- United States

- /

- Banks

- /

- NasdaqCM:ECBK

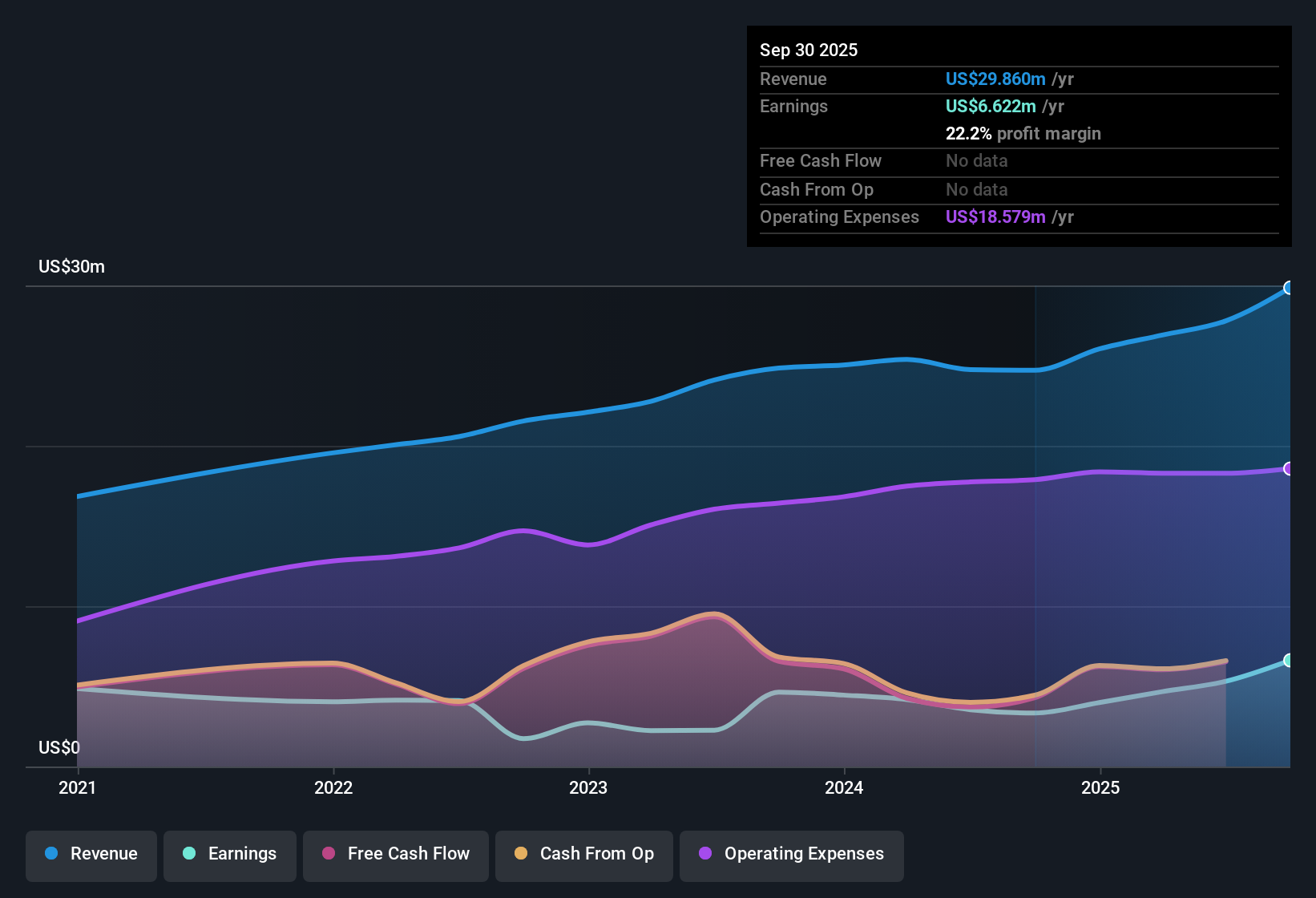

ECB Bancorp (ECBK) Profit Margin Jumps to 22.2%, Reinforcing Bullish Community Narratives

Reviewed by Simply Wall St

ECB Bancorp (ECBK) delivered robust earnings growth, with profits rising by 8.3% per year over the past five years. Net profit margin reached 22.2%, a marked improvement over last year’s 13.5%. Earnings growth in the past year soared to 98.6%, which is well above the company’s five-year average. Investors are sizing up this high-quality earnings performance against a relatively high Price-to-Earnings Ratio of 21.5x. This figure stands well above industry averages and could shape sentiment going forward.

See our full analysis for ECB Bancorp.Next, we’ll see how these headline numbers stack up against the most widely held narratives. Sometimes they confirm expectations, and sometimes they reveal a different story entirely.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margins Outpace Last Year

- Net profit margin rose to 22.2%, up sharply from the prior year's 13.5%. This indicates stronger profitability beyond just headline growth.

- The rapid margin improvement bolsters the case that ECBK's management is focused on efficient operations and may justify investor optimism about profitability durability.

- Margin expansion is one of the main features that risk-averse investors look for when share price multiples are above average, since it suggests core business strength rather than one-off gains.

- This improvement fits the view that stability and prudent management can command a premium, even when the industry faces pressure.

Five-Year Profit Growth Holds Steady

- Profits expanded by an average of 8.3% per year over the past five years, indicating consistent long-term strength rather than a short-lived surge.

- Investors who value steady compounding over fast, unpredictable swings will find that this track record supports positioning ECBK as a more defensive “sleep well at night” stock.

- The absence of big earnings drops or volatility means the investment case relies on gradual, reliable gains as opposed to risky bets.

- In a sector often rocked by regulation and credit cycles, such stability stands out and tends to attract cautious capital.

Valuation Premium Signals High Expectations

- ECBK trades at a Price-to-Earnings Ratio of 21.5x, noticeably above both its peer average of 11.8x and the US Banks industry average of 11.3x.

- The elevated valuation reflects how the market weighs recent quality growth and profit gains against limited excitement for aggressive expansion.

- Sustaining such a premium typically requires ongoing margin strength or a new growth narrative, or else the stock risks sliding if future reports disappoint.

- Investors should track whether performance continues to warrant this higher multiple or if sector sentiment catches up and narrows the gap.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on ECB Bancorp's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Although ECBK’s earnings and profit margins are impressive, its high valuation multiples mean investors face the risk of overpaying if growth momentum slows.

To reduce that risk, check out these 875 undervalued stocks based on cash flows and discover companies that could offer stronger value without the premium price tag.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if ECB Bancorp might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:ECBK

ECB Bancorp

ECB Bancorp, Inc. operating as a holding company for Everett Co-operative Bank that provides various banking products and services.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives