- United States

- /

- Banks

- /

- NasdaqCM:ESQ

Esquire Financial Holdings (ESQ) Net Profit Margin Surpasses Peers, Reinforcing Quality Narrative

Reviewed by Simply Wall St

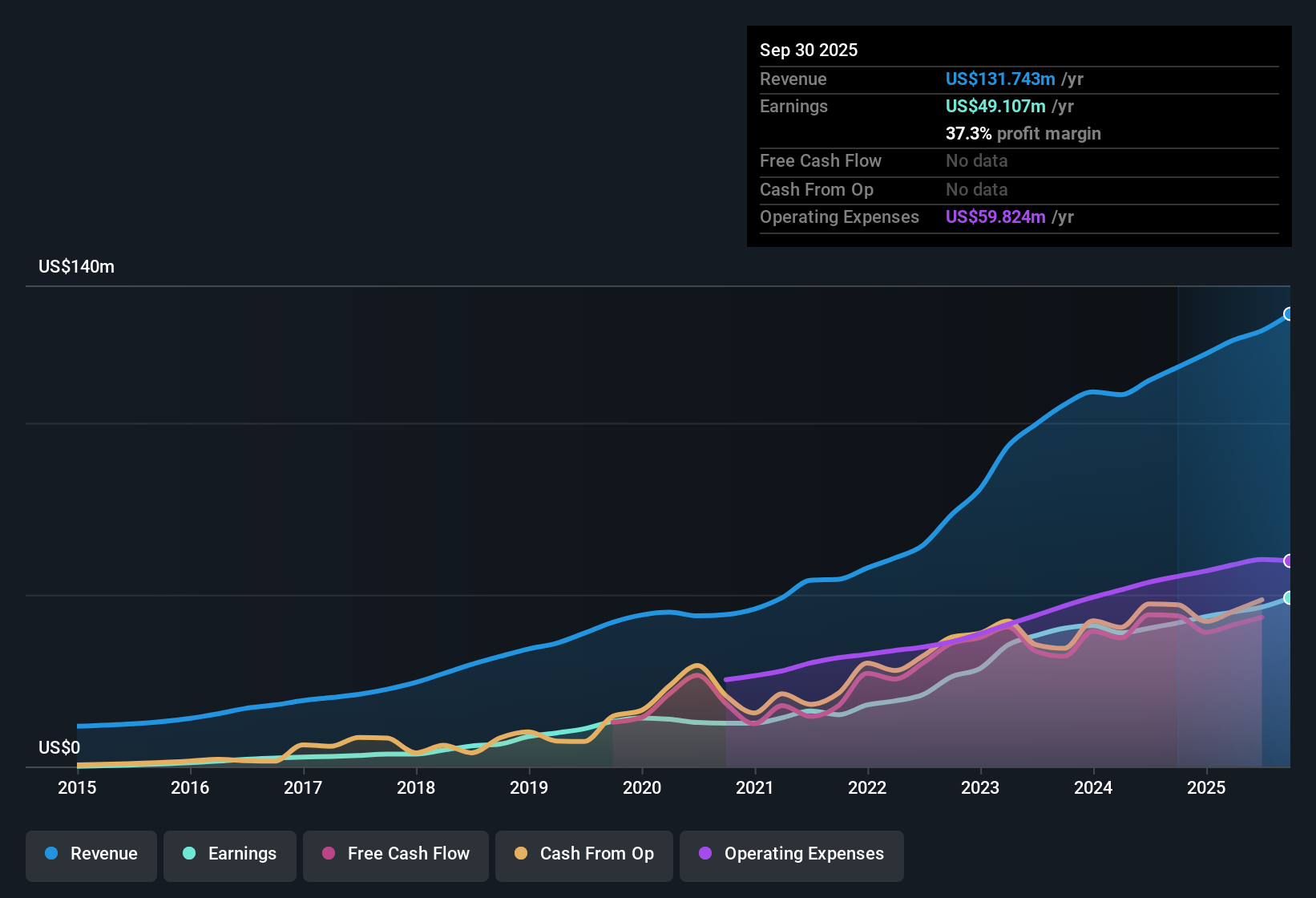

Esquire Financial Holdings (ESQ) delivered a net profit margin of 36.6%, up from 35.8% a year ago, and reported 15.3% earnings growth over the past year. Impressively, the company has recorded a five-year annualized earnings growth rate of 27.6%, reflecting a consistent expansion in profits. With these results, ESQ demonstrates not only high-quality earnings but also a robust track record of profit growth, although the latest gains come in slightly below its longer-term averages.

See our full analysis for Esquire Financial Holdings.Next, we will measure these earnings results against the latest narratives circulating in the market to see which storylines hold up and which may need a rethink.

Curious how numbers become stories that shape markets? Explore Community Narratives

Net Profit Margins Outpace Peers

- Esquire Financial Holdings posted a net profit margin of 36.6%, meaning it captures more profit from each dollar of revenue than most competitors. This margin is not only up from 35.8% last year but also stands out versus the broader US Banks industry.

- Focusing on the company’s sustained profitability, the analysis emphasizes that margins above peers reinforce ESQ’s reputation for prudent risk management and conservative growth.

- Compared to the US Banks industry average margin, ESQ’s 36.6% reflects disciplined expense control, which supports its appeal as a stable, steady bank to those seeking resilience in volatile markets.

- The company’s trend of consistent high-quality earnings signals a differentiated business model, especially as sector stress has made robust margins a rarity among mid-sized banks.

Pace of Growth Settles Below Long-Term Trends

- This year’s earnings grew by 15.3%, which, while healthy, lags behind the impressive five-year annualized growth average of 27.6%. This indicates that the most recent expansion has slowed when compared to ESQ’s longer-term run rate.

- Analysts reviewing these trends note that although growth remains steady, some may question if the rate is peaking.

- The five-year annualized rate of 27.6% still demonstrates rare consistency, but the step down to 15.3% suggests future gains may depend on new initiatives or market dynamics, instead of riding the same drivers as before.

- Unlike some high-flying banks that saw steep drop-offs or reversals, ESQ continues to grow, but investors might wonder if the company can reignite double-digit expansion above industry norms again in coming years.

Premium Valuation Versus Peers, But Below DCF Fair Value

- ESQ trades at a Price-To-Earnings ratio of 17.9x, materially higher than the US Banks industry average of 11.3x and peer average of 8.8x. Yet, the current share price of $102.50 is well below its DCF fair value estimate of $162.32.

- This gap puts a spotlight on valuation tensions, with prevailing market analysis highlighting both upside and caution.

- On the one hand, the high P/E reflects investor confidence in ESQ’s quality and profit profile, justifying a premium to slower-growing or less consistent peers, but also raising the hurdle for future returns.

- On the other, trading below DCF fair value hints at possible undervaluation, suggesting investors willing to bet on the underlying fundamentals may see more upside if margins and growth are sustained.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Esquire Financial Holdings's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

While Esquire Financial Holdings continues to grow and delivers above-average margins, recent earnings growth has cooled noticeably below its stellar longer-term trend.

If dependable performance is your top priority, use our stable growth stocks screener (2089 results) to discover companies consistently delivering steady revenue and earnings growth through changing market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Esquire Financial Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:ESQ

Esquire Financial Holdings

Operates as the bank holding company for Esquire Bank, National Association that provides commercial banking products and services to legal and small businesses, and commercial and retail customers in the United States.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives