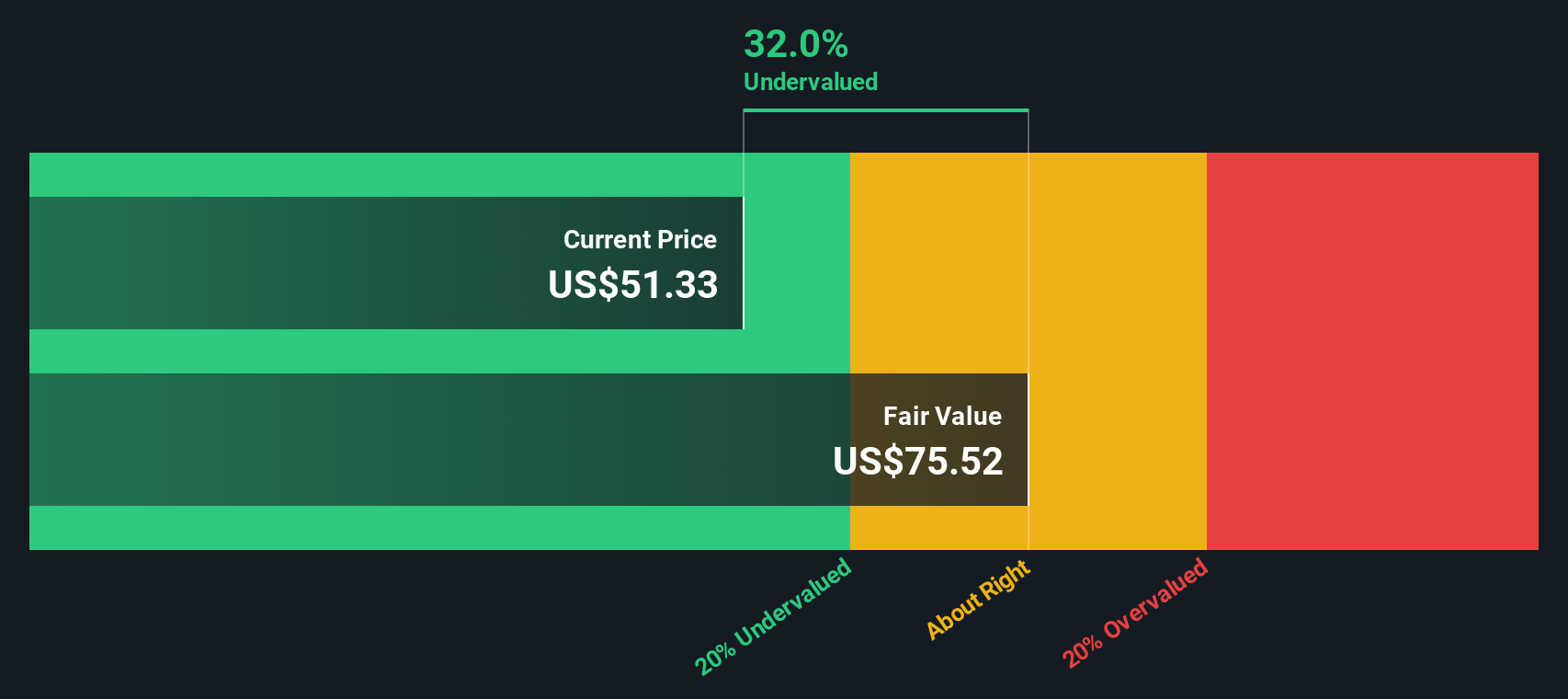

Another View: SWS DCF Model Points to Undervaluation

While the high price-to-earnings ratio suggests First Bancorp is expensive, the SWS DCF model presents a different picture. According to this approach, shares are trading about 39.9% below their estimated fair value of $85.07, which may indicate a potential bargain. Does the market see something the model does not?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out First Bancorp for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 870 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own First Bancorp Narrative

If you have a different perspective or want to see how the numbers stack up for yourself, it’s quick and easy to build your own view of the company, Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding First Bancorp.

Looking for more investment ideas?

Smart investors keep their options open, and some of tomorrow’s biggest opportunities could be in places you haven’t yet considered. Don’t limit your portfolio to just one story. There are exciting prospects waiting.

- Uncover hidden value plays poised for a turnaround by tapping into these 870 undervalued stocks based on cash flows before the broader market catches on.

- Jump on the cutting edge of medicine with these 32 healthcare AI stocks, where innovation and artificial intelligence intersect for next-level potential.

- Boost your income strategy by seeking out these 16 dividend stocks with yields > 3% that offer robust yields and the kind of stability every investor wants.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FBNC

First Bancorp

Operates as the bank holding company for First Bank that provides banking products and services for individuals and businesses.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives