- United States

- /

- Banks

- /

- NasdaqGS:COLB

How Investors May Respond To Columbia Banking System (COLB) US$700 Million Buyback and CFO Transition

Reviewed by Sasha Jovanovic

- Columbia Banking System announced a US$700 million share repurchase program and a leadership transition, with Ivan Seda appointed as the new Chief Financial Officer effective December 31, 2025; the company also released its third quarter earnings and reported lower net charge-offs year-over-year.

- The combination of a major stock buyback, recent acquisition activity, executive changes, and investor activism highlights Columbia’s focus on capital allocation, management stability, and shareholder value in a period of significant transformation.

- We’ll explore how the newly announced US$700 million share repurchase program could impact Columbia’s future growth trajectory and valuation outlook.

We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Columbia Banking System Investment Narrative Recap

To be a Columbia Banking System shareholder today means believing in the company’s ability to integrate acquisitions like Pacific Premier, strengthen its Western U.S. franchise, and grow profitably amid shifting economic and regulatory conditions. While the new US$700 million share repurchase plan signals clear confidence from leadership, this move alone is unlikely to materially change the near-term outlook. The most important short-term catalyst remains the smooth integration of Pacific Premier, while the greatest risk still centers on executing back-to-back mergers without disrupting operations or profitability. Among the latest developments, the appointment of Ivan Seda as the next Chief Financial Officer stands out. Seda steps into the role at a critical moment as Columbia balances acquisition integration, operational efficiency, and ambitious capital return programs, all of which could influence its pace of value creation and investor sentiment. By contrast, investors should be aware that Columbia’s concentration in the Western U.S. market means that ...

Read the full narrative on Columbia Banking System (it's free!)

Columbia Banking System's narrative projects $3.5 billion in revenue and $1.3 billion in earnings by 2028. This requires 22.8% annual revenue growth and an increase in earnings of approximately $771 million from current earnings of $528.5 million.

Uncover how Columbia Banking System's forecasts yield a $29.23 fair value, a 9% upside to its current price.

Exploring Other Perspectives

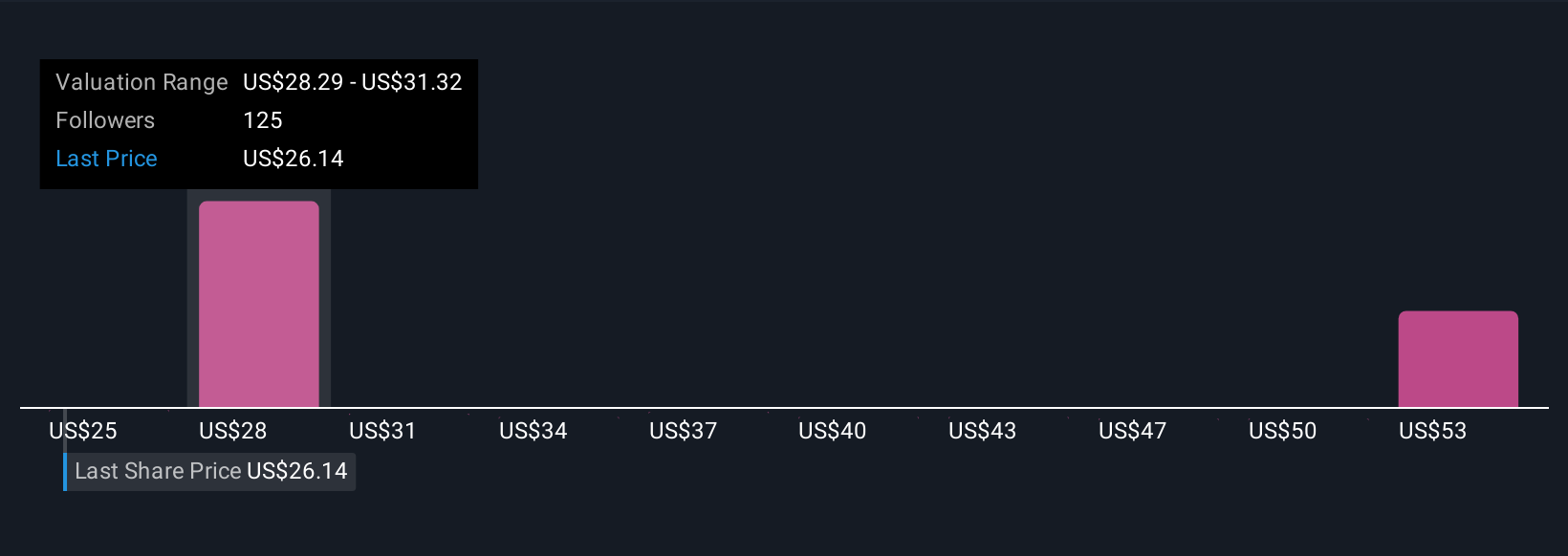

Nineteen members of the Simply Wall St Community estimate Columbia’s fair value between US$25.25 and US$57.38. While many see upside, the pace and effectiveness of merger integrations could drive considerable swings in performance and sentiment going forward.

Explore 19 other fair value estimates on Columbia Banking System - why the stock might be worth 6% less than the current price!

Build Your Own Columbia Banking System Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Columbia Banking System research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Columbia Banking System research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Columbia Banking System's overall financial health at a glance.

Looking For Alternative Opportunities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:COLB

Columbia Banking System

Operates as the Bank holding company of Columbia Bank that provides banking, private banking, mortgage, and other financial services in the United States.

Flawless balance sheet 6 star dividend payer.

Similar Companies

Market Insights

Community Narratives