Stock Analysis

- United States

- /

- Banks

- /

- NasdaqGS:EBTC

Top Three Dividend Stocks For July 2024

Reviewed by Simply Wall St

As global markets exhibit a notably broad advance with small-caps leading the way and consumer prices in the U.S. falling for the first time in four years, investors might find this an opportune moment to consider stable income-generating assets. In this context, dividend stocks stand out as potentially attractive options, offering regular income which could be particularly appealing amidst current economic dynamics and market trends.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Allianz (XTRA:ALV) | 5.24% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 5.10% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 3.66% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 7.02% | ★★★★★★ |

| Globeride (TSE:7990) | 3.83% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.50% | ★★★★★★ |

| James Latham (AIM:LTHM) | 5.94% | ★★★★★★ |

| Kwong Lung Enterprise (TPEX:8916) | 5.81% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.52% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.46% | ★★★★★★ |

Click here to see the full list of 1974 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Virginia National Bankshares (NasdaqCM:VABK)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Virginia National Bankshares Corporation, with a market cap of approximately $185.24 million, serves as the holding company for Virginia National Bank, offering various commercial and retail banking services.

Operations: Virginia National Bankshares Corporation generates revenue through its segments, with the bank contributing $52.43 million, Masonry Capital adding $1.04 million, and VNB Trust & Estate Services providing $1.07 million.

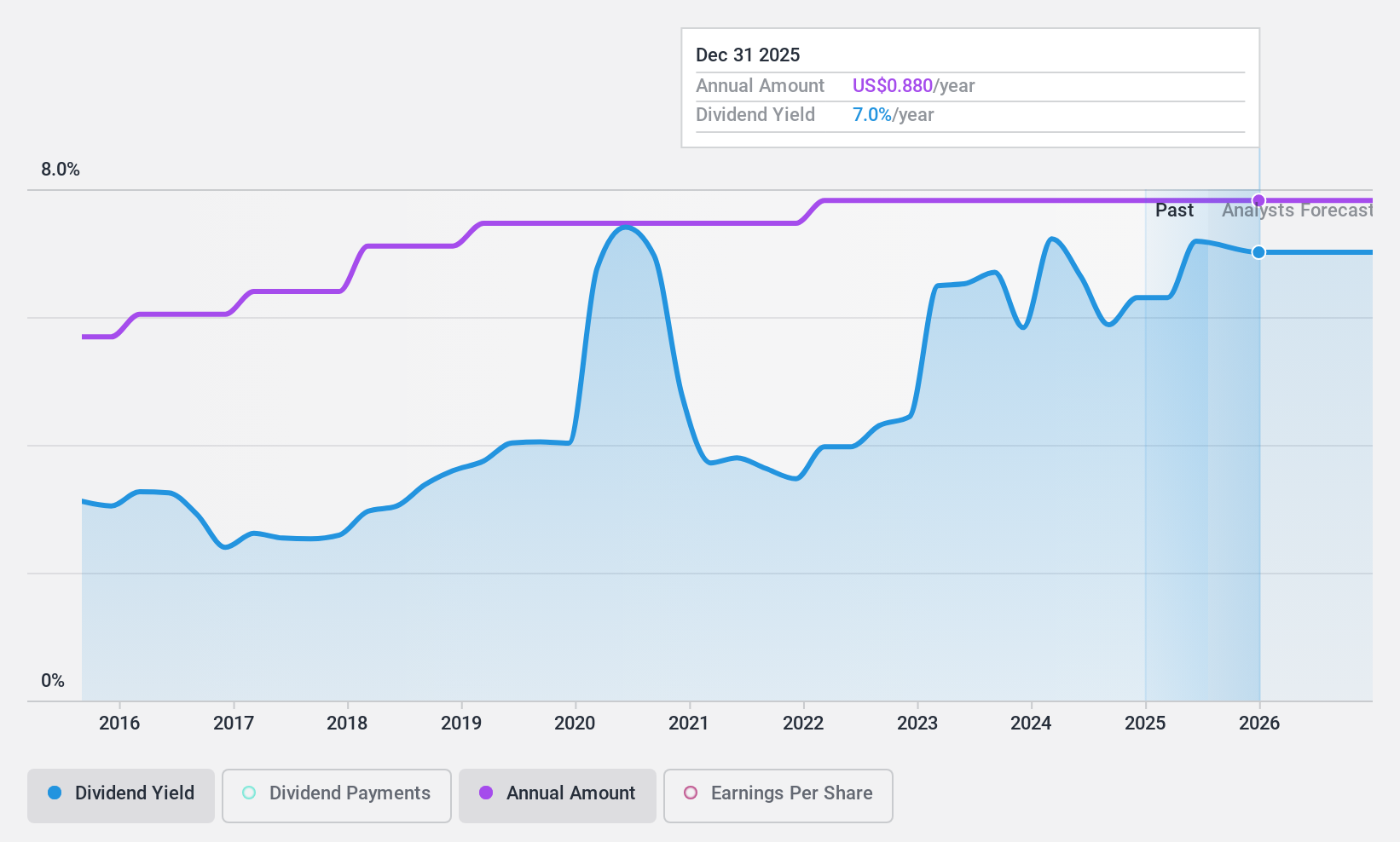

Dividend Yield: 3.5%

Virginia National Bankshares recently affirmed a quarterly cash dividend of US$0.33 per share, maintaining its consistent dividend history. Despite a lower yield of 3.52% compared to the top quartile in the US market at 4.54%, the company's dividends are well-covered by earnings with a payout ratio of 41.4%. However, recent financials show a decline in net interest income and net income year-over-year, raising concerns about sustained profitability and future dividend coverage without more comprehensive data on long-term earnings stability.

- Click here and access our complete dividend analysis report to understand the dynamics of Virginia National Bankshares.

- Upon reviewing our latest valuation report, Virginia National Bankshares' share price might be too optimistic.

Enterprise Bancorp (NasdaqGS:EBTC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Enterprise Bancorp, Inc., serving as the holding company for Enterprise Bank and Trust Company, offers a range of commercial banking products and services with a market capitalization of approximately $325.01 million.

Operations: Enterprise Bancorp, Inc. generates its revenue primarily through commercial banking activities, totaling approximately $159.52 million.

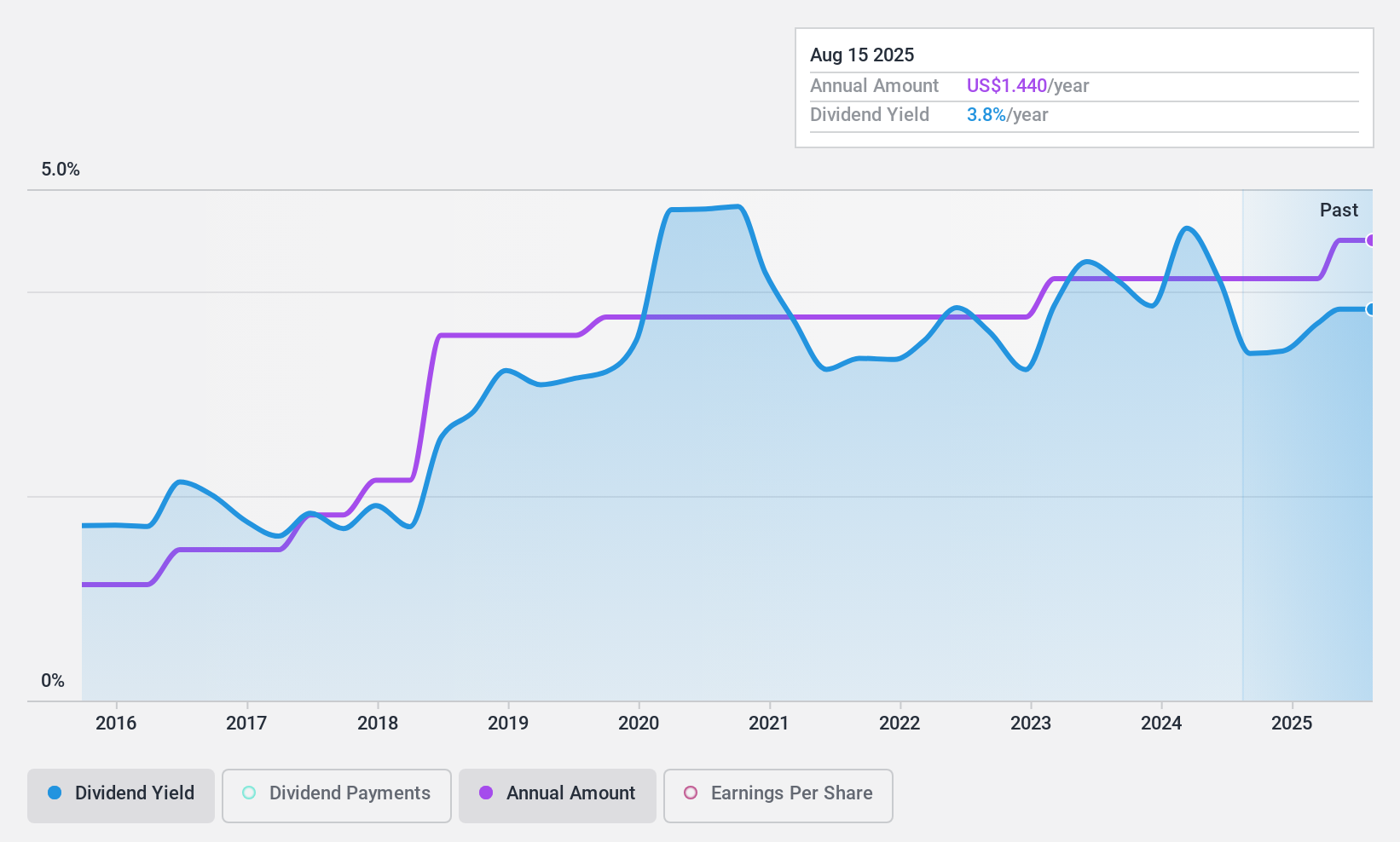

Dividend Yield: 3.4%

Enterprise Bancorp recently declared a quarterly dividend of US$0.24 per share, underscoring its ten-year track record of stable and growing dividends, despite a yield of 3.39% that lags behind the top quartile's 4.54%. The dividend is well-supported by a modest payout ratio of 31.8%, indicating sound financial management. However, recent executive changes with the retirement of CEO John P. Clancy Jr., and appointment of Steven R. Larochelle could signal shifts in strategic direction, potentially impacting future dividends and company stability.

- Dive into the specifics of Enterprise Bancorp here with our thorough dividend report.

- The analysis detailed in our Enterprise Bancorp valuation report hints at an deflated share price compared to its estimated value.

Flushing Financial (NasdaqGS:FFIC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Flushing Financial Corporation, serving as the bank holding company for Flushing Bank, offers banking products and services to consumers, businesses, and governmental units with a market cap of approximately $422.37 million.

Operations: Flushing Financial Corporation generates its revenue primarily through its Community Bank segment, which posted earnings of $191.50 million.

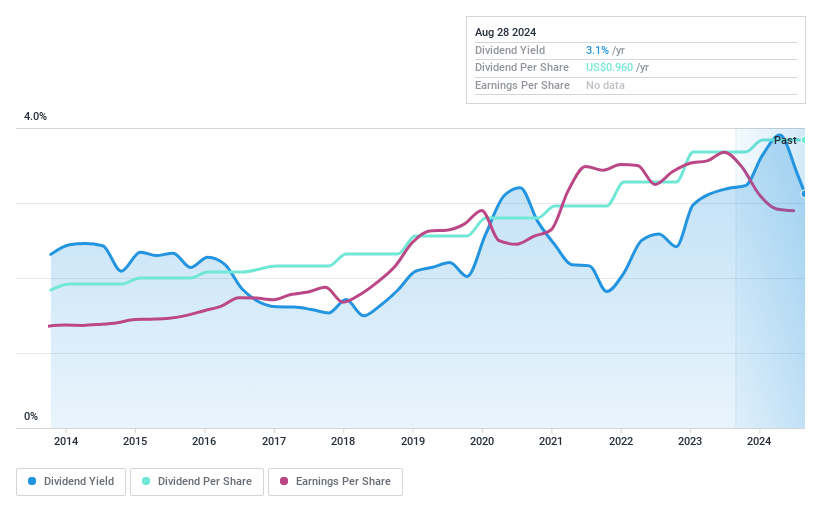

Dividend Yield: 5.8%

Flushing Financial, with a dividend yield in the top 25% of US market payers, recently affirmed a quarterly dividend of US$0.22 per share. Despite its attractive yield and a decade-long history of reliable dividends, the company's high payout ratio at 92.6% raises concerns about sustainability. Recent inclusion in the Russell 2000 Dynamic Index could boost investor interest, yet earnings have dipped with net income falling to US$3.68 million from US$4.04 million last year, indicating potential pressure on future payouts.

- Navigate through the intricacies of Flushing Financial with our comprehensive dividend report here.

- Insights from our recent valuation report point to the potential overvaluation of Flushing Financial shares in the market.

Seize The Opportunity

- Discover the full array of 1974 Top Dividend Stocks right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Enterprise Bancorp is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:EBTC

Enterprise Bancorp

Operates as the holding company for Enterprise Bank and Trust Company that engages in the provision of commercial banking products and services.

Flawless balance sheet, good value and pays a dividend.