- United States

- /

- Banks

- /

- NasdaqGS:COLB

Is Columbia Banking System Fairly Priced After Recent Analyst Debates on Bank Sector Valuation?

Reviewed by Bailey Pemberton

- Ever wondered if Columbia Banking System is actually a bargain, or if the market has already priced in all its potential? If you're searching for hidden value or warning signs, you're in the right place.

- The stock has seen slight movement recently, notching a 0.5% gain over the last week even as it remains down 11.9% for the year. This hints at shifting investor optimism or risk perceptions.

- Media coverage has highlighted steady bank sector volatility and consolidation trends that continue to influence sentiment for regional players like Columbia. In the past month, analysts and market watchers have debated how banking regulation updates and merger activity could impact valuations across the industry.

- On our 6-point undervaluation scale, Columbia Banking System currently scores a 4, suggesting clear upside in some areas but potential overpricing in others. We will break down how different valuation approaches stack up and point you toward an even better way to cut through the noise at the end of this article.

Find out why Columbia Banking System's -11.9% return over the last year is lagging behind its peers.

Approach 1: Columbia Banking System Excess Returns Analysis

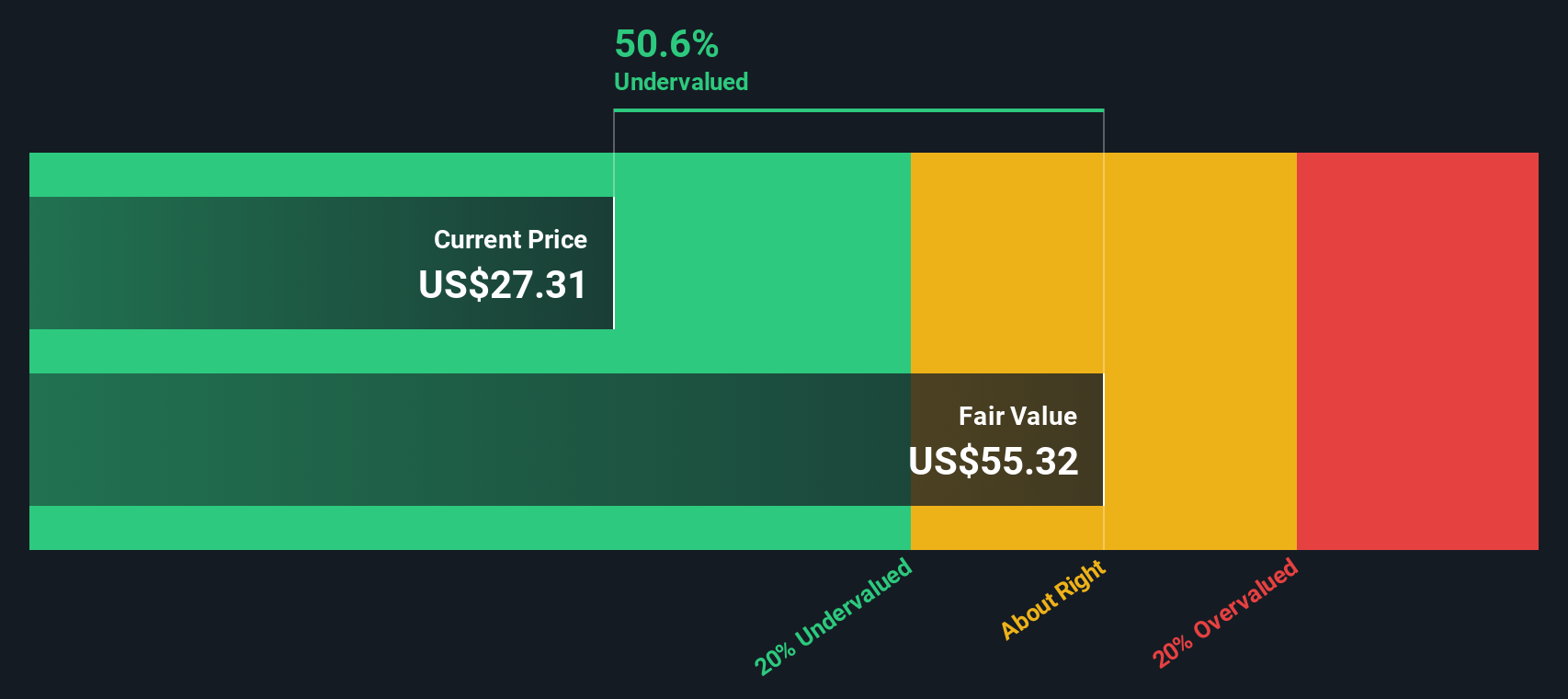

The Excess Returns valuation model estimates a company's intrinsic value by examining the return it generates on its invested capital, particularly relative to its cost of equity. For Columbia Banking System, this method provides a focused view on whether the company is creating genuine value for shareholders beyond the minimum required rate of return.

According to this approach, Columbia's Book Value stands at $26.04 per share, while its Stable EPS is $3.03 per share. These earnings projections are based on weighted future Return on Equity estimates from eight analysts. The company’s average Return on Equity is 10.78%, and the expected Cost of Equity is $1.91 per share. Notably, the calculated Excess Return, which represents the value created above the cost of equity, is $1.13 per share. Looking ahead, analysts expect the Stable Book Value to rise to $28.12 per share, as reflected in estimates from ten different analysts.

Based on these inputs, the model assigns an intrinsic value significantly above current market levels. This implies Columbia Banking System is 54.8% undervalued, suggesting the stock offers attractive upside potential under the excess returns framework.

Result: UNDERVALUED

Our Excess Returns analysis suggests Columbia Banking System is undervalued by 54.8%. Track this in your watchlist or portfolio, or discover 840 more undervalued stocks based on cash flows.

Approach 2: Columbia Banking System Price vs Earnings

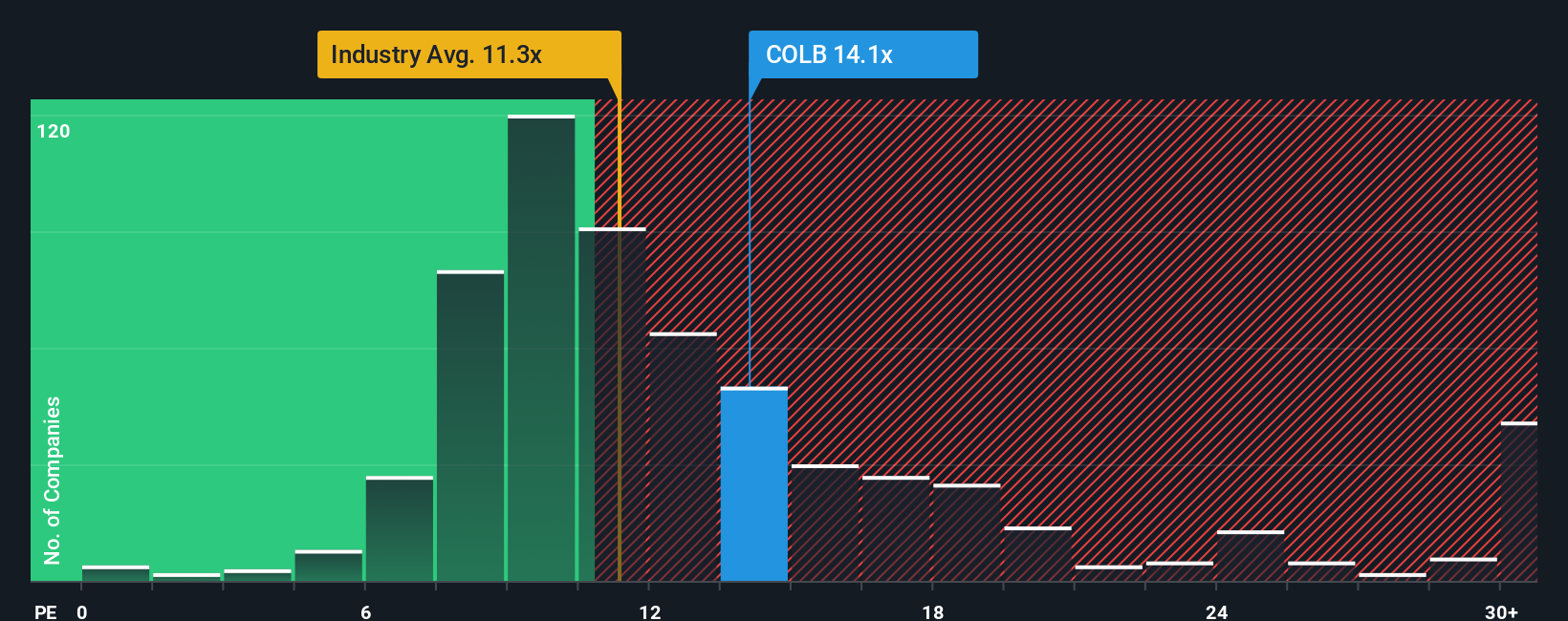

The Price-to-Earnings (PE) ratio is widely regarded as the go-to valuation metric for established, profitable companies because it directly relates a company’s stock price to its actual earnings. This makes it especially suitable for banks like Columbia Banking System, which generate consistent profits year over year.

What counts as a "normal" or "fair" PE ratio typically depends on two main things: the company’s growth prospects and its risk profile. A higher growth expectation or lower perceived risk justifies a higher PE, while slower growth or higher risks call for a lower PE. For context, Columbia Banking System’s PE ratio stands at 16.54x. This is above the regional banking industry average of 10.99x, but below the peer average of 24.92x.

Rather than simply comparing Columbia’s multiple to industry or peers, Simply Wall St uses a proprietary “Fair Ratio” metric. This figure, in Columbia's case 17.21x, considers key variables beyond just market averages, including the company’s projected earnings growth, risk factors, profit margins, and its relative size in the banking sector. This approach aims to reflect a fair valuation tailored to Columbia’s actual prospects and risks.

Since Columbia’s current PE ratio of 16.54x is just below its Fair Ratio of 17.21x, the stock is trading at a level that closely matches what would be considered “fair value.”

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1409 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Columbia Banking System Narrative

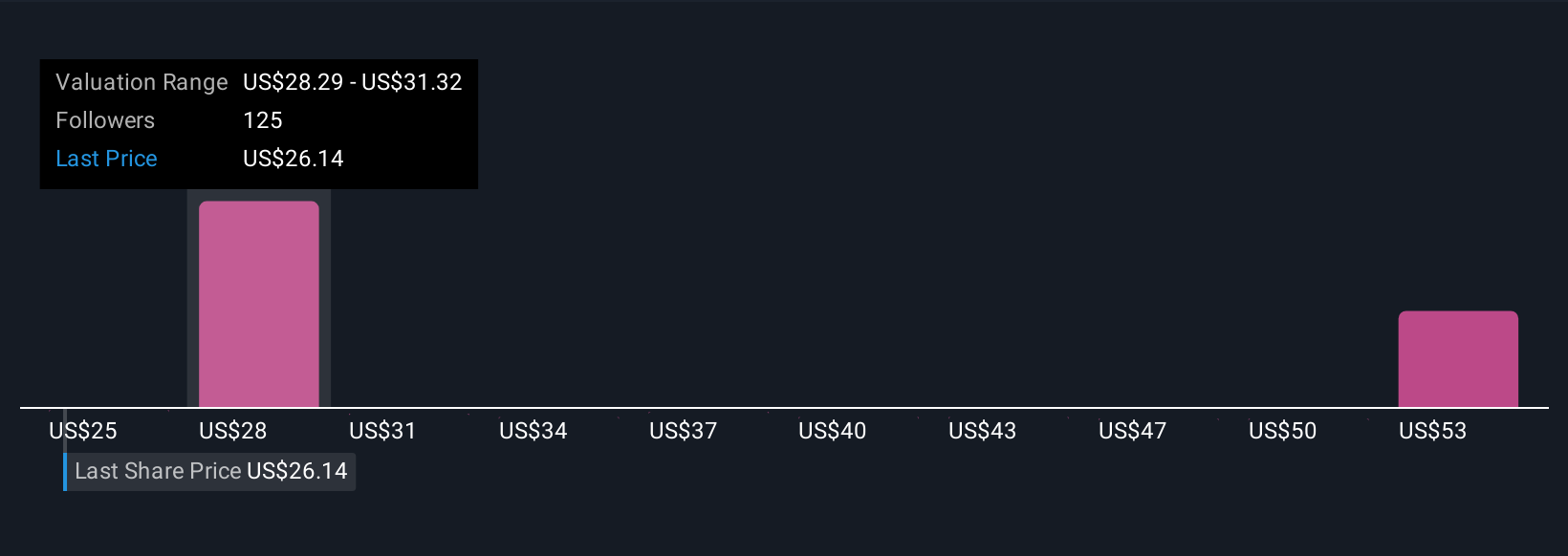

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your personal story or perspective about Columbia Banking System, combining your forecast for key numbers like future revenue, earnings, and margins to arrive at what you believe is a fair value for the stock.

Narratives make investing more accessible by linking a company’s real-world story directly to a set of financial assumptions and a calculated fair value. On Simply Wall St's Community page, millions of investors use Narratives to clarify their views and easily see how their expectations shape buy or sell decisions, simply by comparing their fair value to the current market price.

This approach is dynamic, as Narratives update automatically when new news or earnings data is released, helping you quickly adjust to the latest developments. For example, one Columbia Banking System Narrative projects new acquisitions and digital investment will drive robust annual revenue growth of over 22%, with a bullish fair value of $35 per share. A more cautious Narrative focuses on regional risks and integration challenges, leading to a more conservative fair value near $25 per share.

Do you think there's more to the story for Columbia Banking System? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:COLB

Columbia Banking System

Operates as the Bank holding company of Columbia Bank that provides banking, private banking, mortgage, and other financial services in the United States.

Flawless balance sheet 6 star dividend payer.

Similar Companies

Market Insights

Community Narratives