- United States

- /

- Banks

- /

- NasdaqGS:EWBC

If You Had Bought East West Bancorp (NASDAQ:EWBC) Stock A Year Ago, You'd Be Sitting On A 23% Loss, Today

The simplest way to benefit from a rising market is to buy an index fund. But if you buy individual stocks, you can do both better or worse than that. That downside risk was realized by East West Bancorp, Inc. (NASDAQ:EWBC) shareholders over the last year, as the share price declined 23%. That's well bellow the market return of 9.7%. Longer term investors have fared much better, since the share price is up 3.9% in three years. Shareholders have had an even rougher run lately, with the share price down 12% in the last 90 days.

See our latest analysis for East West Bancorp

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Even though the East West Bancorp share price is down over the year, its EPS actually improved. It's quite possible that growth expectations may have been unreasonable in the past.

It's surprising to see the share price fall so much, despite the improved EPS. So it's easy to justify a look at some other metrics.

East West Bancorp managed to grow revenue over the last year, which is usually a real positive. Since the fundamental metrics don't readily explain the share price drop, there might be an opportunity if the market has overreacted.

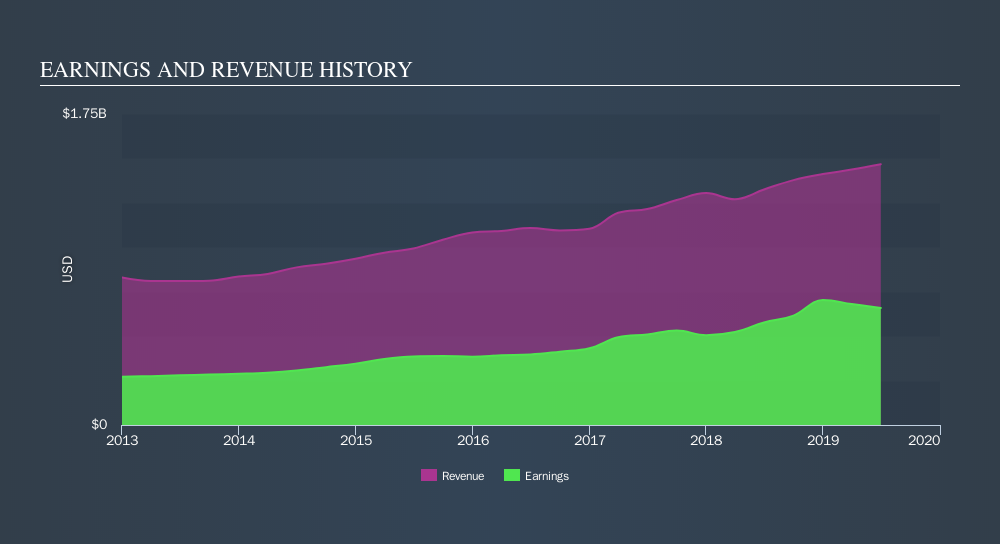

The image below shows how earnings and revenue have tracked over time.

It's good to see that there was some significant insider buying in the last three months. That's a positive. That said, we think earnings and revenue growth trends are even more important factors to consider. So we recommend checking out this free report showing consensus forecasts

What about the Total Shareholder Return (TSR)?

We've already covered East West Bancorp's share price action, but we should also mention its total shareholder return (TSR). Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Dividends have been really beneficial for East West Bancorp shareholders, and that cash payout explains why its total shareholder loss of 22%, over the last year, isn't as bad as the share price return.

A Different Perspective

While the broader market gained around 9.7% in the last year, East West Bancorp shareholders lost 22% (even including dividends) . Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Longer term investors wouldn't be so upset, since they would have made 5.4%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. It is all well and good that insiders have been buying shares, but we suggest you check here to see what price insiders were buying at.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqGS:EWBC

East West Bancorp

Operates as the bank holding company for East West Bank that provides a range of personal and commercial banking services to businesses and individuals in the United States.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives