- United States

- /

- Banks

- /

- NasdaqCM:CZNC

Citizens & Northern (CZNC) Margin Expansion Reinforces Bullish Sentiment on Profit Quality

Reviewed by Simply Wall St

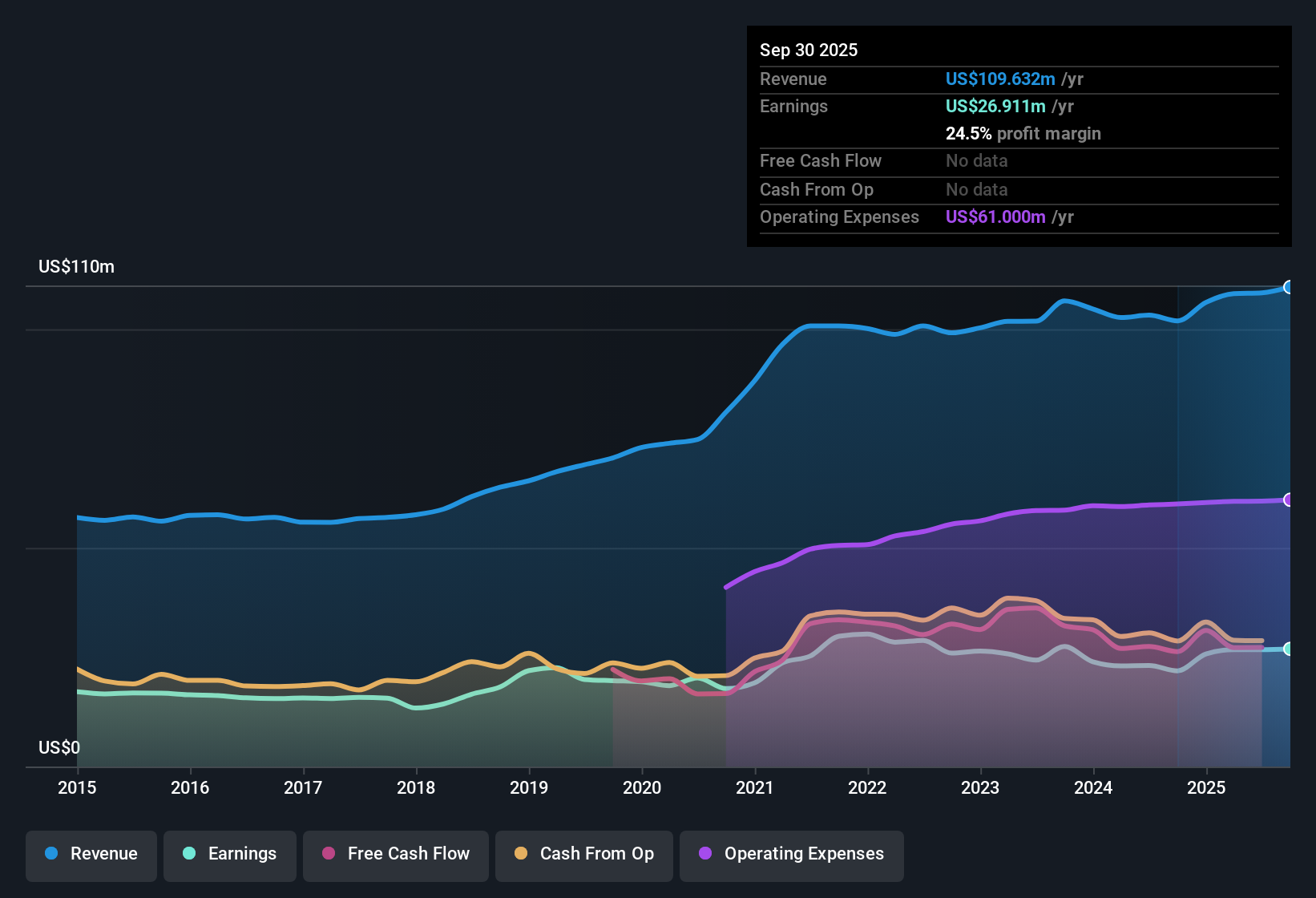

Citizens & Northern (CZNC) posted another solid set of numbers, with earnings climbing 23% over the past year and averaging 1.4% annual growth over the last five years. Net profit margin rose to 24.5%, up from 21.5% a year ago, which underscores consistent improvements in profitability. With earnings forecast to accelerate at 29.9% per year and no major risks flagged in the latest disclosure, investors have plenty of reasons to keep their eyes on the company’s upward momentum.

See our full analysis for Citizens & Northern.Next, we will see how these headline numbers stack up against the narratives shaping sentiment among investors and analysts alike.

Curious how numbers become stories that shape markets? Explore Community Narratives

Guidance Outpaces Market Averages

- Earnings at Citizens & Northern are projected to grow 29.9% per year, far above the US market’s average expectation of 15.5% annual growth.

- This outsized growth forecast heavily supports the bullish case that the bank is carving out a place as a leader among regional players.

- Market watchers highlight that such a sustained forecast signals management’s confidence in their business model, especially when most direct peers see lower growth projections.

- This kind of guidance, paired with margin improvement, is exactly what bullish investors are searching for despite only moderate top-line revenue growth at 6.2% versus the 10% US market average.

Margins Climb as Profitability Grows

- The net profit margin jumped to 24.5% from last year’s 21.5%, reflecting an uptick in profitability even as the US banking sector faces margin pressure.

- What is surprising is that, according to the prevailing market view, the company’s improved earnings quality and rising profit margins make it stand out among smaller banks.

- Analysts note that most regional banks are struggling to keep margins steady. Yet Citizens & Northern’s margin expansion adds weight to the idea of it being a defensible and reliable pick in a shifting landscape.

- This shift in profitability underpins growing investor interest in “steady dividend payers” despite sector-wide caution around asset quality challenges for banks of this size.

Valuation Offers Discount to Peers

- Citizens & Northern trades at a Price-To-Earnings ratio of 11.2x compared to a peer average of 11.8x, and its share price of $19.47 is below the DCF fair value estimate of $33.33.

- Investors focused on value argue that this discount, paired with attractive dividends and robust profit margins, creates an appealing entry point.

- Strong earnings growth projections reinforce the case that the current valuation undervalues future potential, while the lack of flagged risks adds comfort for those on the sidelines.

- The gap to DCF fair value stands out as a concrete marker for upside, especially with fundamentals stacking up above sector averages.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Citizens & Northern's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite strong profit margins and growth forecasts, Citizens & Northern lags the US market in top-line revenue expansion. This highlights challenges in generating steady sales momentum.

If you’re seeking companies with stronger and more consistent revenue and earnings growth, check out stable growth stocks screener (2099 results) to discover better-performing alternatives built for long-term stability.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:CZNC

Citizens & Northern

Operates as the bank holding company for Citizens & Northern Bank that provides various banking and related services to individual and corporate customers.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives