- United States

- /

- Diversified Financial

- /

- NasdaqCM:COOP

Bearish: Analysts Just Cut Their Mr. Cooper Group Inc. (NASDAQ:COOP) Revenue and EPS estimates

Today is shaping up negative for Mr. Cooper Group Inc. (NASDAQ:COOP) shareholders, with the analysts delivering a substantial negative revision to this year's forecasts. Revenue and earnings per share (EPS) forecasts were both revised downwards, with the analysts seeing grey clouds on the horizon.

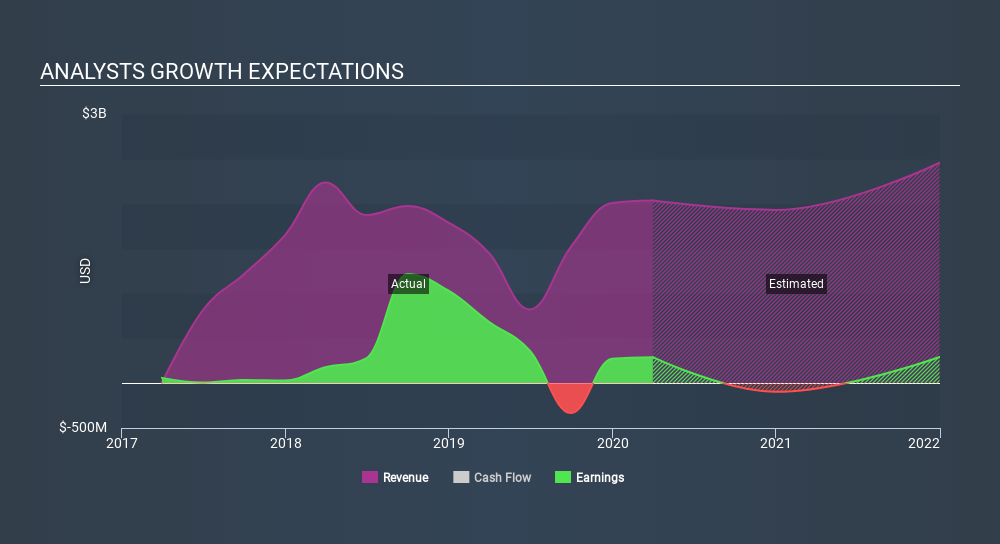

Following the latest downgrade, the four analysts covering Mr. Cooper Group provided consensus estimates of US$1.9b revenue in 2020, which would reflect a measurable 5.1% decline on its sales over the past 12 months. Following this this downgrade, earnings are now expected to tip over into loss-making territory, with the analysts forecasting losses of US$1.07 per share in 2020. Before this latest update, the analysts had been forecasting revenues of US$2.2b and earnings per share (EPS) of US$1.65 in 2020. There looks to have been a major change in sentiment regarding Mr. Cooper Group's prospects, with a measurable cut to revenues and the analysts now forecasting a loss instead of a profit.

Check out our latest analysis for Mr. Cooper Group

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. These estimates imply that sales are expected to slow, with a forecast revenue decline of 5.1%, a significant reduction from annual growth of 44% over the last five years. By contrast, our data suggests that other companies (with analyst coverage) in the same industry are forecast to see their revenue grow 2.2% annually for the foreseeable future. So although its revenues are forecast to shrink, this cloud does not come with a silver lining - Mr. Cooper Group is expected to lag the wider industry.

The Bottom Line

The biggest low-light for us was that the forecasts for Mr. Cooper Group dropped from profits to a loss this year. Regrettably, they also downgraded their revenue estimates, and the latest forecasts imply the business will grow sales slower than the wider market. After a cut like that, investors could be forgiven for thinking analysts are a lot more bearish on Mr. Cooper Group, and a few readers might choose to steer clear of the stock.

Even so, the longer term trajectory of the business is much more important for the value creation of shareholders. We have estimates - from multiple Mr. Cooper Group analysts - going out to 2021, and you can see them free on our platform here.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are downgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NasdaqCM:COOP

Mr. Cooper Group

Operates as a non-bank servicer of residential mortgage loans in the United States.

Reasonable growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.