- United States

- /

- Banks

- /

- NasdaqGM:EBMT

Eagle Bancorp Montana (EBMT) Profit Margins Surge, Challenging Defensive Income Narrative

Reviewed by Simply Wall St

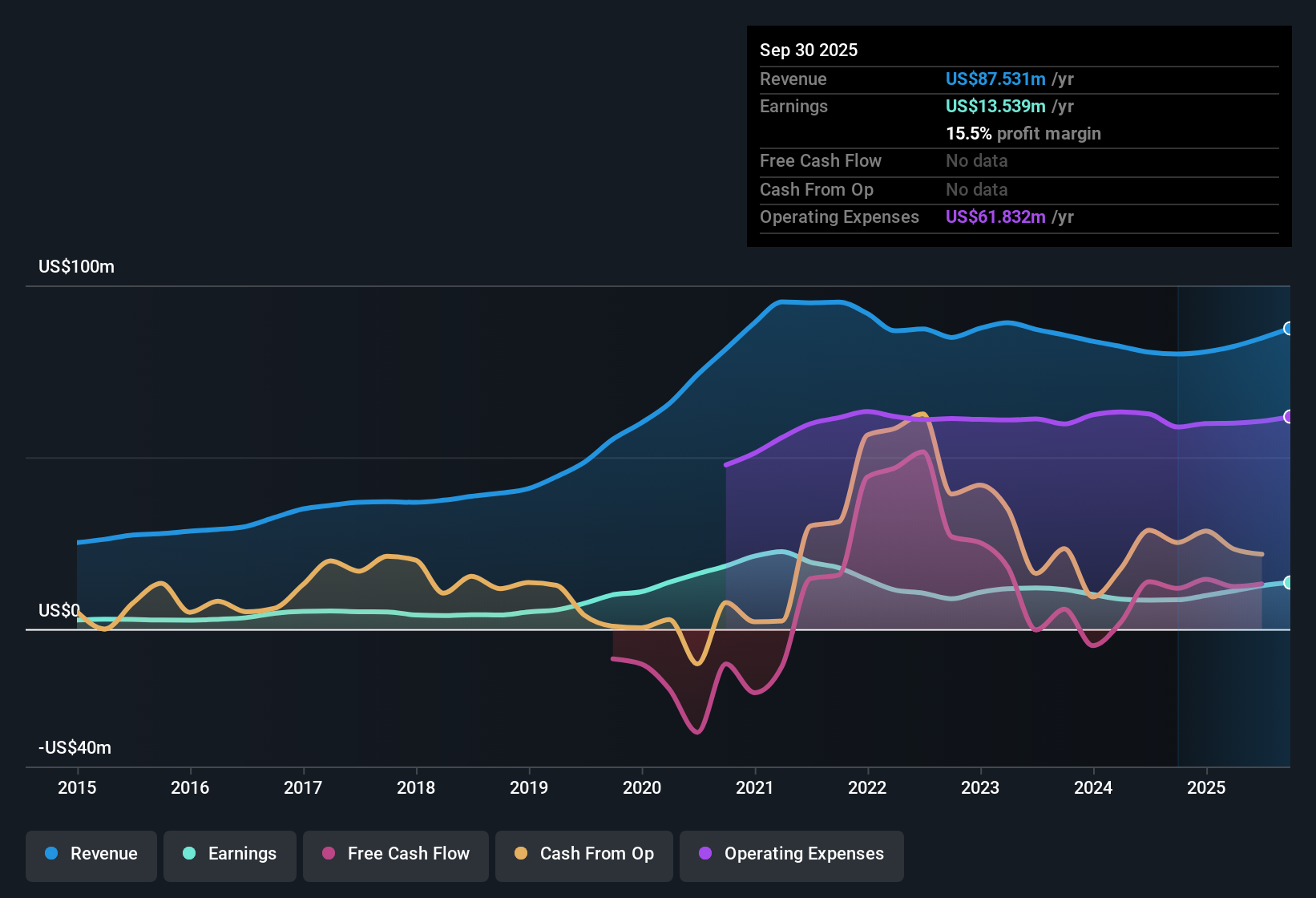

Eagle Bancorp Montana (EBMT) delivered a notable jump in performance this quarter, with net profit margins climbing to 15.5% from 10.6% last year and annual earnings growth soaring to 59.1%. While forward estimates point to annual earnings expansion of 9.13%, revenue is forecast to dip by 3.3% per year over the next three years. Shares currently trade at $16.04, below estimated fair value on a discounted cash flow basis. With profit momentum, improved margins, and a price-to-earnings ratio of 9.2x compared to peer averages above 11x, investors are weighing the company’s positive trends in margins and valuation against a more challenging revenue outlook.

See our full analysis for Eagle Bancorp Montana.The next step is seeing how these headline results stack up against the common market narratives. Investors may also consider whether the recent momentum matches or defies the prevailing expectations.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margins Outpace Historical Trends

- Net profit margins reached 15.5%, a clear improvement compared to the five-year average annual earnings decline of 15%. This shows that profitability is now moving in the opposite direction of its longer-term track record.

- The prevailing narrative highlights EBMT’s shift toward stronger, higher-quality earnings, in part due to these margin gains.

- Steadier profit signals support the idea that the company is better positioned financially than it has been in the past.

- Expectations for future earnings growth remain modest at 9.13% annually, indicating that further outperformance may be less dramatic going forward.

Revenue Guidance Points to a Slower Lane

- Revenue is projected to decline 3.3% per year over the next three years, even with the recent acceleration in profit growth.

- The market’s focus on EBMT as a “safe haven” with defensive income stands out, especially as

- management’s forecasts call for shrinking sales,

- so while profit momentum is encouraging at present, investors anticipating long-range growth may need to reset expectations if revenue trends persist.

Relative Valuation Suggests Room for Re-Rate

- Shares are trading at a price-to-earnings ratio of 9.2x compared to peer and industry averages above 11x, and below the estimated DCF fair value of $17.34. This flags a potential undervaluation.

- The case for yield-seeking investors is supported by this discount alongside steady dividends,

- but muted expectations for revenue growth temper excitement about a sharp re-rating. This suggests the valuation gap may not close quickly unless business momentum improves.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Eagle Bancorp Montana's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite EBMT’s profit margin gains, the company faces declining revenue projections. This factor may limit consistent long-term growth for investors seeking stability.

If you want steadier potential, consider stable growth stocks screener (2121 results) to spot companies with a proven track record of reliable earnings and revenue expansion through various market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eagle Bancorp Montana might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:EBMT

Eagle Bancorp Montana

Operates as the bank holding company for Opportunity Bank of Montana that provides various banking products and services to small businesses and individuals in Montana.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives