- United States

- /

- Banks

- /

- NasdaqGS:EFSC

Enterprise Financial Services (EFSC): Profit Margin Slightly Down, Undervalued Status Fuels Investor Bullishness

Reviewed by Simply Wall St

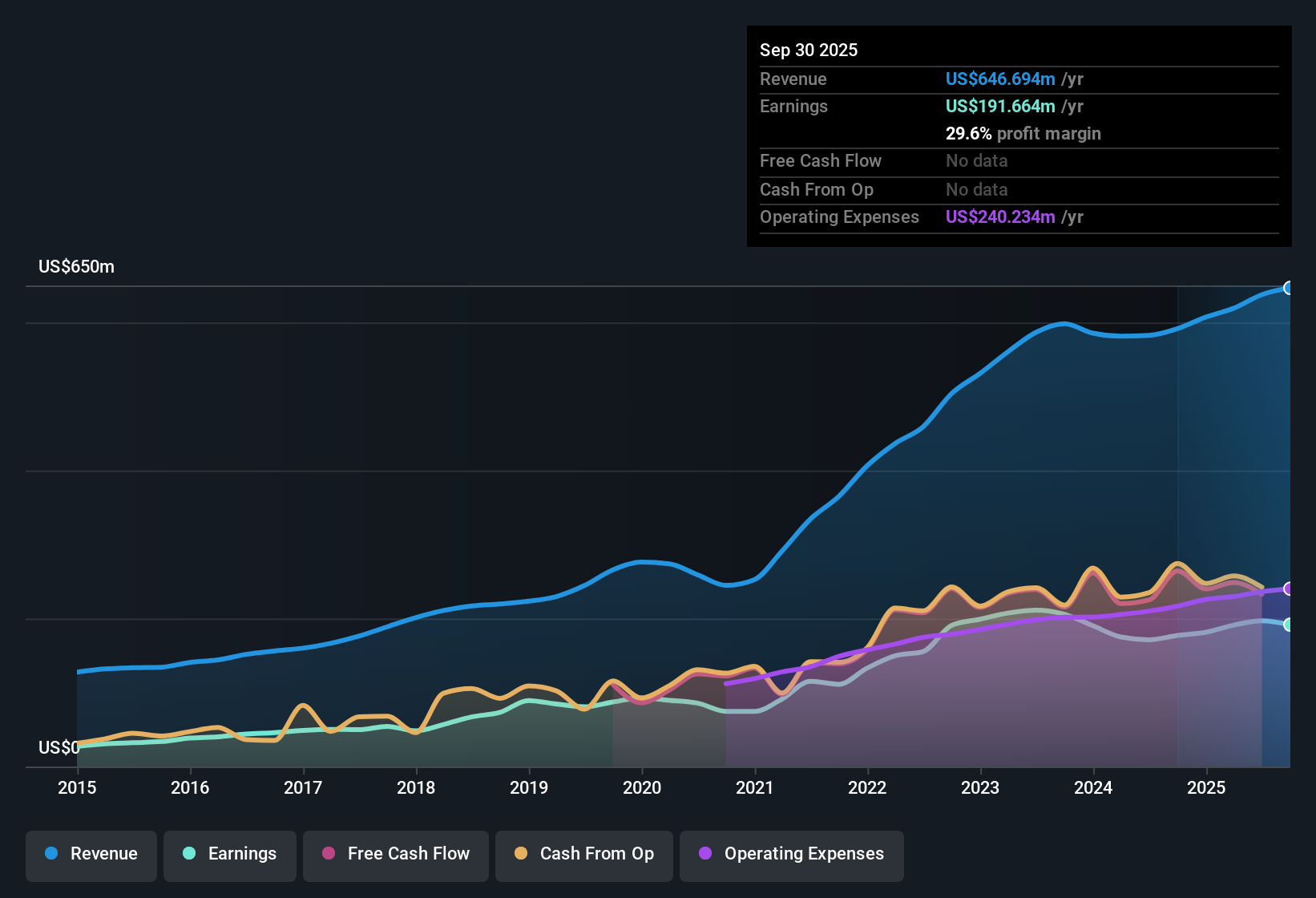

Enterprise Financial Services (EFSC) reported average annual earnings growth of 14% over the past five years, with current year-over-year earnings growth at 8.2%. The company’s net profit margin came in at 28.3%, slightly below last year’s 30%. While revenue is forecast to grow 7.1% per year, this lags the broader US market’s 10.1% expectation. Shares are trading at $53.95, which is well below the estimated fair value of $107.27. The Price-to-Earnings ratio of 10.4x is lower than that of industry peers, leading investors to find the valuation compelling, especially with an attractive dividend and no material risks identified in the latest summary.

See our full analysis for Enterprise Financial Services.Now, let’s see how these earnings results measure up against the key narratives that drive sentiment and long-term expectations for Enterprise Financial Services.

See what the community is saying about Enterprise Financial Services

Margins Poised for Shrinkage

- Analysts expect profit margins to contract from 30.9% today to just 24.1% in three years, a substantial decline that may weigh on future earnings even as revenue trends positive.

- According to the analysts' consensus view, ongoing investments in digital channels and operational efficiency are seen as the levers that could help offset margin pressure by lowering cost-to-serve. However, this optimism is tested by

- rising compliance and technology expenses that could counteract intended savings from operational improvements, and

- whether customer acquisition through new digital initiatives will be sufficient to sustain or grow the topline given a tougher margin environment.

- The consensus narrative underlines that, if margin compression accelerates faster than topline growth can compensate, the company's strong profit history may be at risk of eroding, not just softening.

- Consensus expects that these competing forces will define whether Enterprise Financial Services can remain ahead of peers in profitability in the coming cycle.

- This tug-of-war makes margin guidance a critical figure for investors to track in upcoming reports.

Consensus sees the latest margin guidance as pivotal for the growth-vs-cost debate that could shift sentiment on Enterprise Financial Services. 📊 Read the full Enterprise Financial Services Consensus Narrative.

Peer P/E Discount Supports Valuation

- The current Price-to-Earnings ratio of 10.4x is well below both the US Banks industry average of 11.2x and the peer average of 22.6x, with shares trading at $53.95. This is nearly 50% beneath the DCF fair value of $107.27, pointing to potentially significant undervaluation by standard metrics.

- Analysts' consensus narrative suggests this valuation discount heavily supports the case for Enterprise Financial Services to outperform, as

- analysts see upside if earnings quality and stable dividends persist, especially when few material risks have been flagged, and

- the combination of a low P/E, robust margin history, and dividend strength attract value-focused investors who believe the market is underpricing stability in an uncertain sector backdrop.

Growth Lags US Market Outlook

- While revenue is forecast to grow 7.1% annually and earnings 4.9% per year, these trends trail the broader US market forecasts of 10.1% and 15.6%, respectively.

- The consensus narrative points out that slower top-line and earnings growth imply that, even with strong operational execution and risk controls, capturing market-level returns may be difficult unless efficiencies or catalysts unlock faster expansion. These could include

- new digital products, regional expansion initiatives in the Sunbelt and Midwest, or

- gains from industry consolidation that give Enterprise Financial Services an edge in customer acquisition and cross-selling.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Enterprise Financial Services on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different take on the data? Share your own interpretation by building a personal narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 6 key rewards investors are optimistic about regarding Enterprise Financial Services.

See What Else Is Out There

Enterprise Financial Services' projected revenue and earnings growth rates trail the broader US market. This raises concerns about its ability to deliver top-tier returns.

If consistent expansion matters to you, consider companies with stable, long-term growth by searching through stable growth stocks screener (2115 results) right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Enterprise Financial Services might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EFSC

Enterprise Financial Services

Operates as the financial holding company for Enterprise Bank & Trust that offers banking and wealth management services to individuals and corporate customers in Arizona, California, Florida, Kansas, Missouri, Nevada, and New Mexico.

Very undervalued with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives