- United States

- /

- Banks

- /

- NasdaqGS:EWBC

East West Bancorp (EWBC) Profit Margin Rises to 49.1%, Reinforcing Bullish Narratives

Reviewed by Simply Wall St

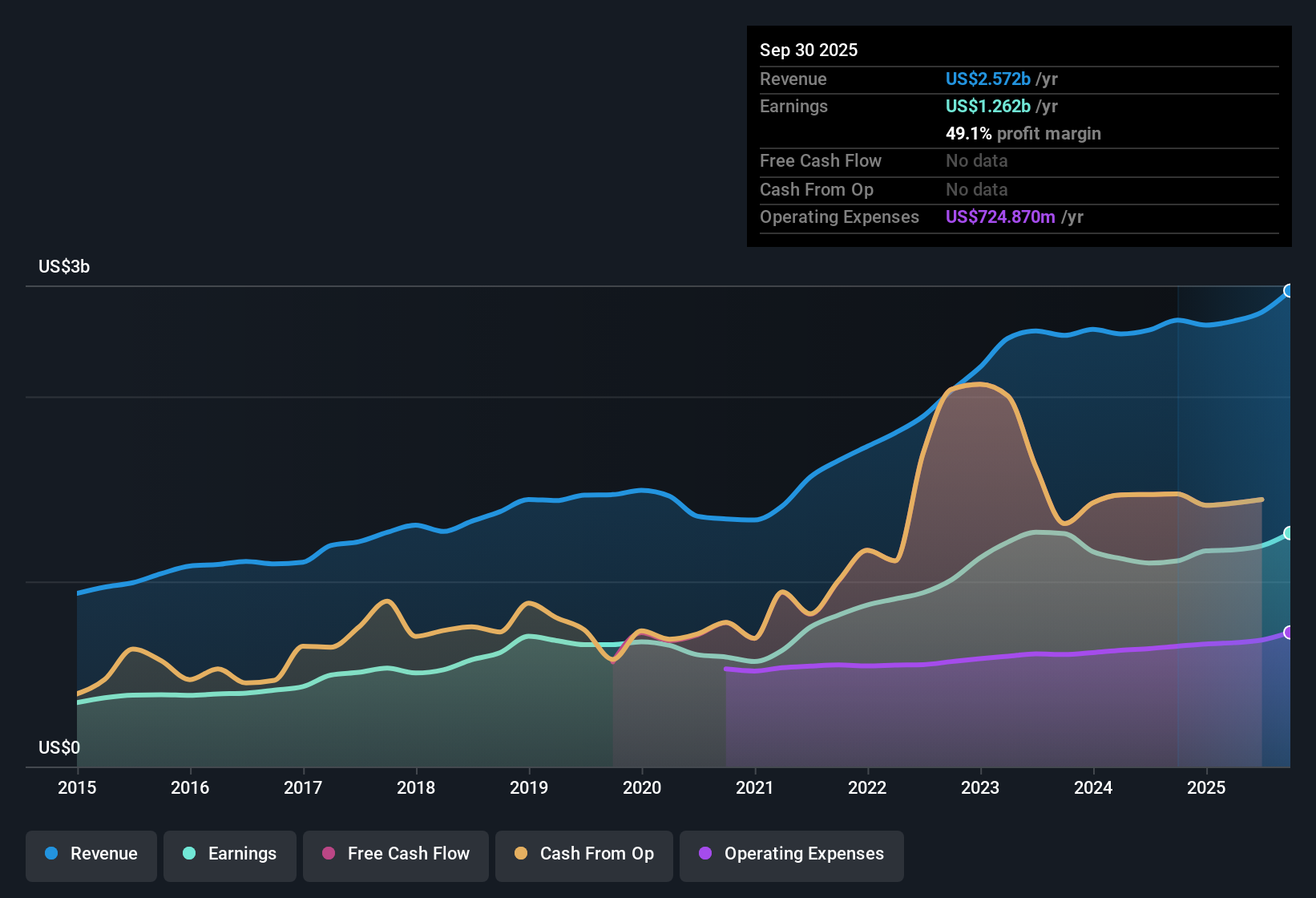

East West Bancorp (EWBC) reported earnings growth of 13.6% in the most recent year, beating its five-year average of 12.6% per year. The bank’s net profit margin rose to 49.1%, up from last year’s 46.1%. With an 11.2x Price-To-Earnings Ratio, the stock trades below both analyst targets and its discounted cash flow estimate of $232.03. The company also maintains attractive dividends and high-quality earnings. For investors, the steady profit growth, improved margins, strong valuation, and minimal risk profile position the company as a capital-efficient and well-managed contender in today’s market.

See our full analysis for East West Bancorp.Next up, we’ll see how the latest results measure against the broader narratives followed by market watchers, and where the conversation might shift.

See what the community is saying about East West Bancorp

Profit Margins Stand Firm at 49.1%

- East West Bancorp posted a net profit margin of 49.1%, rising from last year’s 46.1%. This places the bank at the upper end of sector profitability even as revenue growth is forecast to slow relative to the broader US market.

- According to the analysts' consensus view, several factors support this margin strength:

- Diversified fee income and steady deposit growth from East West’s core Asian-American customer base are cited as key reasons. These factors allow strong capital levels and loan funding despite rising compliance costs.

- Continued investments in digital banking and balanced lending between commercial and residential segments help maintain high efficiency, reinforcing long-term confidence in profitability and earnings resilience against sector pressures.

What happens to these high margins if compliance costs rise or sector competition intensifies? Find out what analysts expect next. 📊 Read the full East West Bancorp Consensus Narrative.

Revenue Growth Lags Broader Market

- Expected annual revenue growth of 8.6% for East West Bancorp falls short of the 10.1% pace predicted for the US market over the same period. This suggests that top-line momentum is solid but not industry leading.

- The analysts' consensus narrative puts this slower growth into perspective:

- While the bank’s expertise in cross-border banking and loyal customer base continues to drive loan and deposit activity, heavy reliance on commercial real estate and regional exposures may pose challenges if US-China sentiment or West Coast property markets decline.

- At the same time, ongoing digital upgrades and product diversification are meant to protect the bank’s market position. However, a sharp increase in fintech competition or shifts in customer preferences could make achieving industry-level growth more difficult.

Valuation Discount Versus Industry Benchmarks

- Shares trade at $102.36, which is below both the $125.40 consensus analyst price target and the $232.03 DCF fair value estimate. The 11.2x Price-To-Earnings ratio is also beneath the sector multiple of 11.9x and future implied PE assumptions.

- From the perspective of the analysts' consensus narrative:

- Valuation is supported by the company’s high-quality earnings, with the discounted share price and attractive dividends suggesting upside if the bank achieves forecasted earnings and margin targets.

- However, analysts note that future growth would need to surpass the bank’s 5.8% earnings CAGR forecast, which is below the US market’s 15.5%, to fully close the valuation gap. This leaves open the question of whether the margin of safety compensates for lower expected topline and profit growth.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for East West Bancorp on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Wondering if the figures tell a different story? Share your insights and shape your narrative in just minutes. Do it your way

A great starting point for your East West Bancorp research is our analysis highlighting 6 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

While East West Bancorp maintains strong profitability, its slower revenue and earnings growth means it may underperform faster-growing peers in the years ahead.

If you want to focus on companies with established track records of robust and consistent expansion, consider our stable growth stocks screener (2094 results) for alternatives built on steady momentum.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if East West Bancorp might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EWBC

East West Bancorp

Operates as the bank holding company for East West Bank that provides a range of personal and commercial banking services to businesses and individuals in the United States.

Very undervalued with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives